Creating Stronger Neighborhoods

Woodburn Partners is one of thousands of small businesses that became part of that mission. It received financial support and training through the Equitable Development Initiative (EDI), supported by JPMorgan Chase. That helped Brown and Earley develop The Coe, a 12 unit residential and retail development in the West Village, a Detroit neighborhood.

When The Coe's development began, the West Village was on the cusp of either taking off or falling apart, says Brown. Now it's a neighborhood that people want to buy into, develop, and visit on the weekends to browse its eclectic stores, cafes and bakeries.

“For the longest time in the city of Detroit, all of the development was happening in Downtown or Midtown, at least the development at scale," says Brown. “So, this [development of The Coe] really showed not just for this neighborhood, but for the neighborhoods at large, that if you're willing to do the work and willing to take the chance, people are happy to live–and want to live–in Detroit's neighborhoods."

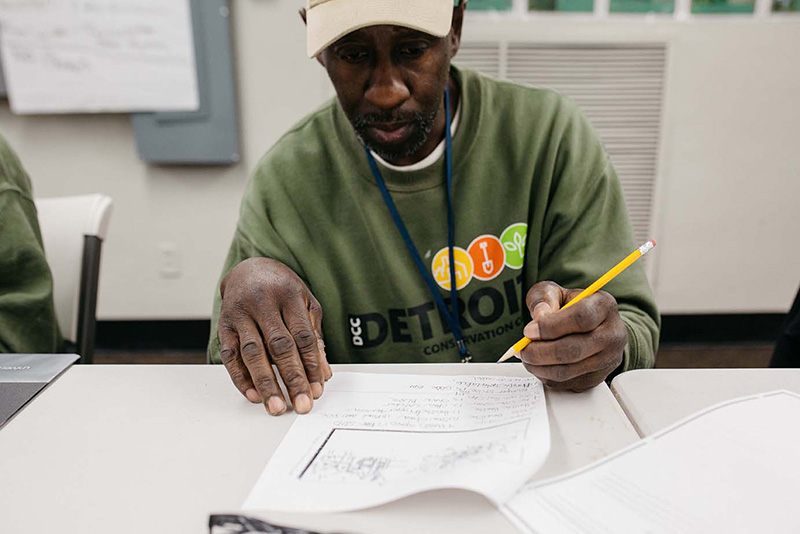

Training to Build Communities

The EDI, the program that helped Brown and Earley, was created by a Community Development Financial Institution called Capital Impact Partners. EDI trains dozens of minority property developers on business management and financing for complexes that qualify as community improvements.

Helping small businesses improve communities has other benefits. According to a Detroit study published in the Journal of Criminal Justice, violent crime and property crime drop in areas where abandoned homes are demolished and replaced with more community-oriented developments.

Helping black-run real estate development companies also creates a virtuous cycle that perpetuates neighborhood rejuvenation. Brown says he now counts no fewer than six new projects going up around The Coe.

“When you have not historically seen people from your neighborhood follow this path, then there's always some doubt. So to have financial institutions that have traditionally been the ones to say 'no,' say, 'hey, keep pushing, we're here to support you,'–it means a huge deal," says Brown.