Stories

JPMorgan Chase Commits to Keeping Houston Strong

Firm provided $30 million in immediate economic relief and is working with customers on $1.2 billion in loans and mortgages.

December 7, 2022

Stories

Firm provided $30 million in immediate economic relief and is working with customers on $1.2 billion in loans and mortgages.

December 7, 2022

JPMorgan Chase & Co. today announced an update on its commitment to Houston after Hurricane Harvey and new steps it will take to keep Houston strong. The firm already has provided more than $30 million in immediate relief and is working with customers on more than $1.2 billion more in loans and mortgages in the Houston area.

“We’ve been serving Houston’s people and businesses for 151 years,” said Jamie Dimon, Chairman and CEO, JPMorgan Chase. “The effects of Hurricane Harvey were devastating. The community has done a great job of recovery, but we know from other disasters that the road is long. We are putting the scale of JPMorgan Chase and our people behind Houston to help speed the recovery along.”

JPMorgan Chase has more than 200 branches and 6,400 employees in the Houston area. It is the city’s largest financial institution with more than $100 billion in local deposits and roots that go back to the founding of the First National Bank of Houston in 1866. The company serves more than 2.5 million local customers and businesses, large and small, across the city.

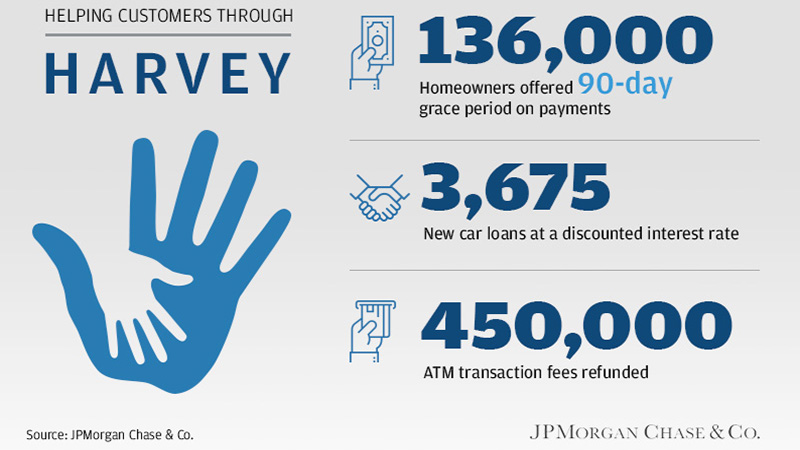

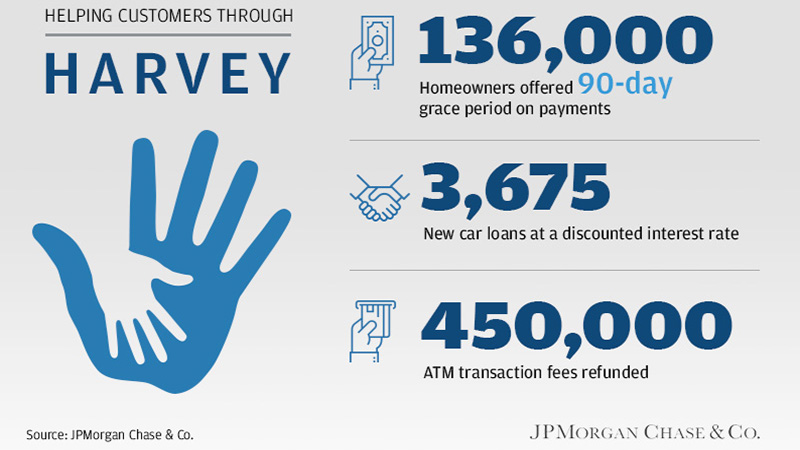

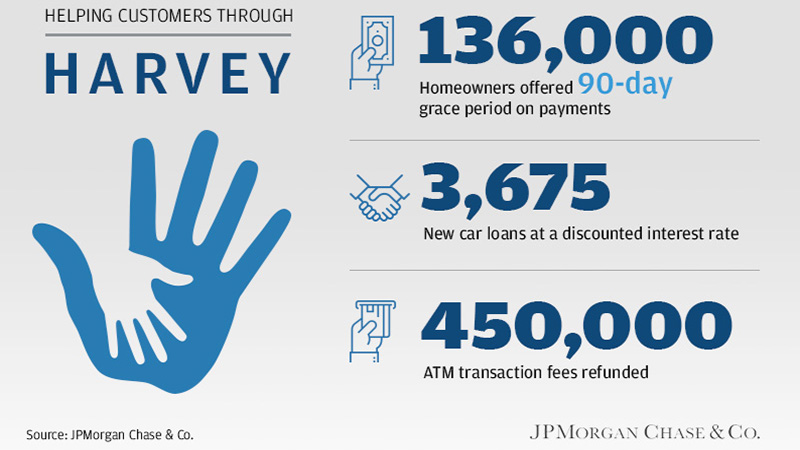

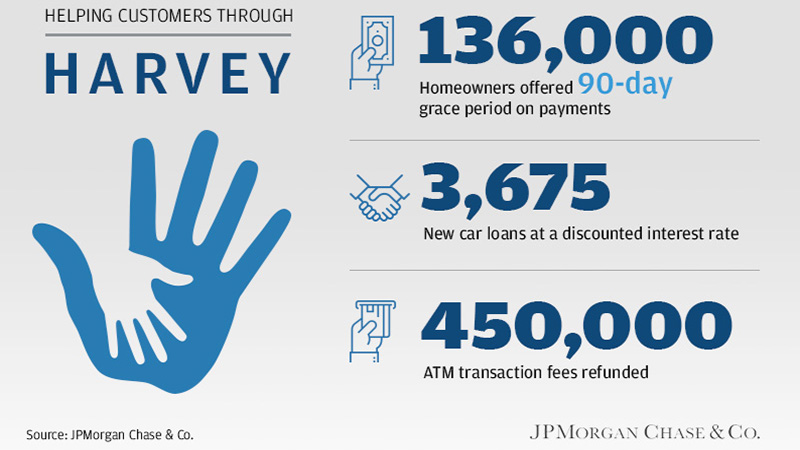

The $30 million in immediate relief that JPMorgan Chase has provided to customers in need—primarily in FEMA-declared disaster areas—includes:

The $1.2 billion in lending includes:

To help Houston, JPMorgan Chase is applying the experience it gained supporting relief and recovery efforts for communities and customers in the Northeast after Superstorm Sandy and in Louisiana after Hurricane Katrina.

Housing was potentially the greatest need. Tens of thousands of Houston families were in hotels or shelters,” said Mike Weinbach, CEO Home Lending, Chase. “We wanted to help get them back home.”

To support housing efforts, the firm has:

“Countless people lost their cars and trucks,” said Mark O’Donovan, CEO of Auto Finance, Chase. “They needed those to get to work and get their kids to school. Chase was here to help them get new cars and get them fast.”

To support local transportation needs, the firm:

“Harvey created daunting challenges for small businesses – interrupting facilities and equipment and the personal lives of owners and their employees,” said Andrew Kresse, CEO of Business Banking, Chase. “Capital and payment relief is at the heart of it, so we want to do what we can to get them to credit that helps them keep their businesses running, so they can focus on their families and employees.”

To support business relief efforts, the firm has:

The firm and its employees made more than $4 million in additional investments and donations to provide immediate relief. The organizations receiving supporting include:

Since the beginning of 2014, JPMorgan Chase has invested $25 million to help create economic opportunity and support Hurricane Harvey relief in the Houston area.

JPMorgan Chase hosted 1,400 Houston area neighbors at community events at three branches in early October. Teams gave guidance on insurance, payment deferment, home repair loans and FEMA and SBA assistance while nonprofits provided employment assistance and free counseling.

JPMorgan Chase employees volunteered across Houston, including gutting homes, packing lunches for kids and packing meals for families.

“We’re here and we are not leaving,” said Gordon Smith, CEO of Consumer & Community Banking, Chase. “Houston is indeed strong, and will only get stronger.”

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services Firm with assets of $3.2 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of customers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands.