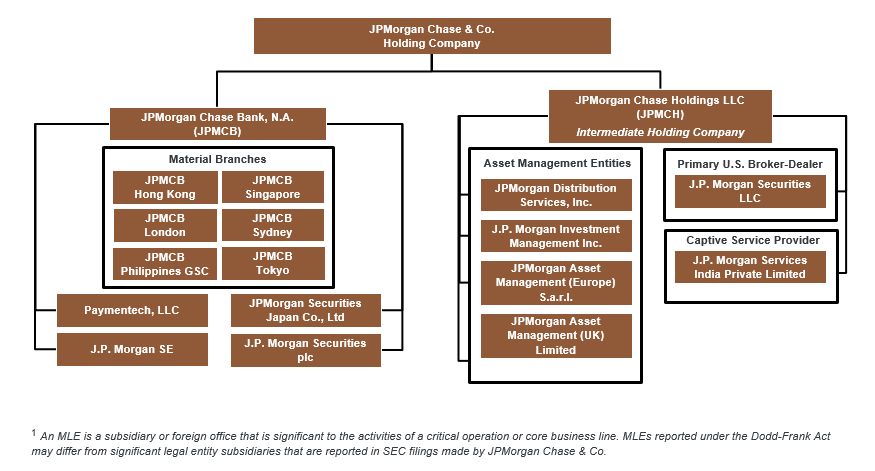

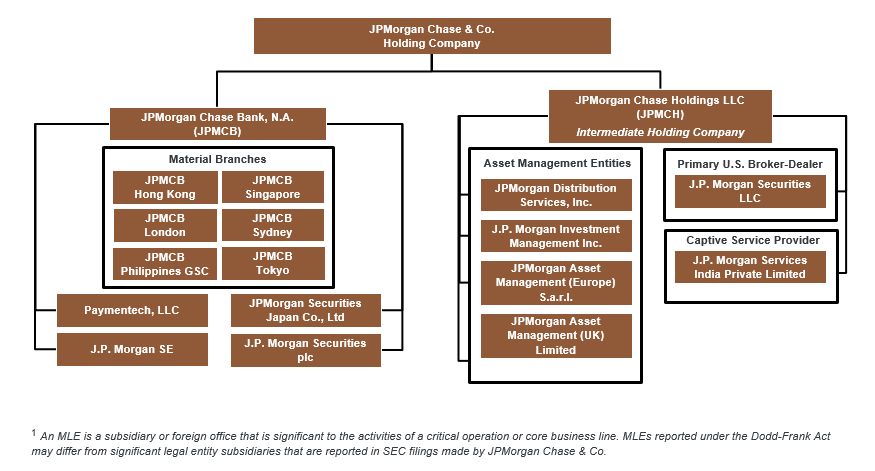

Material Entities

Material Legal Entities1as of July 1, 2025

Investor Relations

| Moody's | S&P | Fitch | |

|---|---|---|---|

| Outlook | Stable | Stable | Stable |

| Long-term issuer rating | A1 | A | AA- |

| Short-term issuer rating | P-1 | A-1 | F1+ |

| Senior Unsecured | A1 | A | AA- |

| Subordinated debt | A2 | A- | A |

| Junior Subordinated | A3 | BBB | BBB+ |

| Trust Preferred | Baa1 | BBB | BBB+ |

| Preferred stock | Baa1 | BBB | BBB+ |

JPMorgan Chase & Co. Credit Ratings

| Moody's | S&P | Fitch | |

|---|---|---|---|

| Outlook | Stable | Stable | Stable |

| Long-term issuer rating | Aa2 | AA- | AA |

| Short-term issuer rating | P-1 | A-1+ | F1+ |

| Senior Unsecured | Aa2 | AA- | AA |

| Long-term domestic deposits | Aa1 | N/A | AA+ |

| Subordinated debt | Aa3 | A | A+ |

JPMorgan Chase Bank, N.A. Credit Ratings

| Moody's | S&P | Fitch | |

|---|---|---|---|

| Outlook | Stable | Stable | Stable |

| Long-term issuer rating | Aa3 | AA- | AA |

| Short-term issuer rating | P-1 | A-1+ | F1+ |

JPMorgan Securities LLC Credit Ratings

| Moody's | S&P | Fitch | |

|---|---|---|---|

| Outlook | Stable | Stable | Stable |

| Long-term issuer rating | Aa3 | AA- | AA |

| Short-term issuer rating | P-1 | A-1+ | F1+ |

JPMorgan Securities plc Credit Ratings

| Moody's | S&P | Fitch | |

|---|---|---|---|

| Outlook | Stable | Stable | Stable |

| Long-term issuer rating | Aa2 | AA- | AA |

| Short-term issuer rating | P-1 | A-1+ | F1+ |

JPMorgan Chase Bank SE Credit Ratings

These credit ratings are provided for information purposes only. Credit ratings are solely the opinions of the rating agencies. JPMorgan Chase does not endorse, and accepts no responsibility for, the credit ratings issued by the rating agencies. Credit ratings may be changed, superseded or withdrawn by the rating agencies at any time.

Material Entities

Material Legal Entities1as of July 1, 2025

Senior and Subordinated Debt

JPMorgan Chase & Co. trailing 12-month senior and subordinated benchmark debt issuance

| ISIN / Link to Prospectus |

Type | Coupon | Currency | Notional (mm) |

Issue Date |

Maturity Date |

|---|---|---|---|---|---|---|

| XS3300349399 | Senior - Callable |

3mE + 0.53% |

EUR | 1,500 | 2/18/2026 | 2/18/2029 |

| XS3300349639 | Senior - Callable |

3.136% until 2/18/2031; then 3mE + 0.76% |

EUR | 1,750 | 2/18/2026 | 2/18/2032 |

| US46647PFK75 | Subordinated - Callable | 5.193% until 2/5/2036; then Compounded SOFR + 1.30% |

USD | 3,000 | 2/5/2026 | 2/5/2037 |

| US46647PFG63 | Senior - Callable | 4.347% until 1/22/2031; then Compounded SOFR + 0.84% |

USD | 2,600 | 1/22/2026 | 1/22/2032 |

| US46647PFH47 | Senior - Callable | Compounded SOFR + 0.84% | USD | 400 | 1/22/2026 | 1/22/2032 |

| US46647PFJ03 | Senior - Callable | 4.898% until 1/22/2036; then Compounded SOFR + 1.07% | USD | 3,000 | 1/22/2026 | 1/22/2037 |

| US46647PFD33 | Senior - Callable | 4.255% until 10/22/2030; then Compounded SOFR + 0.93% |

USD | 2,000 | 10/22/2025 | 10/22/2031 |

| Senior - Callable | 4.81% until 10/22/2035; then Compounded SOFR + 1.19% |

USD | 3,000 | 10/22/2025 | 10/22/2036 | |

| US46647PFC59 | Subordinated - Callable |

5.576% until 7/23/2035; then Compounded SOFR + 1.635% | USD | 4,000 | 7/23/2025 | 7/23/2036 |

| US46647PEY88 | Senior - Callable | 5.103% until 4/21/2030; then Compounded SOFR + 1.435% |

USD | 2,500 | 4/22/2025 | 4/22/2031 |

| US46647PEX06 | Senior - Callable | 5.572% until 4/21/2035; then Compounded SOFR + 1.68% | USD | 3,500 | 4/22/2025 | 4/22/2036 |

JPMorgan Chase & Co. outstanding preferred stock

| CUSIP or ISIN Link to Prospectus |

Name (Ticker) | Coupon | Currency | Notional (mm) | Issue Date | Maturity Date | Callable on or after |

|---|---|---|---|---|---|---|---|

| US48128AAJ25 | Non-Cumulative Preferred Stock, Series OO | 6.500% until 4/1/2030; then 5Y CMT +2.152% | USD | 3,000 | 2/4/2025 | Perpetual | 4/1/2030 |

| US48128BAQ41 | Non-Cumulative Preferred Stock, Series NN |

6.875% until 06/01/2029; then 5Y CMT +2.737% | USD | 2,500 | 3/12/2024 | Perpetual | 6/1/2029 |

| US48128B5232 | Non-Cumulative Preferred Stock, Series MM (JPM PR M) |

4.20% | USD | 2,000 | 7/29/2021 | Perpetual | 9/1/2026 |

| US48128BAN10 | Non-Cumulative Preferred Stock, Series KK |

3.65% until 06/01/2026; then 5Y CMT +2.85% | USD | 2,000 | 5/12/2021 | Perpetual | 6/1/2026 |

| US48128B5497 | Non-Cumulative Preferred Stock, Series LL (JPM PR L) |

4.625% | USD | 1,850 | 5/20/2021 | Perpetual | 6/1/2026 |

| US48128B5802 | Non-Cumulative Preferred Stock, Series JJ (JPM PR K) |

4.550% | USD | 1,500 | 3/17/2021 | Perpetual | 6/1/2026 |

| 48128BAH4 | Non-Cumulative Preferred Stock, Series II | 4% until 4/1/25; then 3m SOFR + 2.745% | USD | 1,500 | 2/24/2020 | Perpetual | 4/1/2025 |

| 48128B622 | Non- Cumulative Preferred Stock, Series GG (JPM PR J) |

4.750% | USD | 900 | 11/7/2019 | Perpetual | 12/1/2024 |

| 48128B648 | Non- Cumulative Preferred Stock, Series EE (JPM PR C) |

6.000% | USD | 1,850 | 1/24/2019 | Perpetual | 3/1/2024 |

| 48128B655 | Non- Cumulative Preferred Stock, Series DD (JPM PR D) |

5.750% | USD | 1,696 | 09/21/18 | Perpetual | 12/01/23 |

| 48128BAD3 | Non- Cumulative Preferred Stock, Series CC |

4.625% until 11/01/22; then 3m SOFR + 2.84161% |

USD | 1,258 | 10/20/17 | Perpetual | 11/01/22 |

JPMorgan Chase & Co. outstanding preferred stock

Holders of JPMorgan Chase & Co.'s debt and equity securities will absorb losses if it were to enter into a resolution.

Federal Reserve rules require that JPMorgan Chase & Co. (the “Parent Company”) maintain minimum levels of unsecured external long-term debt and other loss-absorbing capacity with specific terms (“eligible LTD”) for purposes of recapitalizing JPMorgan Chase’s operating subsidiaries if the Parent Company were to enter into a resolution either:

If the Parent Company were to enter into a resolution, holders of eligible LTD and other debt and equity securities of the Parent Company will absorb the losses of the Parent Company and its subsidiaries.

The preferred “single point of entry” strategy under JPMorgan Chase’s resolution plan contemplates that only the Parent Company would enter bankruptcy proceedings. JPMorgan Chase’s subsidiaries would be recapitalized, as needed, so that they could continue normal operations or subsequently be divested or wound down in an orderly manner. As a result, the Parent Company’s losses and any losses incurred by its subsidiaries would be imposed first on holders of the Parent Company’s equity securities and thereafter on its unsecured creditors, including holders of eligible LTD and other debt securities. Claims of holders of those securities would have a junior position to the claims of creditors of JPMorgan Chase’s subsidiaries and to the claims of priority (as determined by statute) and secured creditors of the Parent Company.

Accordingly, in a resolution of the Parent Company in bankruptcy, holders of eligible LTD and other debt securities of the Parent Company would realize value only to the extent available to the Parent Company as a shareholder of JPMorgan Chase Bank, N.A. and its other subsidiaries, and only after any claims of priority and secured creditors of the Parent Company have been fully repaid.

The FDIC has similarly indicated that a single point of entry recapitalization model would be its expected strategy to resolve a systemically important financial institution, such as the Parent Company, under Title II. However, the FDIC has not formally adopted or committed to any specific resolution strategy.

If the Parent Company were to approach, or enter into, a resolution, none of the Parent Company, the Federal Reserve or the FDIC is obligated to follow JPMorgan Chase’s preferred resolution strategy, and losses to holders of eligible LTD and other debt and equity securities of the Parent Company, under whatever strategy is ultimately followed, could be greater than they might have been under JPMorgan Chase’s preferred strategy.

No Offer or Solicitation

The contents of this website are provided for information purposes only and do not constitute an offer to sell or the solicitation of an offer to buy any securities.

Investment Considerations

An investment in securities entails certain risks, including those described in the offering documents relating to the securities. Information contained on this website may not be sufficient for a prospective investor to make an informed decision regarding an investment in any securities issued or sponsored by JPMorgan Chase or any of its affiliates. Reported performance results may not be indicative of future results. Prospective investors should consult their own financial and legal advisors about risks associated with investments in a particular issue of securities and the suitability of investing in such securities in light of their particular circumstances.

Information Subject to Change

JPMorgan Chase and its affiliates reserve the right to amend or revise any information or documents contained on this website at any time without notice. In particular, program and transaction documents contained on this website may be amended, supplemented or otherwise modified from time to time.

Website Contains Dated Materials

This website operates as, among other things, an archive for offering documents and other materials prepared from time to time with respect to specific issuances of securities. The information and documents contained on this website speak only as of the dates indicated therein and may not be accurate as of any subsequent date. JPMorgan Chase and its affiliates do not undertake any obligation or assume any responsibility to update any of such information or documents.

No Liability

In no event shall JPMorgan Chase or any of its affiliates be liable for any damages of any kind (including, without limitation, special, incidental, indirect or consequential damages) on any theory of liability arising out of or in connection with the use of any information on this website.

Non-Deposit Products

The securities described on this website are not insured or guaranteed by the FDIC or any other governmental agency or instrumentality, and are not bank deposits, obligations or guarantees.