To better understand the full range of independent businesses, we recently added midsize businesses to our business research agenda. Also known as middle market businesses and frequently defined as having between $10 million and $1 billion in annual revenues, these firms are often anchors of regional economies. Our combined small and midsize business research will provide data-driven insights about firms across the size spectrum.

Takeaway #2: Cash flow management and liquidity are critical for business financial health. Small businesses may differ along many dimensions, but they all need to manage their cash flows because the timing and consistency of revenues may not match those of expenses. For example, they may need to pay suppliers before they are paid by customers, or they may need to invest in equipment in anticipation of future orders. Firms can leverage their cash reserves as well as credit to help manage cash flow volatility.

Adequate cash reserves can also help provide liquidity in times of distress. The typical small business holds enough cash to cover average outflows for about two weeks in the event of a complete disruption to inflows. During acute distress (e.g., hurricanes, pandemic), small firms often pull back expenses to reflect lower revenues. Government aid providing liquidity can also support spending during downturns.

Real-time measures of financial health can help policymakers gauge the severity of events such as the COVID-19 pandemic and plan policy responses. In 2020, we published a series of reports with timely information on small business revenues, expenses, and cash balances at the onset of the pandemic; industry-level financial outcomes; and metro area differences. Later, our in-depth analysis of counties and industries in Illinois assisted state policymakers in targeting local recovery efforts.

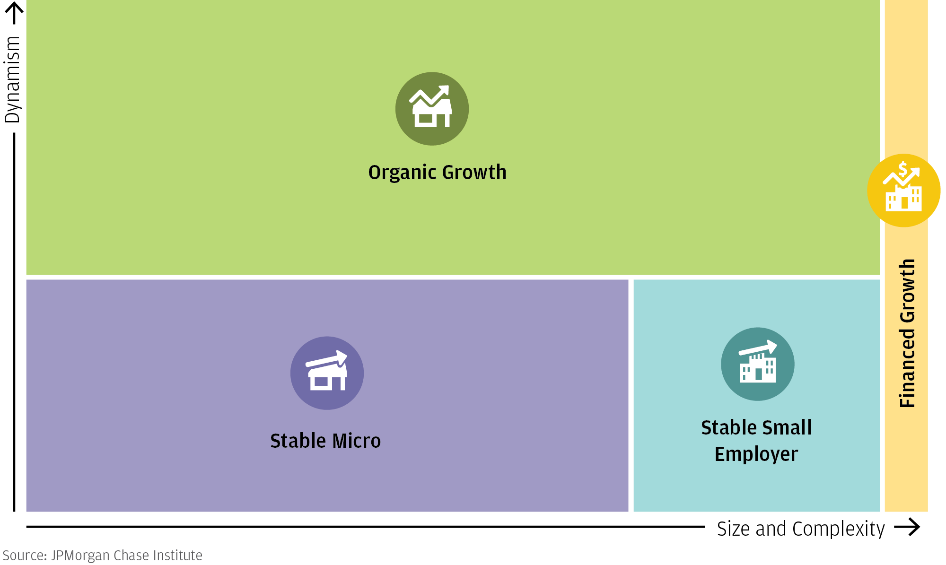

Takeaway #3: Business dynamism is essential to economic growth. Starting a new business is risky. Only about half survive more than five years, few will scale, and most nonemployers will never hire paid employees. Nevertheless, they all contribute to business dynamism: as firms enter, grow/shrink, and exit, resources are reallocated to more efficient and innovative uses, boosting overall productivity. Policies that help businesses survive and thrive are not about subsidizing small firms. Rather, they are about providing opportunities for small firms to demonstrate their business models despite challenges based on size.

Small businesses are also an important part of labor market dynamism, and not just because of the jobs they might create. Self-employment is one way to participate in the labor force, and 9.7 percent of Americans are self-employed. Some pursue entrepreneurship due to promising business opportunities, while others turn to it out of necessity as they search for suitable wage work. Policies that allow Americans to consider entrepreneurship as a viable option, such as affordable health insurance, could contribute to business dynamism as well as a fluid labor market.

Looking forward to the Institute’s next chapter, we plan to build upon this foundation of empirical research and continue to find innovative ways to use JPMorganChase’s proprietary data on small and midsize businesses for the public good. As debates continue around how to support entrepreneurship, our findings offer insights for smarter, data-driven policy.