November 06, 2025

Rising housing costs and limited supply have made access to stable and affordable housing increasingly out of reach for millions of Americans, straining household budgets and slowing economic growth. The scale of housing affordability challenges is significant, affecting communities across rural and urban America. The primary driver of this challenge is the persistent underproduction of homes for households at all income levels, which has failed to keep pace with growing demand. Addressing this challenge will require coordinated action among government, private sector, and nonprofit organizations to increase the availability of housing.

JPMorganChase is committed to supporting the communities we serve and advancing solutions to housing affordability challenges. The JPMorganChase PolicyCenter is launching a series of papers highlighting effective state and local policies that expand housing supply and improve access to homeownership.

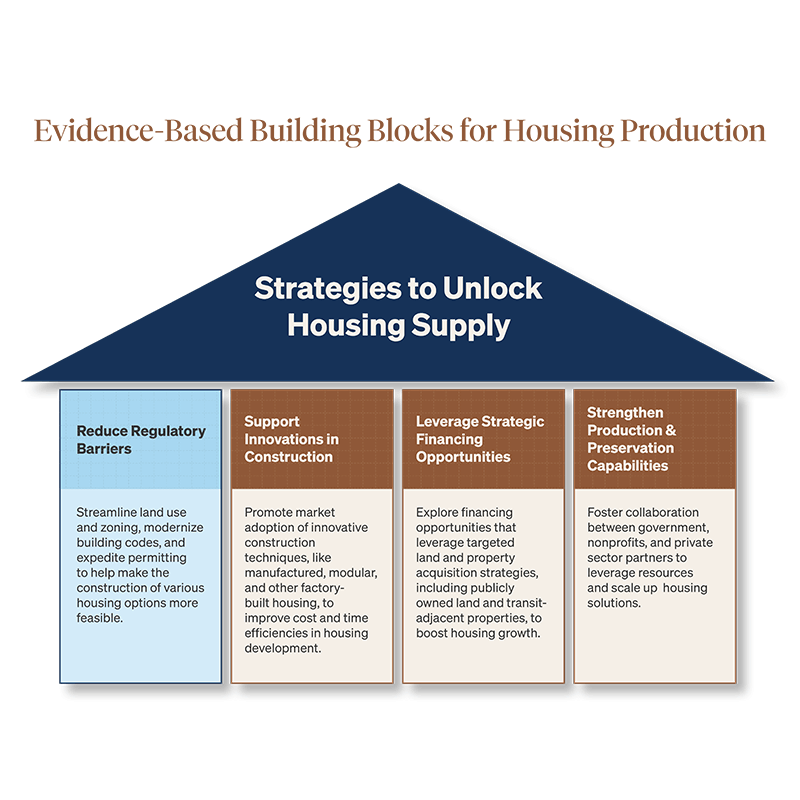

In this first paper of the series, we examine strategies for reducing regulatory barriers to housing production, recommending that state and local policymakers take the following evidence-based steps to unlock housing supply:

State and local recommendations

- Reform zoning and land use rules to allow for more types of housing, especially “missing middle” options, by cutting overly restrictive regulations.

- Update building codes to support faster, more cost-effective construction while maintaining safety and quality.

- Streamline permitting processes to improve transparency, speed up approvals, and reduce delays for new housing development.

The series will follow the building blocks outlined below—strategies that can help reinforce housing production ecosystems when applied at the state and local levels. The first paper in this series will dive into the first building block: state and local strategies to reduce regulatory barriers and unlock housing supply through land use, zoning, building code, and permitting reforms.