11% Return on Tangible Common Equity

Record Full-Year 2014 Net Income of $21.8 Billion, and Record $5.29 Per Share, on Revenue1 of $97.9 Billion

- The Firm delivered solid underlying performance in the fourth quarter

- Consumer & Community Banking: Consumer & Business Banking average deposits up 8%; credit card sales volume1 up 10%; record client investment assets up 13%; Business Banking loan originations up 18%

- Corporate & Investment Bank: maintained #1 ranking for Global Investment Banking fees with 8.1% wallet share for full-year 2014 and moved to #1 ranking in EMEA

- Commercial Banking: period-end loan balances up 8%, driven by 12% growth in Commercial Real Estate; record gross investment banking revenue with Commercial Banking clients, up 11% in the fourth-quarter and totaling $2 billion for the full-year

- Asset Management: twenty-third consecutive quarter of positive net long-term client flows; record assets under management up 9%; record average loan balances up 11%

- Fourth-quarter results included as a significant item $990 million (after-tax) legal expense

- Approximately $3 billion returned to shareholders in 4Q14 and $10 billion in full-year 2014

- Maintained fortress balance sheet

- Common Equity Tier 11.5 of $165 billion, or ratio of 10.1%

- Strong liquidity - compliant with final U.S. LCR - HQLA of $626 billion

- Firm Supplementary Leverage Ratio ("SLR") of 5.6% and Bank SLR of 5.9%

- Core loans up 8% compared with the prior year

- JPMorgan Chase supported consumers, businesses and our communities

- $2.1 trillion of credit and capital raised in 2014

- $197 billion of credit for consumers

- $19 billion of credit for U.S. small businesses

- $668 billion of credit for corporations

- $1.2 trillion of capital raised for clients

- $75 billion of credit and capital raised for nonprofit and government entities, including states, municipalities, hospitals and universities

- Hired over 8,200 U.S. veterans and service members since 2011

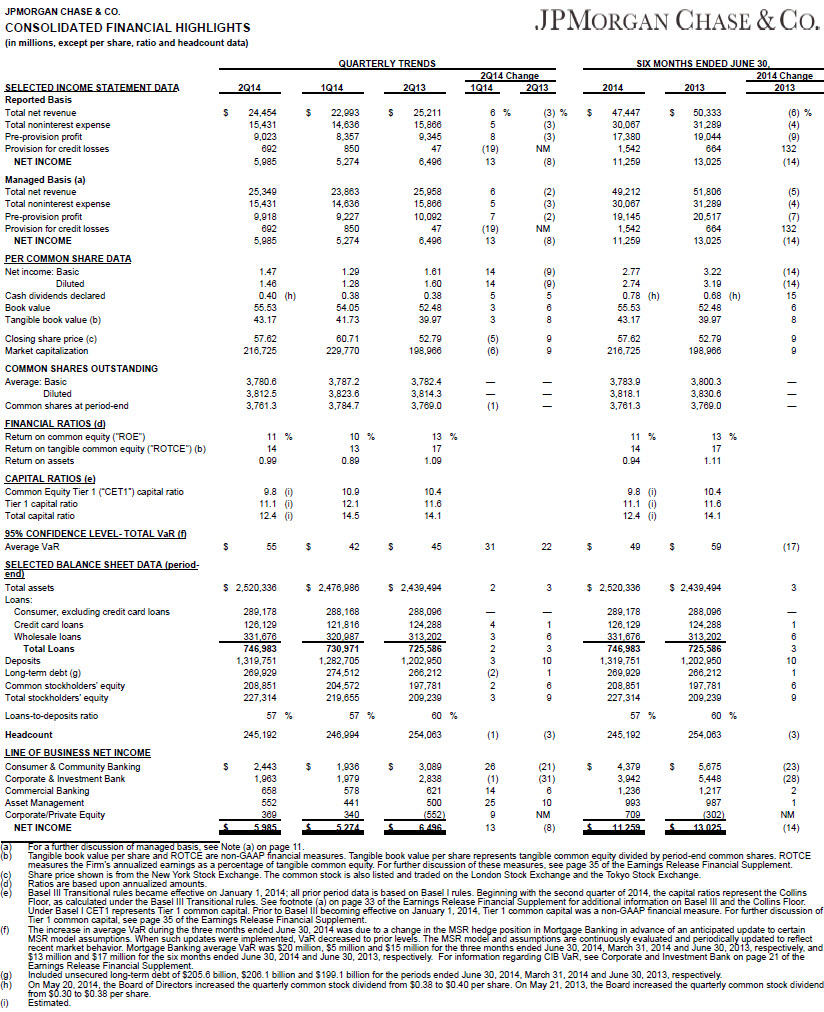

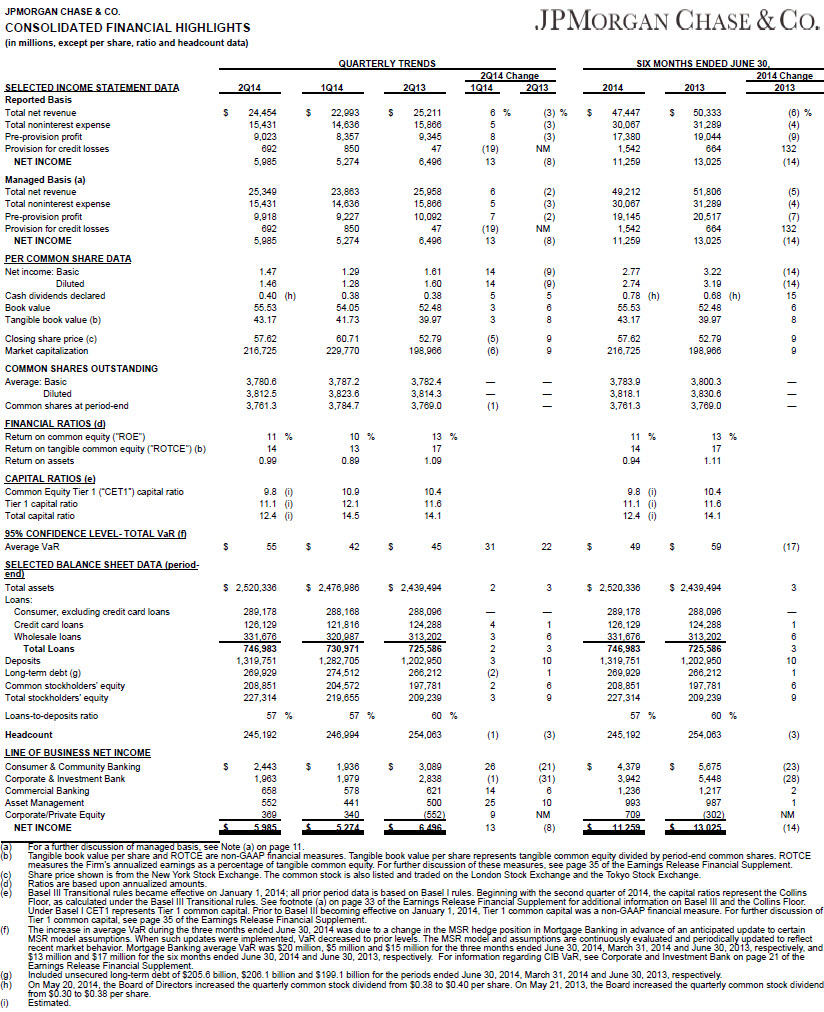

New York, January 14, 2015 - JPMorgan Chase & Co. (NYSE: JPM) today reported net income for the fourth quarter of 2014 of $4.9 billion, compared with net income of $5.3 billion in the fourth quarter of 2013. Earnings per share were $1.19, compared with $1.30 in the fourth quarter of 2013. Revenue for the quarter was $23.6 billion, down 2% compared with the prior year. The Firm's return on tangible common equity1 for the fourth quarter of 2014 was 11%, compared with 14% in the prior year. Core loans increased by 8% compared with the prior year. The Firm returned approximately $3 billion of capital to shareholders in the fourth quarter

Net income for full-year 2014 was a record $21.8 billion, compared with $17.9 billion in the prior year. Earnings per share were $5.29 for 2014, also a record, compared with $4.35 for 2013. Revenue for 2014 was $97.9 billion, down 2% compared with 2013 revenue of $99.8 billion. The Firm's return on tangible common equity for the year 2014 was 13%.

Jamie Dimon, Chairman and Chief Executive Officer, commented on the financial results: "Our businesses continue to demonstrate strong momentum and expense discipline. Consumer & Community Banking delivered impressive growth in deposits and investment assets in the fourth quarter and throughout 2014, while outperforming its expense reduction target for the year. Mortgage originations improved sequentially in the fourth quarter, despite a seasonally slow quarter. Our Card business delivered double-digit sales volume growth, outpacing the industry for the 27th consecutive quarter. Auto had a good quarter and the pipeline remains strong."

Dimon added: "The Corporate & Investment Bank saw strong performance in fees, maintaining its #1 position in Global IB fees in 2014 with particular strength in Europe, although Markets remained somewhat challenged. Commercial Banking grew period-end loans 8% versus the prior year and Commercial Banking clients generated record investment banking revenues for the quarter and the year. Lastly, Asset Management had over $80 billion of net long-term inflows for the second consecutive year and overall AUM grew 9% this quarter compared to the prior year."

Dimon concluded: "2014 was a record year for the Firm for net income and EPS. We delivered on our commitments - including business simplification, controls, expense discipline and meeting our capital targets for the year - while maintaining excellent customer satisfaction rankings. I am proud of this great company, its exceptional management team and employees, and everything we are achieving for our clients, shareholders and communities. Each of our businesses and the company are very well positioned going into 2015 for long-term growth and success."

In the discussion below of the business segments and of JPMorgan Chase as a Firm, information is presented on a managed basis. For more information about managed basis, as well as other non-GAAP financial measures used by management to evaluate the performance of each line of business, see page 12. Effective with the fourth quarter of 2014, the Firm revised its methodology for allocating the cost of its outstanding preferred stock to its business segments to be consistent with the Firmwide income statement presentation. Prior period business segment results have been revised to conform with the current period presentation. For further discussion, see page 2 of the Earnings Release Financial Supplement. The following discussion compares the fourth quarters of 2014 and 2013 unless otherwise noted. Footnotes in the sections that follow are described on page 13.

CONSUMER & COMMUNITY BANKING (CCB)

| Results for CCB ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 10,949 |

$ 11,367 |

$ 11,439 |

$ 418 |

4% |

$ (490) |

(4)% |

|---|

| Provision for Credit Losses |

950 |

902 |

72 |

48 |

5 |

878 |

NM |

|---|

| Noninterest Expenses |

6,411 |

6,305 |

7,321 |

106 |

2 |

(910) |

(12) |

|---|

| Net Income |

$ 2,179 |

$ 2,529 |

$ 2,448 |

$ (350) |

14% |

$ (269) |

(11)% |

|---|

Discussion of Results:

Net income was $2.2 billion, a decrease of $269 million, or 11%, compared with the prior year, due to higher provision for credit losses and lower net revenue, largely offset by lower noninterest expense.

Net revenue was $10.9 billion, a decrease of $490 million, or 4%, compared with the prior year. Net interest income was $7.1 billion, down $47 million, driven by spread compression, predominantly offset by higher deposit balances in Consumer & Business Banking and higher loan balances in Credit Card. Noninterest revenue was $3.8 billion, a decrease of $443 million, or 10%, driven by lower mortgage fees and related income and non-core portfolio exits in Credit Card.

The provision for credit losses was $950 million, compared with $72 million in the prior year. The current-quarter provision reflected a $251 million reduction in the allowance for loan losses and total net charge-offs of $1.2 billion. The prior-year provision reflected a $1.2 billion reduction in the allowance for loan losses and total net charge-offs of $1.3 billion.

Noninterest expense was $6.4 billion, a decrease of $910 million, or 12%, from the prior year, predominantly driven by lower Mortgage Banking expense.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted

- Return on equity was 16% on $51.0 billion of average allocated capital.

- Average total deposits were $497.7 billion, up 8% from the prior year and up 1% from the prior quarter. Ranked #1 in deposit growth for the third consecutive year

- Record client investment assets were $213.5 billion, up 13% from the prior year and up 3% from the prior quarter.

- Business Banking originations were $1.5 billion, up 18% from the prior year and down 7% from the prior quarter. Average Business Banking loans were $19.8 billion, up 6% from the prior year and up 1% from the prior quarter.

- Mortgage originations were $23.0 billion, down 1% from the prior year and up 8% from the prior quarter.

- Chase cardholders accounted for over $600 billion, or approximately 16% of total U.S. credit and debit purchase volume.

- Credit card sales volume was $123.6 billion, up 10% from the prior year. General purpose credit card sales volume growth has outperformed the industry for 27 consecutive quarters.

- Period-end Credit Card loan balances were $131.0 billion, up $3.3 billion, or 3% from the prior year.

- Merchant processing volume was $230.2 billion, up 13% from the prior year and up 8% from the prior quarter. Total transactions processed were 10.3 billion, up 7% from the prior year.

- Auto originations were $6.9 billion, up 8% from the prior year and up 1% from the prior quarter.

- Active online customers of 36.4 million which includes active mobile customers of 19.1 million, up 3.5 million or 22%. Chase.com remains the #1 most visited banking portal in the U.S.

Consumer & Business Banking net income was $861 million, an increase of $65 million, or 8%, compared with the prior year, due to higher net revenue.

Net revenue was $4.6 billion, up 3% compared with the prior year. Net interest income was $2.7 billion, flat compared with the prior year, driven by higher deposit balances, offset by deposit spread compression. Noninterest revenue was $1.8 billion, an increase of 6%, driven by higher investment revenue, reflecting record client investment assets, higher deposit-related fees and higher debit card revenue.

Noninterest expense was $3.0 billion, flat compared with the prior year, reflecting efficiency improvements in the business, offset by increased cost of controls.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 31% on $11.0 billion of average allocated capital.

- Ranked #1 in customer satisfaction among the largest U.S. banks for the third consecutive year, according to American Customer Satisfaction Index ("ACSI").

- Average total deposits were $482.8 billion, up 8% from the prior year and up 1% from the prior quarter.

- Ranked #1 in small business banking customer satisfaction in three of the four regions (West, Midwest and South) by J.D. Power.

- Deposit margin was 2.11%, compared with 2.29% in the prior year and 2.20% in the prior quarter.

- Deposit margin was 2.23%, compared with 2.31% in the prior year and 2.27% in the prior quarter.

- Households totaled 25.7 million, up approximately 700,000 or 3% from the prior year and flat compared with the prior quarter.

Mortgage Banking net income was $338 million, a decrease of $255 million from the prior year, driven by higher provision for credit losses and lower net revenue, largely offset by lower noninterest expense.

Net revenue was $1.9 billion, a decrease of $405 million compared with the prior year. Net interest income was $1.0 billion, a decrease of $112 million, or 10%, driven by spread compression and lower loan balances due to portfolio runoff. Noninterest revenue was $845 million, a decrease of $293 million, driven by lower mortgage fees and related income.

The provision for credit losses was $13 million, compared with a benefit of $782 million in the prior year. The current quarter reflected a $100 million reduction in the allowance for loan losses, reflecting continued improvement in home prices and delinquencies. The prior year included a $950 million reduction in the allowance for loan losses. Net charge-offs were $113 million, compared with $168 million in the prior year.

Noninterest expense was $1.3 billion, a decrease of $766 million, or 37%, from the prior year, driven by the absence of non-MBS related legal expense and lower headcount-related expense.

Mortgage Production pretax income was $204 million, an increase of $472 million from the prior year, reflecting lower expense, partially offset by lower benefit from repurchase losses. Mortgage production-related revenue, excluding repurchase losses, was $447 million, a decrease of $53 million from the prior year, primarily reflecting tighter margins due to shift in mix. Production expense was $374 million, a decrease of $615 million from the prior year, predominantly due to the absence of non-MBS related legal expense and lower headcount-related expense. Repurchase losses for the current quarter reflected a benefit of $131 million, compared with a benefit of $221 million in the prior year.

Mortgage Servicing $23 million, compared with $11 million in the prior year, reflecting lower expenses, predominantly offset by lower revenue and lower MSR risk management income. Mortgage net servicing-related revenue was $624 million, a decrease of $74 million from the prior year, driven by lower gains on excess interest only securities and lower average third party loans serviced, largely offset by higher gains on Government National Mortgage Association ("Ginnie Mae") loan sales. MSR risk management was a loss of $41 million, compared with a loss of $24 million in the prior year. Servicing expense was $560 million, a decrease of $103 million from the prior year due to lower headcount-related expense and lower expense on foreclosure-related matters.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Mortgage originations were $23.0 billion, down 1% from the prior year and up 8% from the prior quarter.

- Period-end total third-party mortgage loans serviced were $751.5 billion, down 8% from the prior year and down 2% from the prior quarter.

Real Estate Portfolios pretax income was $339 million, down $918 million from the prior year, driven by higher provision for credit losses and lower net revenue, partially offset by lower noninterest expense.

Net revenue was $714 million, a decrease of $171 million from the prior year, driven by lower noninterest revenue due to higher loan retention, and lower net interest income. Net interest income was lower due to spread compression and lower loan balances due to portfolio runoff.

TThe provision for credit losses was $11 million, compared with a benefit of $783 million in the prior year. The current-quarter provision reflected a $100 million reduction in the non credit-impaired allowance for loan losses, reflecting continued improvement in home prices and delinquencies. The prior-year provision included a $750 million reduction in the purchased credit-impaired allowance for loan losses and a $200 million reduction in the non credit-impaired allowance for loan losses. Net charge-offs were $111 million, compared with $167 million in the prior year.

Noninterest expense was $364 million, a decrease of $47 million, or 11%, compared with the prior year, driven by lower servicing expense on lower default volumes and lower foreclosed asset expense.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted. Average loans include PCI loans)

- Mortgage Banking return on equity was 7% on $18.0 billion of average allocated capital.

- Average home equity loans were $69.1 billion, down $8.9 billion.

- Average mortgage loans were $98.9 billion, up $8.1 billion.

- Allowance for loan losses was $5.5 billion, compared with $6.7 billion.

- Allowance for loan losses to ending loans retained, excluding PCI loans, was 1.76%, compared with 2.23%.

- Allowance for loan losses, excluding PCI loans to nonaccrual loans retained was 41%, compared with 40%.

Card, Merchant Services & Auto net income was $980 million, a decrease of $79 million, or 7%, compared with the prior year, driven by lower net revenue and higher provision for credit losses, partially offset by lower noninterest expense.

Net revenue was $4.5 billion, down $201 million, or 4%, compared with the prior year due to the impact of non-core portfolio exits. Net interest income was $3.4 billion, up $55 million compared with the prior year, driven by higher loan balances and lower revenue reversals associated with lower net charge-offs in Credit Card, largely offset by spread compression. Noninterest revenue was $1.2 billion, down $256 million compared with the prior year; the variance was driven by non-core portfolio exits and higher amortization of new account origination costs, partially offset by the benefit of higher net interchange income and higher Auto lease income.

The provision for credit losses was $849 million, compared with $746 million in the prior year. The current-quarter provision reflected lower net charge-offs and a $150 million reduction in the allowance for loan losses in Credit Card. The prior-year provision reflected a $300 million reduction in the allowance for loan losses in Credit Card. The Credit Card net charge-off rate was 2.69%, down from 2.86% in the prior year; excluding non-core portfolio exits, the Credit Card net charge-off rate would have been 2.48%. The 30+ day delinquency rate was 1.44%, down from 1.67% in the prior year. The Auto net charge-off rate was 0.45%, up from 0.39% in the prior year.

Noninterest expense was $2.1 billion, down $141 million, or 6%, from the prior year, driven by lower remediation costs and lower marketing expense, partially offset by higher Auto lease depreciation expense.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 18% on $19.0 billion of average allocated capital.

- #1 credit card issuer in the U.S. based on loans outstandings.

- #1 U.S. co-brand credit card issuer1.

- #1 global Visa issuer1.

- Chase cardholders accounted for approximately 21% of total U.S. credit purchase volume1.

- Period-end Credit Card loan balances were $131.0 billion, up 3% from the prior year and prior quarter. Credit Card average loans were $127.4 billion, up 3% from the prior year and up 1% from the prior quarter.

- Card Services net revenue as a percentage of average loans was 11.47%, compared with 12.47% in the prior year and 12.17% in the prior quarter.

- #1 wholly-owned merchant acquirer with approximately 50% of U.S. eCommerce volume1.

CORPORATE & INVESTMENT BANK (CIB)

| Results for CIB ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 7,386 |

$ 9,118 |

$ 6,157 |

$ 1,732 |

19% |

$ 1,229 |

20% |

|---|

| Provision for Credit Losses |

(59) |

(67) |

(19) |

8 |

(12) |

(40) |

211 |

|---|

| Noninterest Expenses |

5,576 |

6,035 |

4,892 |

(459) |

(8) |

684 |

14 |

|---|

| Net Income |

$ 972 |

$ 1,687 |

$ 941 |

$ (715) |

42% |

$ 31 |

3% |

|---|

Discussion of Results:

Net income was $972 million, up 3%, compared with $941 million in the prior year, reflecting higher net revenue, predominantly offset by higher noninterest expense due to increased legal expense. Net revenue was $7.4 billion, compared with $6.2 billion in the prior year. Excluding the impact of certain refinements to net FVA/DVA1net revenue was $7.6 billion and net income was $1.1 billion. In the prior year, excluding the impact of FVA/DVA losses, net of hedges1, of $2.0 billion, net revenue was $8.2 billion and net income was $2.2 billion.

Banking revenue was $3.1 billion, up 1% from the prior year. Investment banking fees were $1.8 billion, up 8% from the prior year, driven by record debt underwriting fees of $1.1 billion, up 31% from the prior year. This increase was partially offset by lower equity underwriting fees of $327 million, down 25% from a strong prior year. Advisory fees of $434 million remained flat from the prior year. Treasury Services revenue was $1.0 billion, up 3% compared with the prior year, driven by the absence of a mark-to-market loss on the repositioning of the trade finance portfolio in the prior year, partially offset by lower trade finance revenue and the impact of business simplification initiatives. Lending revenue was $264 million, down 33% from the prior year, primarily reflecting mark-to-market losses on securities received from restructurings compared to gains in the prior year.

Markets & Investor Services revenue was $4.3 billion, up 38% from the prior year. Fixed Income Markets revenue of $2.5 billion was down 23% from the prior year, driven by lower revenues in credit-related and securitized products and by the impact of business simplification initiatives, including the sales of the Physical Commodities and Global Special Opportunities Group businesses. Excluding the revenue decline related to business simplification, Fixed Income Markets was down 14%1. Equity Markets revenue of $1.1 billion was up 25% compared with the prior year, primarily on higher derivatives revenue and higher prime services revenue. Securities Services revenue was $1.1 billion, up 6% from the prior year primarily driven by higher fees and commissions as well as higher net interest income on increased deposits. Credit Adjustments & Other revenue was a loss of $452 million, compared with a loss of $2.1 billion driven by a $1.5 billion loss as a result of implementing the FVA framework as well as losses of $536 million from DVA in the prior year. The current period includes net losses on CVA as well as refinements to net FVA/DVA.

The provision for credit losses was a benefit of $59 million, compared with a benefit of $19 million in the prior year. The ratio of the allowance for loan losses to period-end loans retained was 1.07%, compared with 1.15% in the prior year. Excluding the impact of the consolidation of Firm-administered multi-seller conduits and trade finance loans, the ratio of the allowance for loan losses to period-end loans retained was 1.82%, compared with 2.02% in the prior year.

Noninterest expense was $5.6 billion, up 14% from the prior year, driven by higher legal expense and higher cost of controls, partially offset by the impact of business simplification and lower compensation expense. The ratio of compensation expense to total net revenue was 27%.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted, and all rankings are according to Dealogic)

- Return on equity was 5% on $61.0 billion of average allocated capital; excluding legal expense, return on equity was 11%1.

- Overhead ratio was 75%.

- Ranked #1 in Global Investment Banking fees with 8.1% wallet share for the year ended December 31, 2014.

- Ranked #1 in Global Debt, Equity and Equity-related with 7.6% wallet share; #1 in Global Long-Term Debt with 8.0% wallet share; #1 in Global Syndicated Loans with 9.5% wallet share; #3 in Global Equity and Equity-related with 7.1% wallet share; and #2 in Global M&A, with 8.2% wallet share, based on revenue, for the year ended December 31, 2014.

- Average client deposits and other third-party liabilities were $433.8 billion, up 3% from the prior year and up 3% from the prior quarter.

- Assets under custody were $20.5 trillion, flat from the prior year and down 3% from the prior quarter.

- Period-end total loans were $102.0 billion, down 5% from the prior year and down slightly from the prior quarter.

- Nonaccrual loans were $121 million, down 65% from the prior year and down 48% from the prior quarter.

COMMERCIAL BANKING (CB)

| Results for CB ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 1,770 |

$ 1,703 |

$ 1,876 |

$ 67 |

4% |

$ (106) |

(6)% |

|---|

| Provision for Credit Losses |

(48) |

(79) |

43 |

31 |

(39) |

(91) |

NM |

|---|

| Noninterest Expenses |

666 |

668 |

653 |

(2) |

- |

13 |

2 |

|---|

| Net Income |

$ 693 |

$ 671 |

$ 711 |

$ 22 |

3% |

$ (18) |

(3)% |

|---|

Discussion of Results:

Net income was $693 million, a decrease of $18 million, or 3%, compared with the prior year, reflecting lower net revenue and higher noninterest expense, predominantly offset by a lower provision for credit losses.

Net revenue was $1.8 billion, a decrease of $106 million, or 6%, compared with the prior year. Net interest income was $1.1 billion, a decrease of $125 million, or 10%, compared with the prior year, reflecting the absence of proceeds from a lending-related workout in the prior year and yield compression, partially offset by higher loan balances. Noninterest revenue was $643 million, an increase of $19 million, or 3%, compared with the prior year, driven by higher investment banking revenue largely offset by business simplification and lower other fees.

Revenue from Middle Market Banking was $705 million, a decrease of $53 million, or 7%, compared with the prior year. Revenue from Corporate Client Banking was $511 million, an increase of $17 million, or 3%, compared with the prior year. Revenue from Commercial Term Lending was $313 million, an increase of $9 million, or 3%, compared with the prior year. Revenue from Real Estate Banking was $120 million, a decrease of $89 million, or 43%, compared with the prior year, driven by the absence of proceeds from a lending-related workout.

The provision for credit losses was a benefit of $48 million, compared with an expense of $43 million in the prior year. Net charge-offs were $28 million (0.08% net charge-off rate), compared with net charge-offs of $25 million (0.07% net charge-off rate) in the prior year and net charge-offs of $5 million (0.01% net charge-off rate) in the prior quarter. The allowance for loan losses to period-end loans retained was 1.67%, down from 1.97% in the prior year and down from 1.76% in the prior quarter. Nonaccrual loans were $331 million, down $183 million, or 36%, from the prior year, and down $44 million, or 12%, from the prior quarter.

Noninterest expense was $666 million, up 2% compared with the prior year, driven by higher investment in controls.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 19% on $14.0 billion of average allocated capital.

- Overhead ratio was 38%, compared with 35% in the prior year.

- Gross investment banking revenue (which is shared with the Corporate & Investment Bank) was a record $557 million, up 11% from the prior year and up 11% from the prior quarter. Record YTD gross investment banking revenue was $2.0 billion, up 18% from the prior year.

- Average loan balances were $145.7 billion, up 7% from the prior year and up 2% from the prior quarter.

- Period-end loan balances were $148.5 billion, up 8% from the prior year and up 3% from the prior quarter.

- Average client deposits and other third-party liabilities were $208.4 billion, up 2% from the prior year and up 2% from the prior quarter.

ASSET MANAGEMENT (AM)

| Results for AM ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 3,200 |

$ 3,046 |

$ 3,200 |

$ 154 |

5% |

$ - |

- % |

|---|

| Provision for Credit Losses |

3 |

9 |

21 |

(6) |

(67) |

(18) |

(86) |

|---|

| Noninterest Expenses |

2,320 |

2,081 |

2,245 |

239 |

11 |

75 |

3 |

|---|

| Net Income |

$ 540 |

$ 590 |

$ 581 |

$ (50) |

(8)% |

$ (41) |

(7)% |

|---|

Discussion of Results:

Net income was $540 million, a decrease of $41 million, or 7%, from the prior year, reflecting higher noninterest expense, partially offset by lower provision for credit losses.

Net revenue was $3.2 billion, flat to the prior year. Noninterest revenue was $2.6 billion, down $26 million, or 1%, from the prior year, due to lower valuations of seed capital investments, predominantly offset by net client inflows. Net interest income was $632 million, up $26 million, or 4%, from the prior year, due to higher loan and deposit balances, partially offset by spread compression.

Revenue from Global Investment Management was $1.7 billion, down 3% compared with the prior year. Revenue from Global Wealth Management was $1.5 billion, up 4% compared with the prior year.

Client assets were $2.4 trillion, an increase of $44 billion, or 2%, compared with the prior year. Excluding Retirement Plan Services, client assets were up 8% compared with the prior year. Assets under management were $1.7 trillion, an increase of $146 billion, or 9%, from the prior year, due to net inflows to long-term products and the effect of higher market levels.

The provision for credit losses was $3 million, compared with $21 million in the prior year.

Noninterest expense was $2.3 billion, an increase of $75 million, or 3%, from the prior year, as the business continues to invest in both infrastructure and controls.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 23% on $9.0 billion of average allocated capital.

- Pretax margin was 27%, down from 29% in the prior year.

- For the 12 months ended December 31, 2014, assets under management reflected net inflows of $98 billion, driven by net inflows of $80 billion to long-term products and $18 billion to liquidity products. For the quarter, net inflows were $37 billion, driven by net inflows of $27 billion to liquidity products and $10 billion to long-term products.

- Net long-term client flows were positive for the twenty-third consecutive quarter.

- Assets under management ranked in the top two quartiles for investment performance were 76% over 5 years, 72% over 3 years and 72% over 1 year.

- Customer assets in 4 and 5 Star-rated funds were 52% of all rated mutual fund assets.

- Client assets were $2.4 trillion, up 2% from the prior year and up 2% from the prior quarter.

- Average loans were $103.3 billion, a record, up 11% from the prior year and up 2% from the prior quarter.

- Average deposits were $152.0 billion, a record, up 6% from the prior year and up 1% from the prior quarter.

CORPORATE/PRIVATE EQUITY

| Results for Corporate/Private Equity ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 247 |

$ (75) |

$ 1,440 |

$ 322 |

NM |

$ (1,193) |

(83)% |

|---|

| Provision for Credit Losses |

(6) |

(8) |

(13) |

2 |

25% |

7 |

54 |

|---|

| Noninterest Expenses |

436 |

709 |

441 |

(273) |

(39) |

(5) |

(1) |

|---|

| Net Income |

$ 547 |

$ 95 |

$ 597 |

$ 452 |

476% |

$ (50) |

(8) % |

|---|

Discussion of Results:

Net income was $547 million, compared with net income of $597 million in the prior year.

Private Equity reported net income of $107 million, compared with net income of $13 million in the prior year, primarily due to higher net gains, partially offset by approximately $200 million of related goodwill impairment.

Treasury and CIO reported a net loss of $205 million, compared with a net loss of $268 million in the prior year. Net revenue was a loss of $243 million, compared with a loss of $337 million in the prior year. Net interest income was a loss of $339 million, compared with a loss of $408 million in the prior year.

Other Corporate reported net income of $645 million, compared with net income of $852 million in the prior year. The prior year included a $1.3 billion gain on the sale of Visa shares and a $493 million gain on the sale of One Chase Manhattan Plaza. The current quarter included $84 million (pretax) of legal expense, compared with $412 million (pretax) of legal expense in the prior year. The current quarter also included an approximately $500 million benefit from tax adjustments, and a $149 million contribution to our foundation, compared to a $355 million benefit from tax adjustments in the prior year.

JPMORGAN CHASE (JPM)(*)

| Results for JPM ($ millions) |

4Q14 |

3Q14 |

4Q13 |

3Q14 |

4Q13 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 23,552 |

$ 25,159 |

$ 24,112 |

$ (1,607) |

6% |

$ (560) |

(2)% |

|---|

| Provision for Credit Losses |

840 |

757 |

104 |

83 |

11 |

736 |

NM |

|---|

| Noninterest Expenses |

15,409 |

15,798 |

15,552 |

(389) |

(2) |

(143) |

(1) |

|---|

| Net Income |

$ 4,931 |

$ 5,572 |

$ 5,278 |

$ (641) |

12% |

$ (347) |

(7)% |

|---|

(*)Presented on a managed basis. See note on page 12 for further explanation of managed basis. Net revenue on a U.S. GAAP basis totaled $22.5 billion, $24.2 billion, and $23.2 billion for the fourth quarter of 2014, third quarter of 2014, and fourth quarter of 2013, respectively.

Discussion of Results:

Net income was $4.9 billion, down $347 million from the prior year. The decrease was driven by lower net revenue, partially offset by lower noninterest expense.

Net revenue was $23.6 billion, down $560 million, or 2%, compared with the prior year. Noninterest revenue was $12.2 billion, down $788 million, or 6%, compared with the prior year. Net interest income was $11.3 billion, up $228 million, or 2%, compared with the prior year, reflecting lower interest expense, higher loan balances and higher investment securities yields, largely offset by lower loan yields.

The provision for credit losses was $840 million, compared with $104 million from the prior year. The total consumer provision for credit losses was $946 million, compared with $65 million in the prior year. The current-quarter consumer provision reflected a $250 million reduction in the allowance for loan losses, compared to a $1.2 billion reduction in the prior year. The current-quarter consumer allowance release primarily reflects the continued improvement in home prices and delinquency trends in the residential real estate portfolio and the impact of the sustained improvement in the economy on the credit card portfolio. Consumer net charge-offs were $1.2 billion, compared with $1.3 billion in the prior year, resulting in net charge-off rates of 1.28% and 1.44%, respectively.

The wholesale provision for credit losses was a benefit of $106 million, compared with an expense of $39 million in the prior year. Wholesale net charge-offs were $26 million, compared with $22 million in the prior year, resulting in a net charge-off rate of 0.03% for both periods.

The Firm's allowance for loan losses to period-end loans retained1 was 1.55%, compared with 1.80% in the prior year. The Firm's allowance for loan losses to non-performing loans retained, excluding credit card, was 106%, compared with 100% in the prior year. The Firm's nonperforming assets totaled $8.0 billion, down from the prior quarter and prior year levels of $8.4 billion and $9.7 billion, respectively.

Noninterest expense was $15.4 billion, down $143 million, or 1%, compared with the prior year, driven by lower noninterest expense in Mortgage Banking, predominantly offset by higher noninterest expense in the Corporate & Investment Bank. The current quarter noninterest expense included approximately $1.1 billion of legal expense, compared with approximately $847 million of legal expense in the prior year.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Basel III Common Equity Tier 1 ratio was 9.8%.

- Headcount was 245,192, a decrease of 8,871, compared with the prior year.

1. Notes on non-GAAP financial measures:

- In addition to analyzing the Firm's results on a reported basis, management reviews the Firm's consolidated results and the results of the lines of business on a "managed" basis, which is a non-GAAP financial measure. The Firm's definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total consolidated net revenue for the Firm (and for each of the business segments) on a fully taxable-equivalent ("FTE") basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on consolidated net income/(loss) as reported by the Firm or on net income/(loss) as reported by the lines of business.

- The ratio of the allowance for loan losses to end-of-period loans retained, and the allowance for loan losses to nonaccrual loans retained, exclude the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired ("PCI") loans; and the allowance for loan losses related to PCI loans. Additionally, net charge-offs and net charge-off rates exclude the impact of PCI loans.

- Tangible common equity ("TCE") and return on tangible common equity ("ROTCE") are each non-GAAP financial measures. TCE represents the Firm's common stockholders' equity (i.e., total stockholders' equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm's earnings as a percentage of average TCE. TCE and ROTCE are meaningful to management, as well as analysts and investors, in assessing the Firm's use of equity, as well as facilitating comparisons of the Firm with competitors.

- Common Equity Tier 1 ("CET1") capital and the CET1 ratio under the Basel III Advanced Fully Phased-In rules, and the supplementary leverage ratio ("SLR") under the U.S. final SLR rule, are each non-GAAP financial measures. These measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm's capital position. For additional information on these measures, see Regulatory capital on pages 161-165 of JPMorgan Chase & Co.'s Annual Report on Form 10-K for the year ended December 31, 2013, and on pages 73-77 of the Firm's Quarterly Report on Form 10-Q for the quarter ended September 30, 2014.

- The CIB provides non-GAAP financial measures, as such measures are used by management to assess the underlying performance of the business and for comparability with peers.

- The ratio of the allowance for loan losses to end-of-period loans excludes the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB's allowance coverage ratio.

- ROE for the fourth quarter 2014 is calculated excluding legal expense.

- Prior to January 1, 2014, the CIB provided non-GAAP financial measures excluding the impact of FVA (effective fourth quarter 2013) and DVA on net revenue and net income. Beginning in the first quarter 2014, the Firm does not exclude FVA and DVA from its assessment of business performance, with the exception of certain refinements to net FVA and DVA in the fourth quarter 2014; however, the Firm continues to present these non-GAAP measures for the periods prior to January 1, 2014, as they reflected how management assessed the underlying business performance of the CIB in those prior periods.

- The change in Fixed Income Markets revenue excludes the revenue decline related to business simplification, including the sales of Physical Commodities and Global Special Opportunities Group businesses.

2. Additional notes on financial measures:

- Core loans include loans considered central to the Firm's ongoing businesses; core loans exclude runoff portfolios, discontinued portfolios and portfolios the Firm has an intent to exit.

- The amount of credit provided to clients represents new and renewed credit, including loans and commitments. The amount of credit provided to small businesses reflects loans and increased lines of credit provided by Consumer & Business Banking; Card, Merchant Services & Auto; and Commercial Banking. The amount of credit provided to nonprofit and government entities, including states, municipalities, hospitals and universities, represents that provided by the Corporate & Investment Bank and Commercial Banking.

- Consumer & Community Banking 2014 allocated equity includes $3.0 billion of capital held at the Consumer & Community Banking level related to legacy mortgage servicing matters.

- Consumer & Business Banking deposit rankings are based on FDIC 2014 Summary of Deposits survey per SNL Financial.

- The credit and debit volume metric is based on Nilson data as of 2013.

- Credit card sales volume is presented excluding Commercial Card. Rankings and comparison of general purpose credit card sales volume are based on disclosures by peers and internal estimates. Rankings are as of 3Q14.

- Banking portal ranking is per compete.com, as of November 2014.

- Mortgage Banking provision for credit losses is included in Real Estate Portfolios, in production expense in Mortgage Production, and in core servicing expense in Mortgage Servicing.

- #1 credit card issuer and 21% market share rankings based on disclosures by peers and internal estimates as of 3Q14.

- #1 U.S. co-brand issuer based on Phoenix Credit Card Monitor for the 12-months period ending September 2014; based on card accounts and revolving balance dollars.

- Global Visa ranking based on Visa data as of 3Q14 based on consumer and business credit card sales volume.

- #1 wholly-owned merchant acquirer based on Nilson data as of 2013; share of U.S. eCommerce volume based on the Internet Retailer Top 500 for 2013 and JPMC internal merchant client data.

JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm and one of the largest banking institutions in the United States of America (U.S.), with operations worldwide; the Firm has $2.5 trillion in assets and $219.7 billion in stockholders' equity. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, asset management and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of consumers in the U.S. and many of the world's most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about J.P. Morgan's capabilities can be found at jpmorgan.com and about Chase's capabilities at chase.com. Information about the Firm is available at www.jpmorganchase.com.

JPMorgan Chase & Co. will host a conference call today at 8:30 a.m. (Eastern Time) to present second quarter financial results. The general public can access the call by dialing (866) 541-2724 or (866) 786-8836 in the U.S. and Canada, or (706) 634-7246 for international participants. Please dial in 10 minutes prior to the start of the call. The live audio webcast and presentation slides will be available on the Firm's website, www.jpmorganchase.com, under Investor Relations, Investor Presentations.

A replay of the conference call will be available beginning at approximately noon on July 15, 2014, through midnight, August 2, 2014, by telephone at (855) 859-2056 or (800) 585-8367 (U.S. and Canada) or (404) 537-3406 (international); use Conference ID# 51815263. The replay will also be available via webcast on www.jpmorganchase.com under Investor Relations, Investor Presentations. Additional detailed financial, statistical and business-related information is included in a financial supplement. The earnings release and the financial supplement are available at www.jpmorganchase.com.

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.'s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.'s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.'s Annual Report on Form 10-K for the year ended December 31, 2013, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.'s website (https://jpmorganchaseco.gcs-web.com/financial-information/sec-filings) and on the Securities and Exchange Commission's website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.