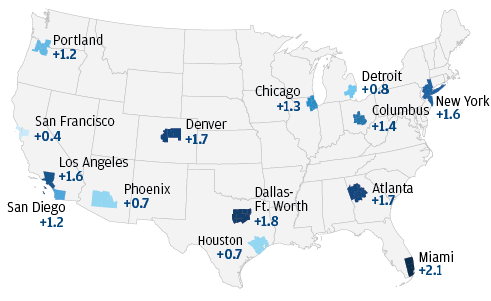

In 2016 the metropolitan share of US Gross Domestic Product was nearly 90 percent. Given the large share of economic output from metropolitan areas it is critical for stakeholders, researchers, and policymakers to have granular, high-frequency economic measurement and analyses at the metropolitan level to complement existing local economic research.

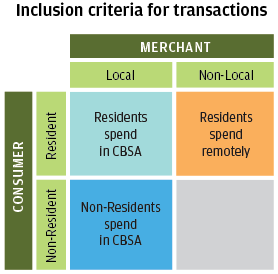

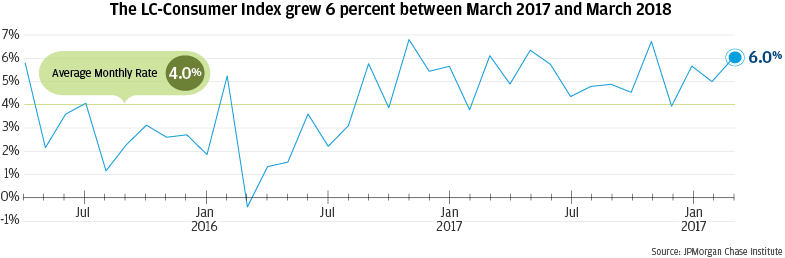

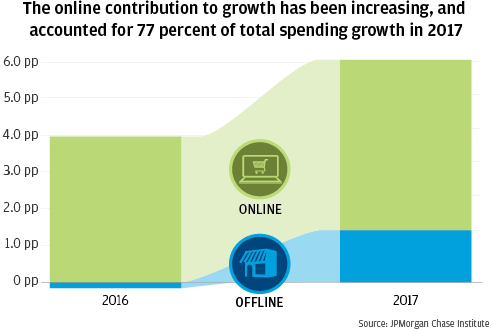

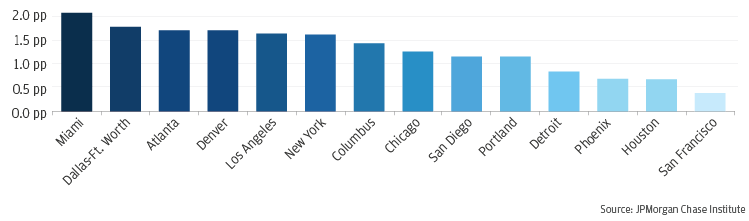

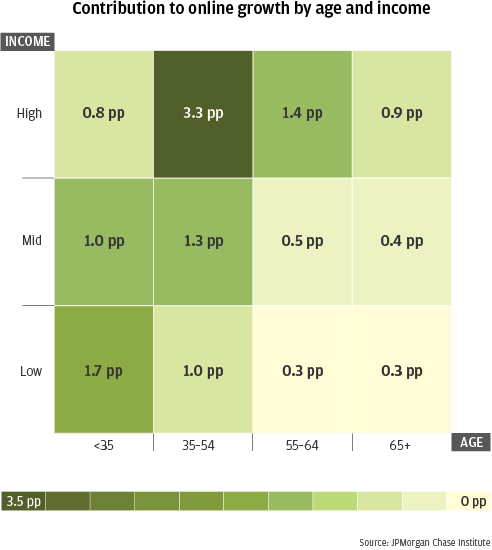

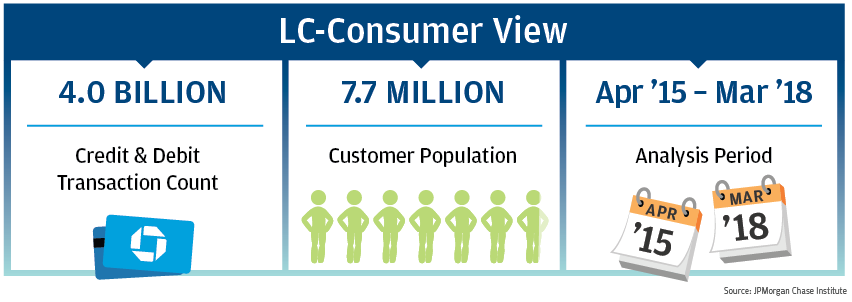

In this report, the JPMorgan Chase Institute expands the scope of our Local Commerce (LC) analyses through the introduction of our consumer view – namely, the transactions executed by consumers residing within a given metro area. This view complements the merchant view leveraged in our existing Local Commerce Index which examines the transactions executed at merchants located within a given metro area. The consumer view enables exploration of the extent to which online commerce has affected growth, who has driven that growth, and how it has impacted the offline marketplace.