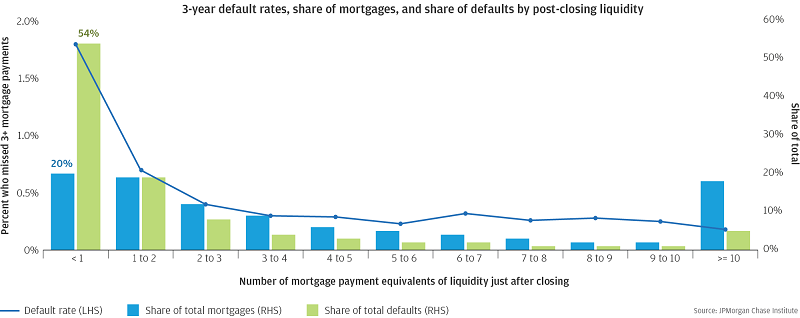

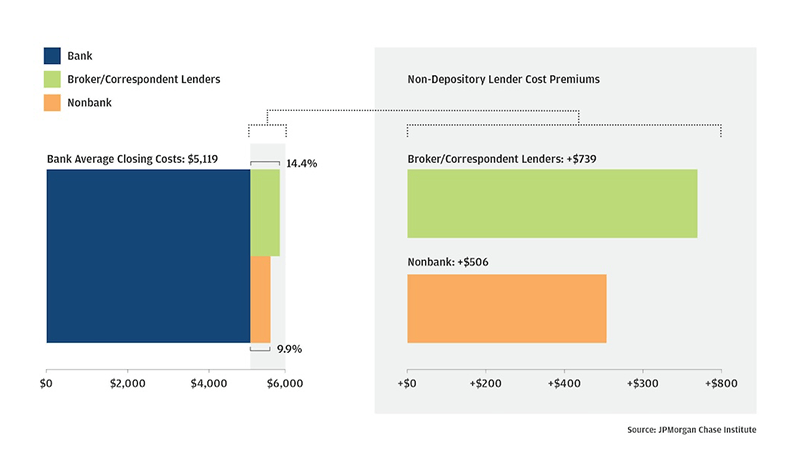

In the first three years following origination, borrowers with little post-closing liquidity defaulted at higher rates and made up a disproportionately high share of defaults.

Stories

By Makada Henry Nickie, Housing Finance Research Director

June 30, 2025

A decade ago, the JPMorganChase Institute launched with a clear mandate to shed light on the economic realities of the American economy, its households, small businesses, and communities. From the outset, we recognized housing finance as a foundational research pillar because it is not only the single largest expenditure for most American families, but also the primary mechanism for wealth creation and a key determinant of financial stability.

With housing costs once again in the mainstream discourse, our latest research on homeownership affordability and the impact of inflation on renters builds on a decade of research that has delivered important insights into how consumers buy homes, cope with rising rents, and build wealth. In the years following the Great Recession, it became evident that the recovery, while measurable at the macroeconomic level, was deeply uneven. National statistics in income, employment, and housing prices often masked the unequal realities faced by households across different wealth levels, regions, and socioeconomic backgrounds. This is where the Institute stepped in – striving to answer not just what was happening in the financial lives of consumers, but how and to whom. These insights have provided an empirical bedrock for policymakers, business leaders, and community stakeholders.

Advancing the frontiers of housing research

Our housing work has been defined by a commitment to providing empirical answers to foundational questions through the unique lens of household financial flows. This approach has allowed us to uncover unexpected patterns and challenge prevailing industry wisdom about what truly drives housing stability, affordability, and wealth-building.

In the first three years following origination, borrowers with little post-closing liquidity defaulted at higher rates and made up a disproportionately high share of defaults.

A 10 percent mortgage payment reduction reduced default rates by 22 percent

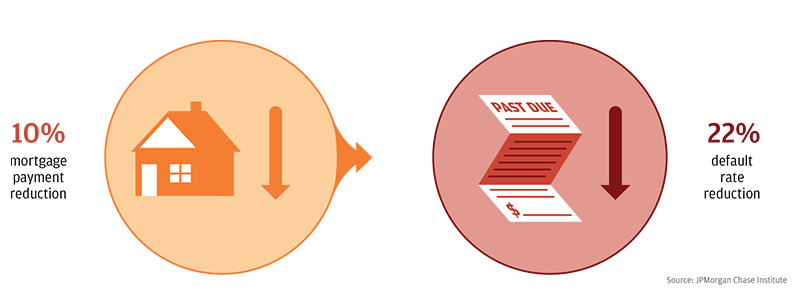

Navigating mortgage closing costs—lender type impact

Borrowers using nonbanks and broker lenders can expect to pay significantly more in upfront loan costs compared to depository lenders. These increased costs can make access to homeownership challenging

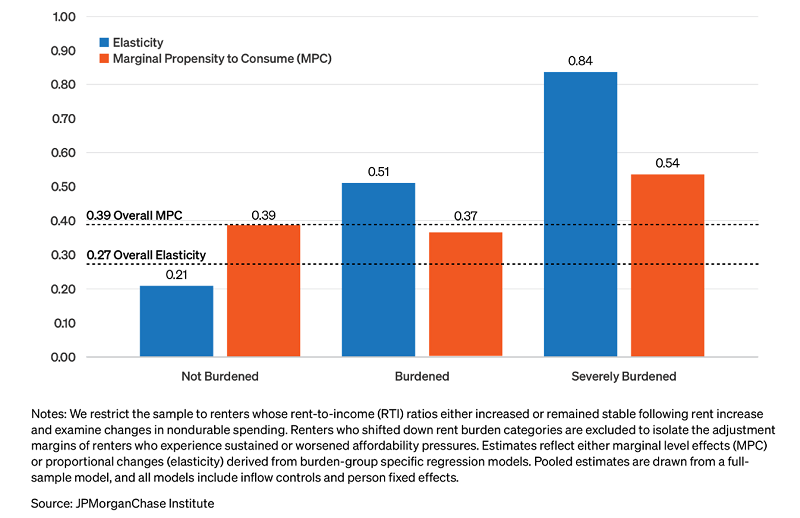

For every $1 increase in rent, renter households reduce other spending by 39 cents, with larger percentage cutbacks among the most rent-burdened renters

Shaping a more affordable housing future

A decade of the Institute’s foundational insights into wealth-building mechanisms and barriers to sustainable homeownership has built the bridge between empirical research and policy advocacy. Our research has helped shape the JPMorganChase PolicyCenter’s efforts to advance equitable policy solutions by providing the essential building blocks for legal reforms such as the Uniform Partition of the Heirs Property Act, aimed at helping families unlock generational wealth by clearing tangled titles.

Our evaluation of the state of housing unaffordability, renter financial stability, and the effectiveness of policy prescriptions has supported the development of the PolicyCenter’s agenda. Together, we have created a center of expertise that has spurred crucial policy momentum; from building the case for increased housing supply to developing an actionable blueprint of federal opportunities essential for building an affordable housing supply pipeline and expanding the path to homeownership for under-resourced communities.

The next decade in housing research

In an era characterized by accelerating change and growing economic uncertainty, the role of data-driven decisionmaking is more important than ever. As we look ahead to the next decade, our research agenda is evolving to confront a new set of interconnected challenges at the frontier of housing economics. From quantifying the financial impact of natural hazard risk as it becomes capitalized into insurance and mortgage markets, to understanding the lasting effects of housing supply constraints on the homeownership prospects of the next generation of homeowners. We look forward to continuing to leverage our data and expertise to help advance policy that delivers better outcomes for all.

Makada Henry-Nickie

Housing Finance Research Director, JPMorganChase Institute