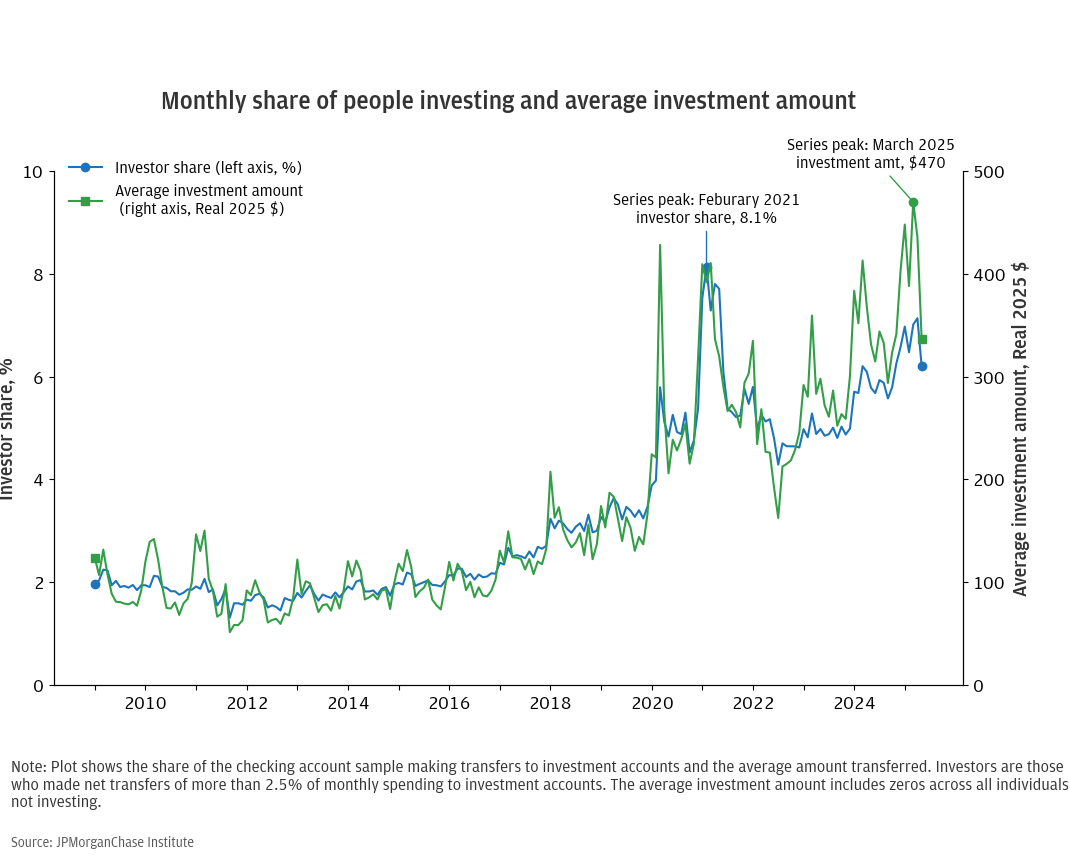

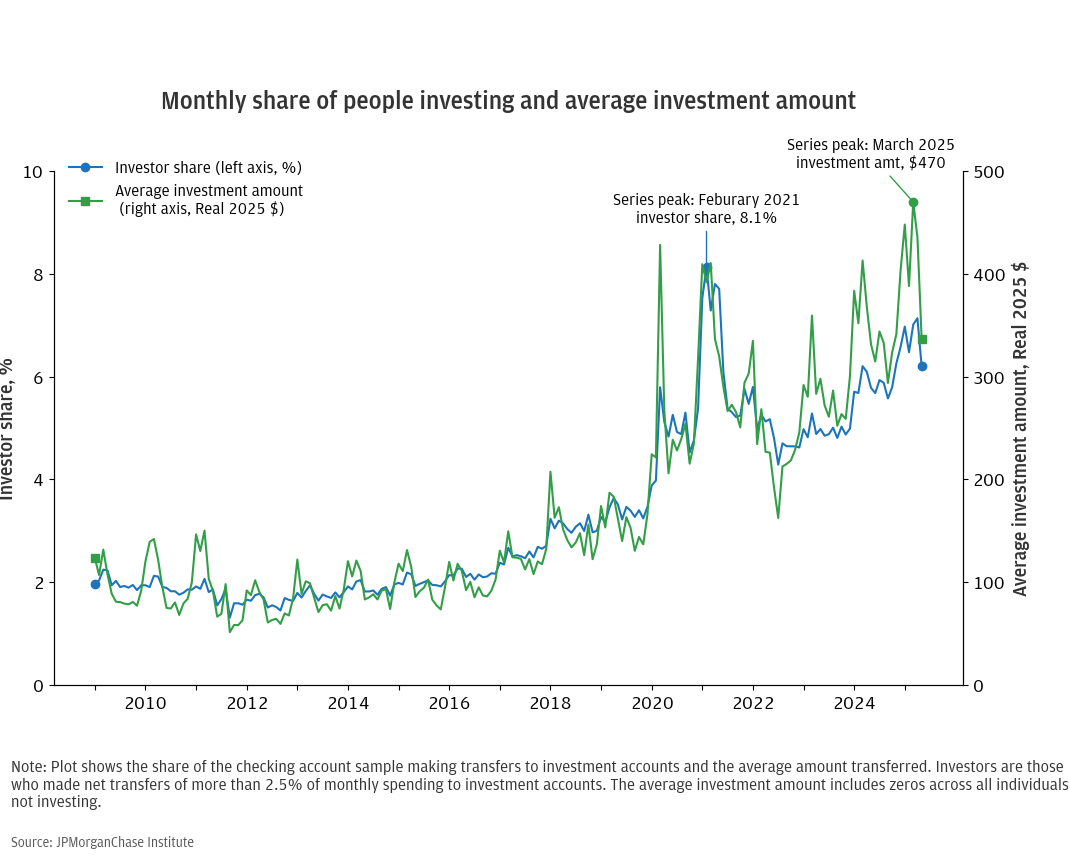

Figure 1: Early 2025 retail investor flows rival the pandemic peak in terms of number of people moving money to investment accounts and exceed it in terms of dollars transferred.

Research

August 27, 2025

Investing activity has risen notably over the past ten years: the share of the population and the dollars transferred to investment accounts is several times the 2015 level. This long-running rise in retail investing regained momentum since the start of 2024. Recent levels of retail investing activity rival the pandemic era savings boom—which led to rapid growth in the number of people with investment accounts—despite the low aggregate savings rate over this period. Increases in investing among those with below-median incomes have continued, and young people are getting a much earlier start. This trend, amid a decline in those becoming first-time homeowners, suggests a potential change in wealth accumulation patterns, in which the stock market plays a bigger role in people’s financial lives relative to prior generations. Shifts in how people accumulate wealth merit attention from policymakers concerned with household financial health, the implications of financial stability, and wealth inequality. The analysis also suggests scope for adaptations in the financial industry to ensure provision of suitable investment products and financial education for a broader and younger investing population.

The monthly number of people moving money into investment accounts has risen to several times the norm from the mid-2010s, with larger increases among lower-income and younger individuals.1 After normalizing from the pandemic savings surge over 2022−2023, investing activity began picking up again in 2024. By early 2025, the number of people moving money from checking accounts to investment accounts reached its highest levels since 2021, and the dollar amounts transferred eclipsed its prior peak. Higher monthly investing flows are notable, given personal savings rate has remained relatively low.2 The sustained solid trends in retail investing suggest a potential lasting shift in people’s wealth accumulation in which the stock market plays a bigger role in more people’s financial lives, even outside of traditional retirement accounts.

This report breaks out differences across income, age, and gender groups. Growth in the number of investors and the frequency of transfers to investment accounts has been higher among individuals with below-median incomes. In an analysis of birth-year cohorts, we find that over one-third of people aged 25 in 2024 had already started adding money to retail investment accounts, six-times the investor proportion among those turning 25 in the early 2010s. Men continue to be more active investors than women; the male investing rate temporarily increased relative to women in November 2024.

Recent trends suggest a continued deepening in U.S. households’ engagement with financial markets, with potential implications for higher wealth effects on spending. Additionally, the connection between inequality and markets has likely shifted, as wealth covering a broader part of the population is now moving with asset prices. If appropriately managed, younger people’s earlier adoption of these accounts presents a potentially positive sign for their wealth-building opportunities. Still, this segment of the population is facing substantial headwinds from low real income growth relative to pre-pandemic trends and historically low levels of housing affordability.

Figure 1 shows monthly investment activity broken out by the share of active checking account users making transfers to investment accounts and the average dollars transferred to investments per active checking account user.3 These investing indicators—which exhibit significant seasonality over the year (January through April tend to be elevated due in part to annual bonuses and tax refunds)—increased notably on a year-on-year basis in 2024 and again in early 2025. Recent levels are close to those seen during the pandemic savings boom.

The early 2024 increase in flows coincided with fresh all-time highs for the S&P 500 stock market index. Transfers into investment accounts continued to grow on a year-over-year basis through late 2024 and early 2025—alongside continued strong stock market performance—potentially supported by a general trend-chasing pattern among retail investors. Dip-buying may also have played a role over February-April 2025, amid a rise in market volatility, before falling off sharply as markets settled in May.

Increases in transfers to investment accounts over the past two years are notable because they have not been supported by some of the usual drivers: high levels of the savings rate, excess liquidity, and high real income growth. The aggregate personal savings rate has been relatively depressed, averaging 4-5 percent since January 2024, compared to 6-7 percent in 2019 and peaks exceeding 20 percent in 2020 and 2021. Meanwhile, median real cash balances and income growth are low relative to pre-pandemic trends. Unless bolstered by fundamental drivers—i.e., a rising saving rate, supported by income growth—there are limits to how much the investing trend could continue. Instead, alternating (but fleeting) trend-chasing and dip-buying behavior may be behind the strength in flows into investment accounts.[i] Housing market conditions—namely, low affordability—may be shifting the allocation of savings, making financial assets like stocks relatively more attractive or accessible than home equity.

The two panels of Figure 2 show the share of individuals transferring funds to investment accounts and the dollar amounts invested, broken out by those with above- and below-median incomes. As of May 2025, the share of people with below-median incomes transferring funds to investment accounts was about 5 times higher than the average over 2010-2015. The monthly investing share for above-median-income individuals was up three-fold. We group individuals by income, averaging observed checking account inflows over a period of at least 4 years—after adjusting for inflation and real growth—and comparing to individuals in the sample of the same age.5

Panel A: Number of investors, by income

Panel B: Dollars transferred to investment accounts, by income

Greater growth among lower-income individuals has narrowed the investing gap across income groups. Panel A shows the monthly share of lower-income investors was 3.8 percent in May 2025 (2010−15 average of 0.8 percent) versus 8.6 percent for above-median-income individuals (2010−15 average: 2.9 percent). This means that in the first half of the 2010s, below-median-income individuals made up approximately 20 percent of those investing in a given month, whereas in May 2025 their share was 31 percent. Outside of months influenced by pandemic cash stimulus payments, this was the highest value in the series dating back to the Great Recession. Panel B, showing dollars transferred, shows the share of investment flows from below-median-income individuals rising from about 7 over 2010−15 to approximately 12 percent in recent months.

People are getting a much earlier start to investing. Figure 3 shows data on the lifecycle of investing for annual cohorts of young individuals since 2009. It tracks the share of individuals that had moved significant funds from their checking accounts to investment accounts since age 22. Investing was a relatively rare occurrence for people in their mid-20s in the first half of the 2010s. Only 6 percent of people aged 25 in 2015 had made investment transfers out of their checking account since they were 22. This fraction increased six-times to 37 percent for people aged 25 in 2024. The use of investment accounts wasn’t even that high among 35-year-olds prior to the pandemic: only 28 percent of those aged 35 in 2019 had made investment transfers.

Growth in the share of young people with investments accelerated in the years up to and during the pandemic. After that point, our measure shows a modest retracement. As context, labor force participation increases sharply for people in the late-teens, early-twenties population. For people without significant incomes during the pandemic, their finances were less likely to be directly affected by the savings boom. The rise in investing for younger individuals may therefore capture a temporary cohort effect, strongest for those with meaningful incomes during the unique 2020−21 period. While investing participation for 25-year-olds may continue to decline from this peak, the new norm appears likely to remain substantially higher than during the pre-pandemic era.

Beyond the overall expansion of investment participation, specific demographic groups—namely, younger investors and men—have exhibited occasional surges in activity relative to other groups. To show this, the figures below track gender and age differences in investing flows on a month-to-month basis. As shown above and in prior Institute reports, the rise in retail investing during the pandemic was more pronounced for young people and men.6 More recently, the two panels of Figure 4 show a modest rise in the flows of men relative to women in November 2024 (Panel A) and little change in the shares by age group around this time (Panel B).

Panel A: Investor activity over time by gender

Panel B: Investor activity over time by age

While investing flows of men increased in November 2024 relative to women, they subsequently returned close to their 2024 average. Changes in economic optimism, potentially related to political outcomes, could explain the temporary gender shift.7 The share of younger individuals investing rose slightly relative to older individuals in late 2024, but then declined through the early months of 2025, resuming a trend of gradual normalization to its pre-pandemic range. Housing affordability headwinds that disproportionately impact young renters could be playing a role reducing the share of under-40 investors since 2022.8 Demographic shifts in investing flows during the pandemic – driven in part by social media investment fads – were much larger than the modest month-to-month differentiation appearing in the ensuing years.9

What the data show

Investing activity has risen notably over the past 10 years: the share of the population and the dollars transferred to investment accounts is several times the 2015 level. Strong growth since 2023 has reinforced the apparent durability of this trend, which continued through early 2025. Increases have been larger for lower-income individuals. Younger individuals are getting an earlier start to investing: the share of people aged 25 with investment accounts has risen 6-fold, to 37 percent as of 2024, relative to 2015. Men occasionally experience heightened investment flows relative to women, as occurred most recently in November 2024.

Broader context

A range of factors have contributed to the increase in investing over the past 10 years. First, investment accounts have become increasingly accessible: investment minimums and trading costs have fallen. Second is the pandemic-era savings boom, which led to rapid growth in the number of people with investment accounts. Third is stock market performance. The stock market has more than doubled over the past decade, which has spurred trend-chasing behavior covered in prior Institute analysis.

More recently, the state of the housing market may be playing a role, as historic low levels of affordability make wealth accumulation in the form of homeownership less accessible for many. The housing market has long been a core asset for most households. However, fewer young individuals are becoming first-time homebuyers, while the investing population has moved sharply in the opposite direction.10

What it means for policy and the economy

Shifts in how people are accumulating wealth merit attention from policymakers concerned with household financial health, the implications of financial stability, and wealth inequality. Expansion in investing of younger generations highlights the importance of financial education tailored to these new entrants in financial markets to support long-term outcomes for a larger population. In rising markets, a broader part of the population will face tax implications of capital gains, which may be a source of negative financial surprises around tax time if financial education doesn’t adapt. In market downturns, we’ll see a significant number of new investors facing losses—directly visible to them in real-time. New investors, or even seasoned ones, may not be adequately well equipped to manage their responses, suggesting potential shifting roles for financial advisors.

Last, this research suggests growing degree of attention being paid to financial markets across the population. People are more familiar with moving money across accounts on a month-to-month basis—including on their phones—where tools for monitoring investments mingle with other apps that distract or entertain. This could increase feedback between markets and household financial behavior, including changes in investing such as fad-chasing and spending behavior.

Aladangady, Aditya, Jesse Bricker, Andrew C. Chang, Sarena Goodman, Jacob Krimmel, Kevin B. Moore, Sarah Reber, Alice Henriques Volz, and Richard A. Windle. 2023. “Changes in U.S. Family Finances from 2019 to 2022: Evidence from the Survey of Consumer Finances.” Board of Governors of the Federal Reserve System. https://doi.org/10.17016/8799

Gargano, Antonio. and Rossi, Alberto. 2018. “Does it pay to pay attention?” The Review of Financial Studies.

Hasso, Tim, Daniel Müller, Matthias Pelster, and Sonja Warkulat. 2022. “Who participated in the GameStop frenzy? Evidence from brokerage accounts.” Finance Research Letters. Available at SSRN: https://ssrn.com/abstract=3792095

O’Trakoun, John. 2024. “Sentiment Is Sweet When You’re in the Driver’s Seat.” Richmond Fed Macro Minute. https://www.richmondfed.org/research/national_economy/macro_minute/2024/sentiment_is_sweet_20240326

Wheat, Chris, Erica Deadman, Daniel M. Sullivan. 2024. “Household Finances Pulse through June 2024: Balances Continue to Decline.” JPMorgan Chase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/household-pulse-balances-through-june-2024

Wheat, Chris, and George Eckerd. 2024a. “The Rise in Retail Investing: Roles of the Economic Cycle and Income Growth.” JPMorgan Chase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/the-rise-in-retail-investing-roles-of-the-economic-cycle-and-income-growth

Wheat, Chris, and George Eckerd. 2024b. “The changing demographics of retail investors.” JPMorgan Chase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/the-changing-demographics-of-retail-investors

Wheat, Chris, and George Eckerd. 2024c. “Returns-chasing and dip-buying among retail investors.” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/returns-chasing-and-dip-buying-among-retail-investors

Wheat, Chris, and George Eckerd. 2025a. “Sizing up real income gains December 2019 to March 2025.” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/sizing-up-real-income-gains-december-2019-to-march-2025

Wheat, Chris, and George Eckerd. 2025b. “The Affordability Gap: Is home ownership still within reach in today’s economy?” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/community-development/the-affordability-gap-is-home-ownership-still-within-reach-in-todays-economy.

We thank our research team, especially Man Xu, for her contributions to the analysis. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways and acknowledge their contributions to each and all releases.

This material is a product of JPMorganChase Institute and is provided to you solely for general information purposes. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the authors listed and may differ from the views and opinions expressed by J.P. Morgan Securities LLC (JPMS) Research Department or other departments or divisions of JPMorgan Chase & Co. or its affiliates. This material is not a product of the Research Department of JPMS. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which is provided for illustration/reference purposes only. The data relied on for this report are based on past transactions and may not be indicative of future results. J.P. Morgan assumes no duty to update any information in this material in the event that such information changes. The opinion herein should not be construed as an individual recommendation for any particular client and is not intended as advice or recommendations of particular securities, financial instruments, or strategies for a particular client. This material does not constitute a solicitation or offer in any jurisdiction where such a solicitation is unlawful.

Wheat, Chris, and George Eckerd. 2025. “A decade in the market: How retail investing behavior has shifted since 2015.” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/a-decade-in-the-market-how-retail-investing-behavior-has-shifted-since-2015

Authors

Chris Wheat

President, JPMorganChase Institute

George Eckerd

Wealth and Markets Research Director, JPMorganChase Institute

Footnotes

See the Wheat and Eckerd (2024a, 2024b). The Federal Reserve’s Survey of Consumer Finances, last fielded in 2022, shows an all-time high share, 53 percent, of U.S. households with some stocks (Aladangady et al., 2023).

The aggregate personal savings rate published by the Bureau of Economic Analysis remained in a range between 3.5-5.5 percent since January 2024, well below the 2020-21 monthly peaks that exceeded 20 percent and the 2019 average of 7 percent. (FRED ticker: PSAVERT, accessed July 2025)

The average includes zeros for those without a positive investment transfer. We adjust the sample for changes over time in the income levels of Chase checking account users.

See Wheat and Eckerd (2024c). The stock market made fresh new all-time highs in early 2024 and sustained strong performance through the end of the year. An uptick in flows in March and April 2025 would also align with interest in buying the dip after a significant drawdown from its February 2025 highs.

The same income-ranking methodology used in prior Institute reports on retail investor, e.g., Wheat and Eckerd (2024a).

See Wheat and Eckerd 2024b.

A Richmond Fed note, O’Traukan (2024), discusses how party affiliation corresponded to shifts in responses comprising the University of Michigan Consumer Sentiment Index. While evidence is scant on pass-through to actual financial activity, Sandoval and Walsh (2024) found evidence that political affiliation also led to spending differences after the 2016 U.S. elections, using data from Florida.

Institute research has also covered the decline of housing affordability for would-be first-time homebuyers since 2021 (Wheat and Eckerd, 2025b).

Hasso et al. (2022) use data from a platform with a disproportionate share of male users show large spikes in activity in investments related to social media trends in early 2021. Gargano and Rossi (2018) provide foundational insight into the amount of attention people pay when investing.

The average age of first-time homebuyers rose to 38 in 2024, according to the National Association of Realtors, a series high.

Media contact

Shelby Wagenseller, Shelby.Wagenseller@jpmchase.com