The COVID-19 pandemic has been a widespread and prolonged disruption to life in the U.S. since a national emergency was declared on March 13, 2020. Small businesses saw substantial revenue declines in the initial months. Expenses also declined commensurately, reflecting lower revenues as well as efforts to preserve liquidity. The signature program for small businesses was the Paycheck Protection Program (PPP), which distributed nearly $800 billion in 2020 and 2021 through 11.8 million loans to small businesses nationwide. Our research brief offers insights about two features of the PPP: the large number of relatively small loans and the duration of what was initially short-term relief.

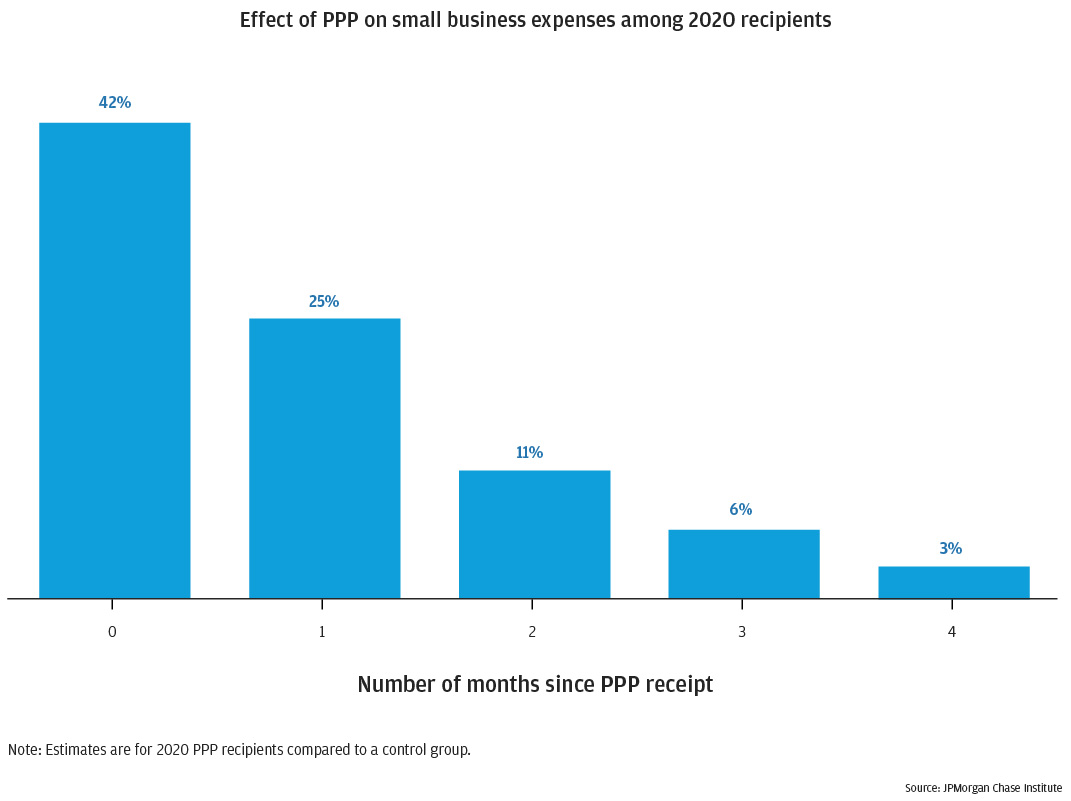

We analyzed the magnitude and duration of any effects the PPP had on business operating activity, as measured by expenses. Our findings shed light on the effects of smaller loans, in contrast to other studies focusing on loans greater than $150,000. Nearly 69 percent of PPP loans in 2020 and 87 percent of those in 2021 were $50,000 or less. We found that upon receipt of PPP funds, small business expenses increased by over 40 percent relative to a control group, with significant but declining effects over four months.