Technological innovation is transforming economic exchange. Just a decade ago, the Online Platform Economy comprised a handful of marketplaces connecting independent sellers to buyers of physical goods. Today, many consumers use software platforms to procure almost any kind of good or service from independent suppliers as a routine part of daily life. Have these innovations created viable new options for making a living?

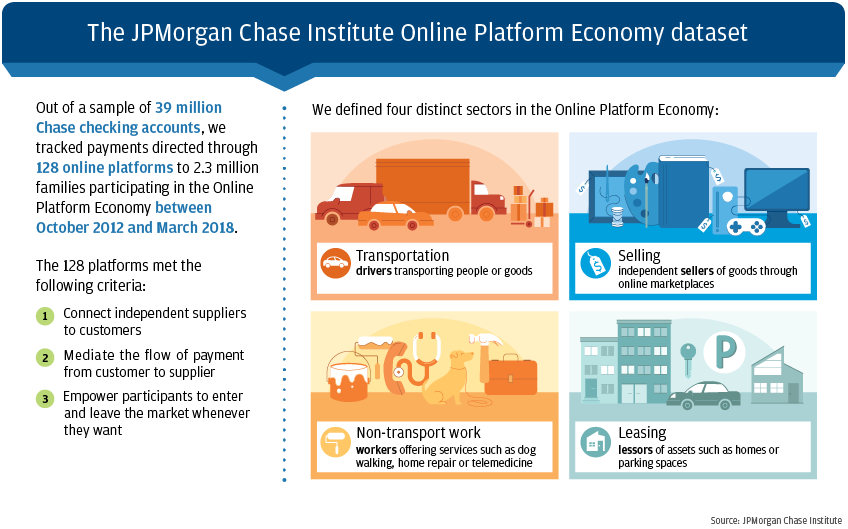

For this study, we extend the JPMorgan Chase Institute Online Platform Economy dataset in order to track supply-side participation and earnings. We identify 38 million payments directed through 128 different online platforms to 2.3 million distinct Chase checking accounts, out of a de-identified sample of 39 million, between October 2012 and March 2018. Our description distinguishes four sectors of the Online Platform Economy:

- The transportation sector, in which drivers transport people or goods

- The non-transport work sector, in which workers offer a growing variety of services including dog walking, home repair, telemedicine, and many others

- The selling sector, in which independent sellers of goods find buyers through online marketplaces

- The leasing sector, in which lessors find lessees to rent homes, parking spaces, and many other types of assets.