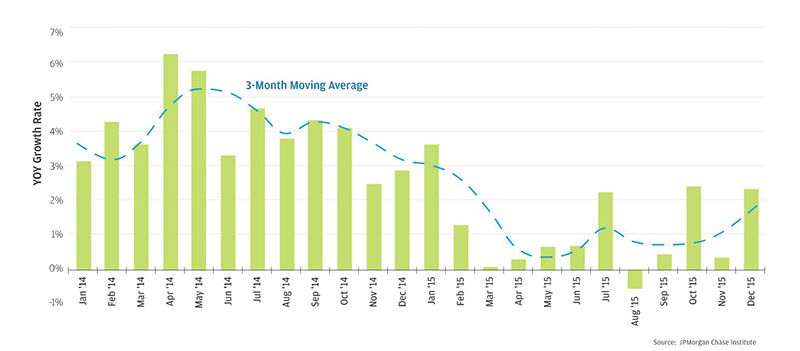

The economy is still jittery after anemic growth during most of 2015 according to the JPMorgan Chase Institute's Local Consumer Commerce Index (LCCI). However, there are glimmers of hope in the December data, which show year-over-year growth of 2.3 percent. All 15 cities that comprise the LCCI experienced positive growth in December, the first month since January 2015 where we observed across-the-board growth. Small businesses also performed well, contributing 1.7 percentage points of the 2.3 percent total growth in December. And, young consumers and consumers in the bottom income quintile continued to be a bright spot, with these groups contributing over 40 percent of the total growth in December.

These insights are from the most recent update to the LCCI, a measure of the monthly year-over-year growth rate of everyday debit and credit card spending by over 50 million anonymized Chase customers across 15 cities in the U.S. The LCCI was first published in the Institute's December research report, Profiles of Local Consumer Commerce, which highlighted a marked slowdown in consumer commercial spending during the first half of 2015.