Conclusion

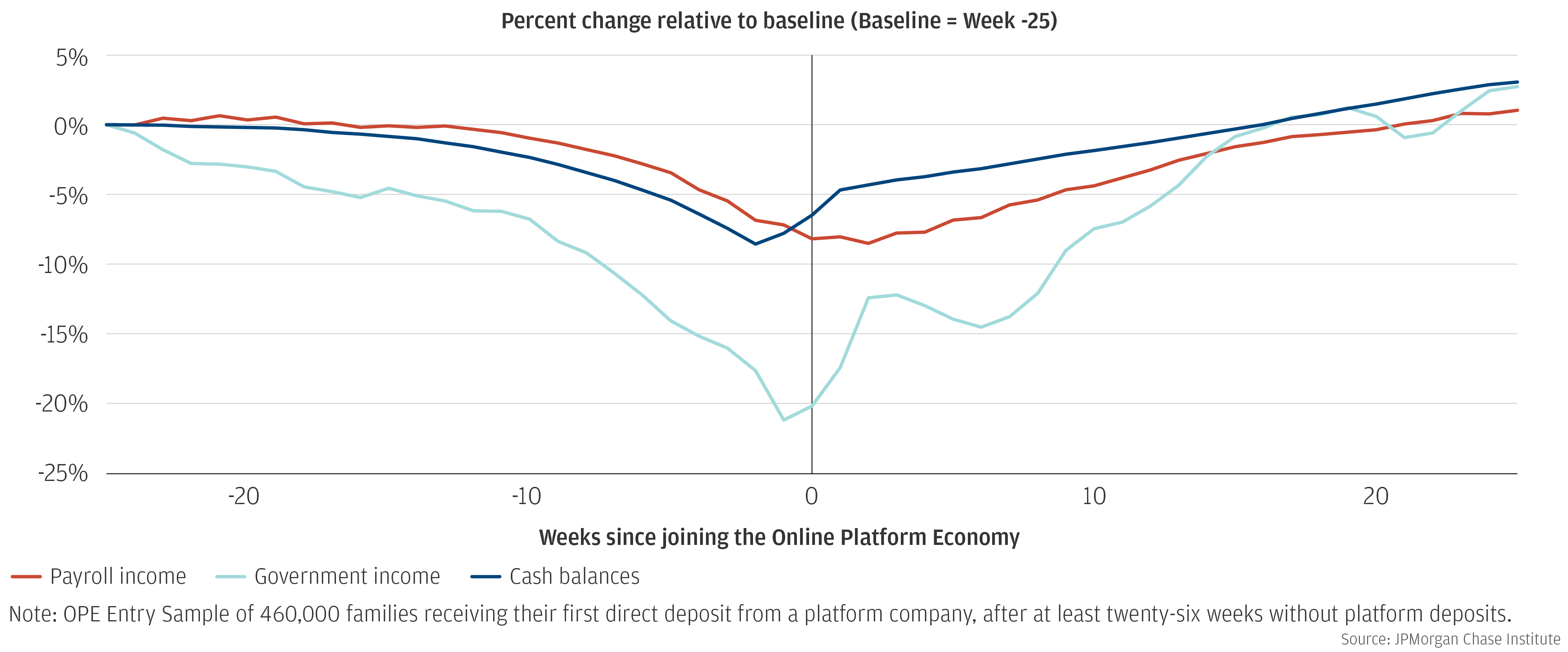

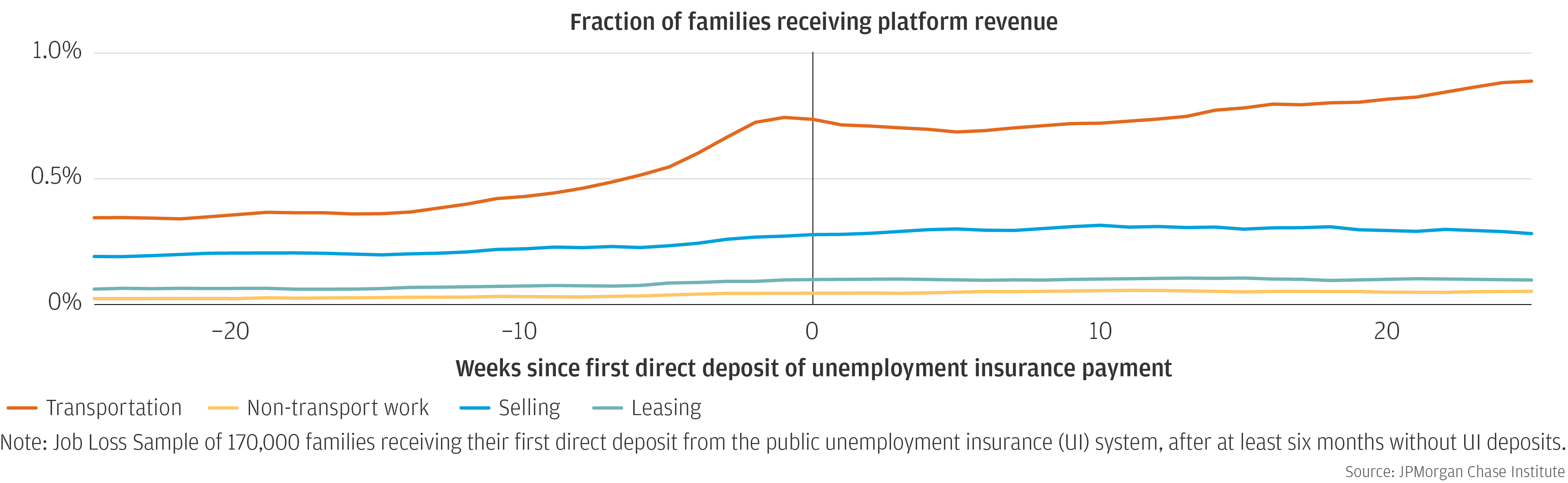

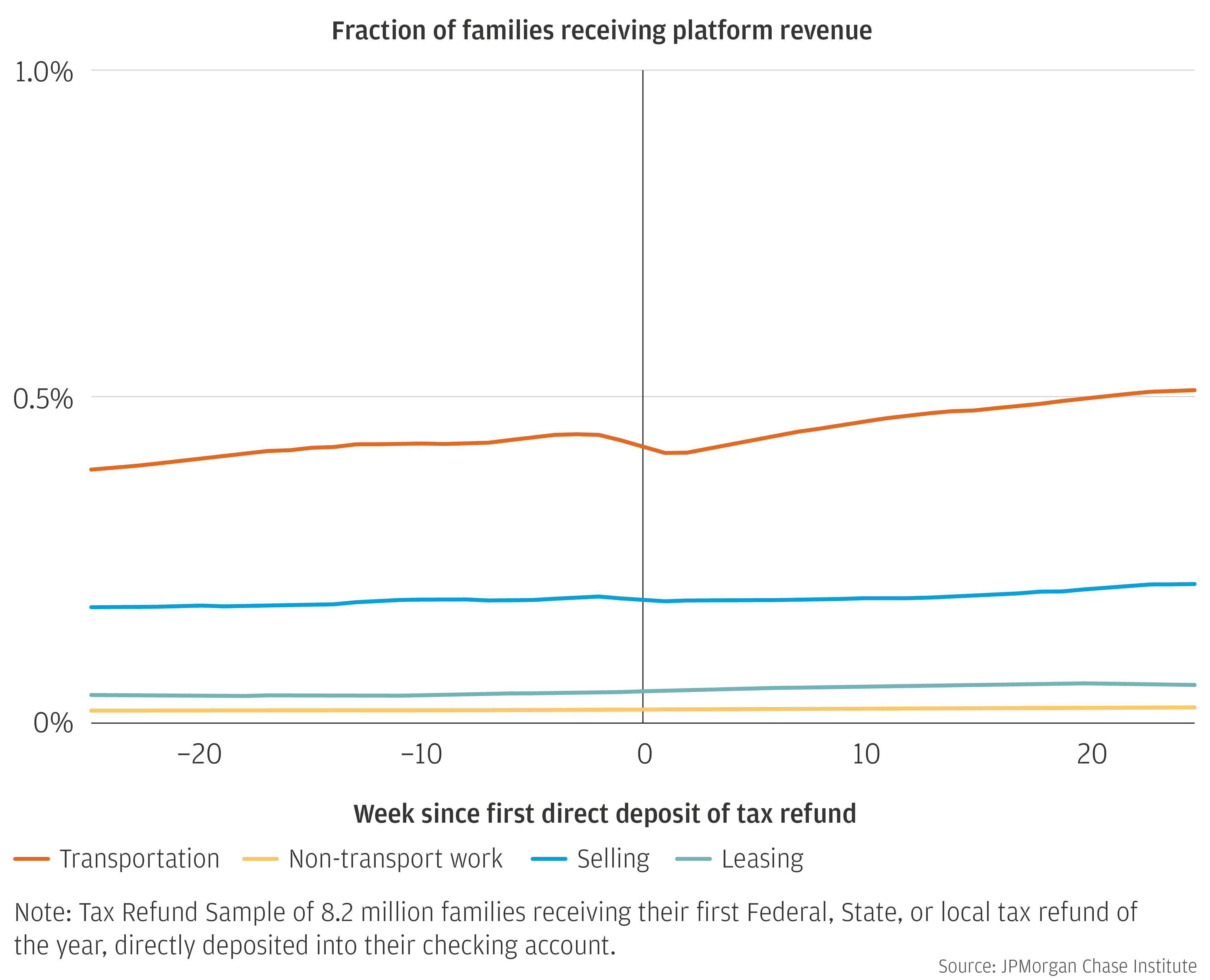

Taken together, our findings indicate that the Online Platform Economy—and particularly its transportation sector—play an income-smoothing function for families between jobs. However, the tax-related cash flow events do not coincide with changes in platform participation or revenues. These findings add an important dimension to discussions around the design of policy and regulation of these labor markets. We see four especially important implications:

First, as policymakers weigh approaches to improve the pay, benefits, and protections of platform workers, they ought to take into consideration potential impacts those same approaches might have on the very characteristics of platform work—low barriers to entry and high flexibility—that allows families to use it to smooth their income. Families in need of an income-smoothing tool may be turning to transportation platforms in particular because barriers to entry on these platforms may be lower than other sectors, and because it may be comparatively easy to generate revenues in the transportation sector with only occasional and periodic engagement. As policy discussions continue around portable benefits schemes, it is important to consider separately the needs of workers who intend to use platforms or other gigs as a primary source of income over the long-term from those who intend to use them as a temporary income-smoothing tool.

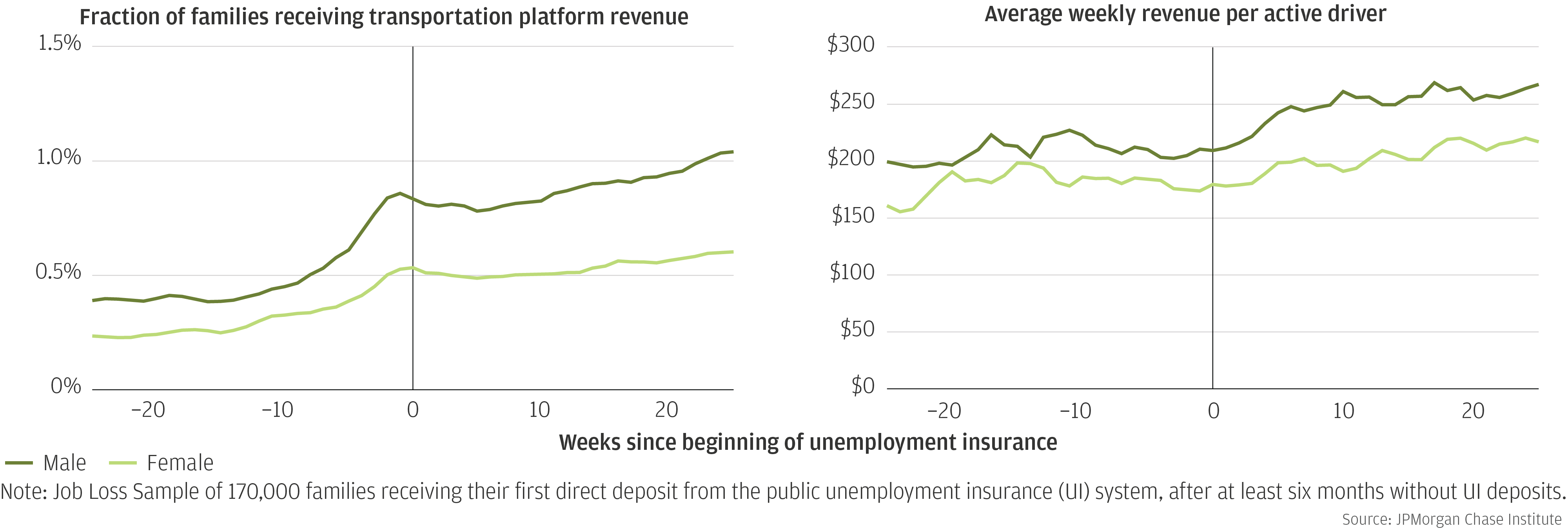

Second, the Online Platform Economy may be more available as an income-smoothing tool for some families than for others. Women (or family members who share accounts with women) experiencing interruptions to their payroll income are less likely to turn to the Online Platform Economy. To the extent that this difference may reflect structural disparities, it would require attention from both policymakers and platform providers.

Third, although fewer than 1 percent of families experiencing involuntary job loss actually turn to the Online Platform Economy to smooth their income, for those families the additional $150-$250 per week in platform revenues may be crucial. Fully accounting for the additional marginal costs associated with platform participation is likely difficult even for participants, so the extent to which platform participation is effective in generating real income remains unknown. However, the additional cash flow may address important immediate needs.

Finally, high rates of labor churn in the Online Platform Economy have been taken in some policy discussions as an indication that joining may have proved to be a bad financial decision for many drivers. However, our findings imply that one function driving through the Online Platform Economy may play is to bridge a gap between jobs. In that case, the fact that many drivers find another job and become inactive shortly after joining should not necessarily be interpreted as “voting with their feet” against the viability of the Online Platform Economy as an option for generating income.