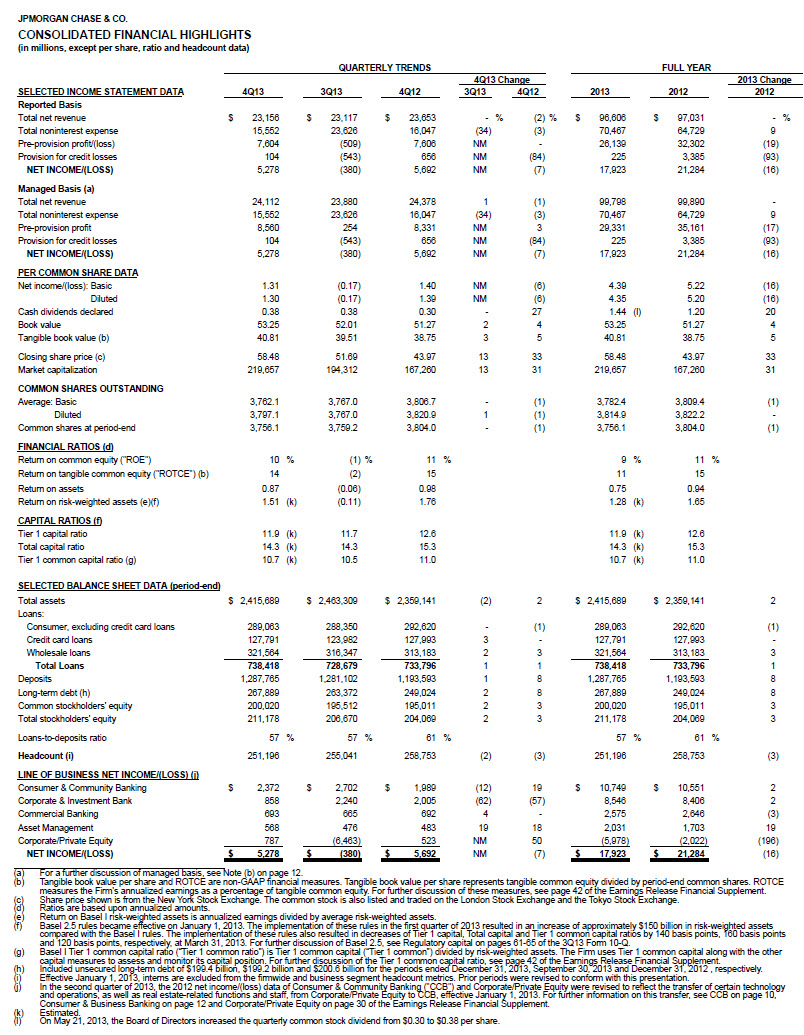

JPMorgan Chase & Co. (NYSE: JPM) today reported net income for the fourth quarter of 2013 of $5.3 billion, compared with net income of $5.7 billion in the fourth quarter of 2012. Earnings per share were $1.30, compared with $1.39 in the fourth quarter of 2012. Revenue for the quarter was $24.1 billion, down 1% compared with the prior year. The Firm's return on tangible common equity1 for the fourth quarter of 2013 was 14%, compared with 15% in the prior year.

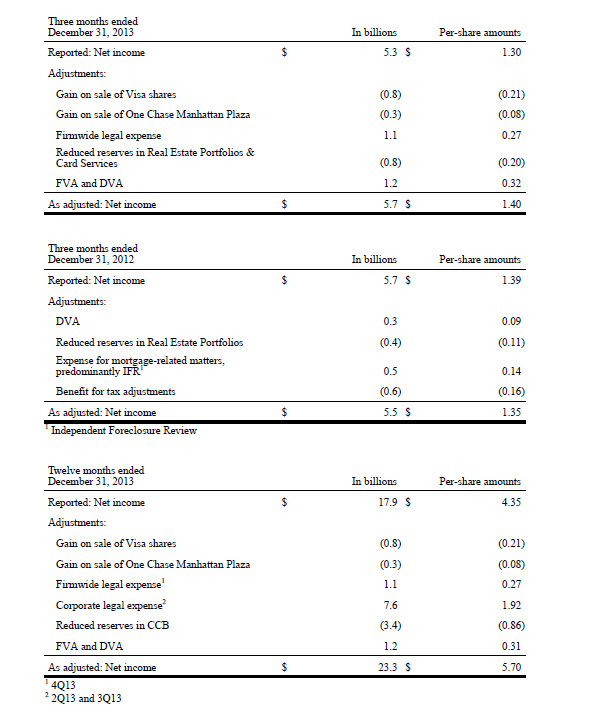

Adjusted for the significant items disclosed in our earnings press releases this quarter and in the fourth quarter of 2012, EPS would have been $1.40 this year compared with $1.35 in the prior year and ROTCE would have been 15% this year, flat compared with the prior year.

Net income for full-year 2013 was $17.9 billion, compared with $21.3 billion for the prior year. Earnings per share were $4.35 for 2013, compared with $5.20 for 2012. Revenue for 2013 was $99.8 billion, flat compared with 2012 revenue of $99.9 billion.

Jamie Dimon, Chairman and Chief Executive Officer, commented on the financial results: "We are pleased to have made progress on our control, regulatory and litigation agendas and to have put some significant issues behind us this quarter. We reached several important resolutions - Global RMBS, Gibbs & Bruns, and Madoff. It was in the best interests of our company and shareholders for us to accept responsibility, resolve these issues and move forward. This will allow us to focus on what we are here for: serving our clients and communities around the world. We remained focused on building our four leading franchises, which all continued to deliver strong underlying performance, for the quarter and the year."

Dimon continued, "The Corporate & Investment Bank was #1 in global IB fees in 2013, with #1 positions in global debt and equity, syndicated loans, and U.S. announced M&A, and we gained share in Banking and Markets. Consumer & Community Banking deposits were up 8% for the fourth quarter of 2013; client investment assets were up 19%; and general purpose credit card sales volume growth has outperformed the industry for 23 consecutive quarters. Gross investment banking revenue3 was a record $1.7 billion for the year, up 5%. Asset Management also had excellent performance with positive net long-term client flows of $90 billion for the full year 2013 and record loan balances, up 21%."

Dimon added: "During the course of 2013, JPMorgan Chase continued to make a significant positive impact on our communities. In 2013, the Firm provided credit and raised capital of over $2.1 trillion for our clients. The Firm has hired over 6,300 military veterans since 2011 as a proud founding member of the 100,000 Jobs Mission."

Dimon concluded: "I am proud of this Company, our employees and what we do every day to serve our clients, customers and communities. We are increasingly optimistic about the future of the U.S. economy and will continue to do our part to support growth, economic development and the creation of new jobs around the world."

In the discussion below of the business segments and of JPMorgan Chase as a Firm, information is presented on a managed basis. For more information about managed basis, as well as other non-GAAP financial measures used by management to evaluate the performance of each line of business, see pages 12 and 13. The following discussion compares the fourth quarters of 2013 and 2012 unless otherwise noted. Footnotes in the sections that follow are described on page 14.

CONSUMER & COMMUNITY BANKING (CCB)

| Results for CCB ($ millions) |

4Q13 |

3Q13 |

4Q12 |

3Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 11,314 |

$ 11,082 |

$ 12,362 |

$ 232 |

2% |

$ (1,048) |

(8)% |

| Provision for Credit Losses |

72 |

(267) |

1,091 |

339 |

NM |

(1,019) |

(93) |

| Noninterest Expenses |

7,321 |

6,867 |

7,989 |

454 |

7 |

(668) |

(8) |

| Net Income |

$ 2,372 |

$ 2,702 |

$ 1,989 |

$ (330) |

(12)% |

$ 383 |

19% |

Discussion of Results:

Net income was $2.4 billion, an increase of $383 million, or 19%, compared with the prior year, due to lower provision for credit losses and lower noninterest expense, largely offset by lower net revenue.

Net revenue was $11.3 billion, a decrease of $1.0 billion, or 8%, compared with the prior year. Net interest income was $7.1 billion, down $199 million, or 3%, driven by spread compression in Credit Card, lower deposit margins and lower loan balances due to portfolio runoff, partially offset by higher deposit balances. Noninterest revenue was $4.3 billion, a decrease of $849 million, or 17%, driven by lower mortgage fees and related income, partially offset by higher investment sales revenue.

The provision for credit losses was $72 million, compared with $1.1 billion in the prior year and a benefit of $267 million in the prior quarter. The current-quarter provision reflected a $1.2 billion reduction in the allowance for loan losses and total net charge-offs of $1.3 billion. The prior-quarter provision reflected a $1.6 billion reduction in the allowance for loan losses and total net charge-offs of $1.3 billion. The prior-year provision reflected a $700 million reduction in the allowance for loan losses and total net charge-offs of $1.8 billion.

Noninterest expense was $7.3 billion, a decrease of $668 million, or 8%, from the prior year, driven by lower mortgage servicing expense, partially offset by higher non-MBS related legal expense in Mortgage Production and costs related to the control agenda.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted; banking portal ranking is per compete.com, as of November 2013)

- Return on equity was 20% on $46.0 billion of average allocated capital.

- Average total deposits were $461.1 billion, up 8% from the prior year and 1% from the prior quarter. According to the FDIC 2013 Summary of Deposits survey, Chase grew deposits more than any other bank for the second year in a row, with a growth rate more than twice the industry average.

- Active mobile customers were up 26% over the prior year to 15.6 million, and Chase.com remains the #1 most visited banking portal in the U.S.

- Record client investment assets were $188.8 billion, up 19% from the prior year and 6% from the prior quarter.

- Record credit card sales volume was $112.6 billion, up 11% from the prior year and 5% from the prior quarter. General purpose credit card sales volume growth has outperformed the industry for 23 consecutive quarters.

- Merchant processing volume was $203.4 billion, up 14% from the prior year and 9% from the prior quarter. Total transactions processed were 9.6 billion, up 17% from the prior year and 8% from the prior quarter.

- Auto originations were $6.4 billion, up 16% from the prior year.

- Mortgage originations were $23.3 billion, down 54% from the prior year and 42% from the prior quarter. Purchase originations of $13.0 billion were up 6% from the prior year and down 35% from the prior quarter.

Consumer & Business Banking net income was $780 million, an increase of $49 million, or 7%, compared with the prior year, due to higher net revenue, largely offset by higher noninterest expense.

Net revenue was $4.4 billion, up 4% compared with the prior year. Net interest income was $2.7 billion, up 3% compared with the prior year, driven by higher deposit balances, largely offset by lower deposit margins. Noninterest revenue was $1.7 billion, an increase of 4%, driven by higher investment sales revenue and debit card revenue, partially offset by lower deposit-related fees.

The provision for credit losses was $108 million, compared with $110 million in the prior year and $104 million in the prior quarter.

Noninterest expense was $3.0 billion, up 3% from the prior year, due to costs related to the control agenda.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 28% on $11.0 billion of average allocated capital.

- Ranked #1 in customer satisfaction among the largest banks for the second year in a row by American Customer Satisfaction Index (ACSI).

- Ranked #1 in small business banking customer satisfaction in three of the four regions (West, Midwest and South) by J.D. Power.

- Average total deposits were $446.0 billion, up 10% from the prior year and 2% from the prior quarter.

- Deposit margin was 2.29%, compared with 2.44% in the prior year and 2.32% in the prior quarter.

- Accounts totaled 29.4 million, up 5% from the prior year and flat compared with the prior quarter, reflecting higher customer retention.

- Average Business Banking loans were $18.6 billion, up 1% from the prior year and flat compared with the prior quarter. Originations were $1.3 billion, flat compared with the prior quarter and down 15% from the prior year.

- Chase Private Client locations totaled 2,149, an increase of 931 from the prior year and 201 from the prior quarter.

Mortgage Banking net income was $562 million, an increase of $144 million, or 34%, compared with the prior year, driven by lower noninterest expense and provision for credit losses, predominantly offset by lower net revenue.

Net revenue was $2.2 billion, a decrease of $1.1 billion compared with the prior year. Net interest income was $1.1 billion, a decrease of $58 million, or 5%, driven by lower loan balances due to portfolio runoff. Noninterest revenue was $1.1 billion, a decrease of $1.0 billion, driven by lower mortgage fees and related income.

The provision for credit losses was a benefit of $782 million, compared with a benefit of $269 million in the prior year. The current quarter reflected a $950 million reduction in the allowance for loan losses due to continued improvement in delinquencies and home prices. The prior year included a $700 million reduction in the allowance for loan losses. Net charge-offs were $168 million, compared with $431 million in the prior year.

Noninterest expense was $2.1 billion, a decrease of $809 million, or 28%, from the prior year, due to lower servicing expense.

Mortgage Production retax loss was $274 million, a decrease of $1.1 billion from the prior year, reflecting lower volumes, lower margins and higher legal expense, partially offset by lower repurchase losses. Mortgage production-related revenue, excluding repurchase losses, was $494 million, a decrease of $1.1 billion, or 69%, from the prior year, largely reflecting lower volumes and lower margins. Production expense was $989 million, an increase of $113 million from the prior year, due to higher non-MBS related legal expense, partially offset by lower compensation-related expense. Repurchase losses for the current quarter reflected a benefit of $221 million, compared with a benefit of $53 million in the prior year and a benefit of $175 million in the prior quarter. The current quarter reflected a $1.2 billion reduction in repurchase liability primarily as a result of the settlement with the GSEs for claims associated with loans sold to the GSEs from 2000 to 2008, compared with a $249 million reduction in repurchase liability in the prior year and a $300 million reduction in repurchase liability in the prior quarter.

Mortgage Servicing pretax income was $2 million, compared with a pretax loss of $913 million in the prior year, reflecting lower expense and higher revenue. Mortgage net servicing-related revenue was $689 million, an increase of $71 million. MSR risk management was a loss of $24 million, compared with income of $42 million in the prior year. Servicing expense was $663 million, a decrease of $910 million from the prior year, reflecting lower costs associated with the Independent Foreclosure Review and lower servicing headcount.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Mortgage application volumes were $31.3 billion, down 52% from the prior year and 23% from the prior quarter.

- Period-end total third-party mortgage loans serviced were $815.5 billion, down 5% from the prior year and 2% from the prior quarter.

Real Estate Portfolios pretax income was $1.2 billion, up $410 million from the prior year, due to a higher benefit from the provision for credit losses, partially offset by lower net revenue.

Net revenue was $850 million, a decrease of $115 million, or 12%, from the prior year. This decrease was due to lower noninterest revenue due to higher loan retention and lower net interest income resulting from lower loan balances due to portfolio runoff.

The provision for credit losses was a benefit of $783 million, compared with a benefit of $283 million in the prior year. The current-quarter provision reflected a $950 million reduction in the allowance for loan losses, $750 million from the purchased credit-impaired allowance and $200 million from the non credit-impaired allowance, reflecting continued improvement in delinquencies and home prices. The prior-year provision included a $700 million reduction in the allowance for loan losses from the non credit-impaired allowance. Net charge-offs were $167 million, compared with $417 million in the prior year. Home equity net charge-offs were $179 million (1.21% net charge-off rate), compared with $257 million (1.49% net charge-off rate) in the prior year. Subprime mortgage net recoveries were $6 million (0.33% net recovery rate), compared with net charge-offs of $92 million (4.35% net charge-off ratee). Net recoveries of prime mortgage, including option ARMs, were $8 million (0.06% net recovery ratee), compared with net charge-offs of $66 million (0.63% net charge-off ratee).

Noninterest expense was $411 million, a decrease of $25 million, or 6%, compared with the prior year.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted. Average loans include PCI loans)

- Mortgage Banking return on equity was 11% on $19.5 billion of average allocated capital.

- Average home equity loans were $78.0 billion, down $11.7 billion.

- Average mortgage loans were $90.9 billion, up $1.8 billion.

- Allowance for loan losses was $6.7 billion, compared with $10.6 billion.

- Allowance for loan losses to ending loans retained, excluding PCI loanse, was 2.23%, compared with 4.14%.

Card, Merchant Services & Auto net income was $1.0 billion, an increase of $190 million, or 23%, compared with the prior year, driven by lower provision for credit losses, partially offset by lower net revenue.

Net revenue was $4.7 billion, down $140 million, or 3%, compared with the prior year. Net interest income was $3.3 billion, down $222 million compared with the prior year, primarily driven by spread compression in Credit Card. Noninterest revenue was $1.4 billion, up $82 million compared with the prior year, primarily driven by higher net interchange income, auto lease income and merchant servicing revenue, partially offset by lower revenue from an exited non-core product.

The provision for credit losses was $746 million, compared with $1.3 billion in the prior year and $673 million in the prior quarter. The current-quarter provision reflected lower net charge-offs and a $300 million reduction in the allowance for loan losses reflecting improved delinquency trends and a decrease in restructured loan volume.

The Credit Card net charge-off ratee was 2.85%, down from 3.50% in the prior year and 2.86% in the prior quarter; the 30+ day delinquency rate was 1.67%, down from 2.10% in the prior year and 1.68% in the prior quarter. The Auto net charge-off rate was 0.39%, up from 0.36% in the prior year and 0.35% in the prior quarter.

Noninterest expense was $2.2 billion, up $59 million, or 3% from the prior year, driven by higher marketing expense, payments to customers required by a regulatory consent order and higher auto lease depreciation, predominantly offset by the write-off of intangible assets in the prior year.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 26% on $15.5 billion of average allocated capital.

- #1 credit card issuer in the U.S. based on outstandingse; #1 global Visa issuer based on consumer and business credit card sales volume.

- Period-end Credit Card loan balances were $127.8 billion, flat compared with the prior year and up 3% from the prior quarter. Credit Card average loans were $124.1 billion, flat compared with the prior year and the prior quarter.

- Card Services net revenue as a percentage of average loans was 12.34%, compared with 12.82% in the prior year and 12.22% in the prior quarter.

- Average auto loans were $51.8 billion, up 5% from the prior year and 3% from the prior quarter.

CORPORATE & INVESTMENT BANK (CIB)

| Results for CIB ($ millions) |

4Q13 |

3Q13 |

4Q12 |

3Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 6,020 |

$ 8,189 |

$ 7,642 |

$ (2,169) |

(26)% |

$ (1,622) |

(21)% |

| Provision for Credit Losses |

(19) |

(218) |

(445) |

199 |

91 |

426 |

96 |

| Noninterest Expenses |

4,892 |

4,999 |

4,996 |

(107) |

(2) |

(104) |

(2) |

| Net Income |

$ 858 |

$ 2,240 |

$ 2,005 |

$ (1,382) |

(62)% |

$ (1,147) |

(57)% |

Discussion of Results:

Net income was $858 million, down 57% compared with the prior year. These results primarily reflected lower revenue and a lower benefit from the provision for credit losses, partially offset by slightly lower noninterest expense. Net revenue was $6.0 billion compared with $7.6 billion in the prior year. Net revenue included a $1.5 billion loss as a result of implementing a funding valuation adjustment ("FVA") framework for OTC derivatives and structured notes. This change reflects an industry migration towards incorporating the cost or benefit of funding into their valuation; the majority of this adjustment relates to uncollateralized derivatives. Net revenue also included a $536 million loss from debit valuation adjustments ("DVA") on structured notes and derivative liabilities, compared with a loss from DVA of $567 million in the prior year. Excluding the impact of both FVA1 and DVA, net income was $2.1 billion, down 11% compared with the prior year, and net revenue was $8.0 billion, down 2% compared with the prior year.

Banking revenue was $3.0 billion, down 4% from the prior year. Investment banking fees were $1.7 billion, down 3% from the prior year, driven by lower debt underwriting fees of $801 million, down 19% from a record prior year, and by lower advisory fees of $434 million, down 7% from the prior year. This was predominantly offset by higher equity underwriting fees of $436 million, up 65% from the prior year, on strong market issuance and improved market share. Treasury Services revenue was $1.0 billion, down 7% compared with the prior year, driven by lower trade finance revenue. Lending revenue was $373 million, primarily reflecting net interest income on retained loans, fees on lending-related commitments, and gains on securities received from restructured loans.

Markets & Investor Services revenue was $3.0 billion, down 33% from the prior year. Combined Fixed Income and Equity Markets revenue was $4.1 billion, flat compared with the prior year. In the prior year, Fixed Income Markets also included a modest loss from the synthetic credit portfolio. Securities Services revenue was $1.0 billion, up 3% from the prior year, primarily driven by higher custody and fund services revenue, due largely to higher assets under custody and higher deposits. Credit Adjustments & Other revenue was a loss of $2.1 billion, driven by the impact of both FVA and DVA, compared with a loss of $586 million in the prior year, predominantly driven by DVA.

The provision for credit losses was a benefit of $19 million, compared with a benefit of $445 million in the prior year. The prior year included recoveries and a reduction in the allowance for credit losses, both related to certain restructured nonperforming loans. The ratio of the allowance for loan losses to period-end loans retained was 1.15%, compared with 1.19% in the prior year. Excluding the impact of the consolidation of Firm-administered multi-seller conduits and trade finance loans, the ratio of the allowance for loan losses to period-end loans retained was 2.02%, compared with 2.52% in the prior year.

Noninterest expense was $4.9 billion, down 2% from the prior year, primarily due to lower compensation expense. The compensation ratio was 27%, excluding the impact of FVA and DVA.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted, and all rankings are according to Dealogic)

- Return on equity was 6% on $56.5 billion of average allocated capital (15% excluding FVA and DVA).

- Ranked #1 in Global Investment Banking Fees for the year ended December 31, 2013.

- Ranked #1 in Global Debt, Equity and Equity-related; #1 in Global Long-Term Debt; #1 in Global Syndicated Loans; #2 in Global Announced M&A; #1 in U.S. Announced M&A; and #2 in Global Equity and Equity-related, based on volume, for the year ended December 31, 2013.

- Average client deposits and other third-party liabilities were a record $421.6 billion, up 15% from the prior year and 9% from the prior quarter.

- Assets under custody were a record $20.5 trillion, up 9% from the prior year and 4% from the prior quarter.

- International revenue represented 45% of total revenue (47% of total revenue excluding FVA and DVA).

- Period-end total loans were $107.5 billion, down 7% from the prior year and flat from the prior quarter. Nonaccrual loans were $343 million, down 57% from the prior year and 11% from the prior quarter.

- Overhead ratio was 81% (61% excluding FVA and DVA).

COMMERCIAL BANKING (CB)

| Results for CB ($ millions) |

4Q13 |

4Q13 |

4Q12 |

3Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 1,847 |

$ 1,725 |

$ 1,745 |

$ 122 |

7% |

$ 102 |

6% |

| Provision for Credit Losses |

43 |

(41) |

(3) |

84 |

NM |

46 |

NM |

| Noninterest Expenses |

653 |

661 |

599 |

(8) |

(1) |

54 |

9 |

| Net Income |

$ 693 |

$ 665 |

$ 692 |

$ 28 |

4% |

$ 1 |

- |

Discussion of Results:

Net income was $693 million, flat compared with the prior year, reflecting an increase in noninterest expense and a higher provision for credit losses, offset by higher net revenue.

Net revenue was $1.8 billion, an increase of $102 million, or 6%, compared with the prior year. Net interest income was $1.2 billion, an increase of $56 million, or 5%, compared with the prior year, reflecting the one-time proceeds from a lending-related workout and higher loan and liability balances, partially offset by loan spread compression and lower purchase discounts recognized on loan repayments. Noninterest revenue was $624 million, an increase of $46 million, or 8%, compared with the prior year, reflecting higher community development-related revenue.

Revenue from Middle Market Banking was $744 million, flat compared with the prior year. Revenue from Corporate Client Banking was $488 million, flat compared with the prior year. Revenue from Commercial Term Lending was $298 million, a decrease of $14 million, or 4%, compared with the prior year. Revenue from Real Estate Banking was $206 million, an increase of $93 million, or 82%, compared with the prior year, driven by the one-time proceeds from a lending-related workout.

The provision for credit losses was $43 million, compared with a benefit of $3 million in the prior year. Net charge-offs were $25 million (0.07% net charge-off rate), compared with net charge-offs of $50 million (0.16% net charge-off rate) in the prior year and net charge-offs of $16 million (0.05% net charge-off rate) in the prior quarter. The allowance for loan losses to period-end loans retained was 1.97%, down from 2.06% in the prior year and down from 1.99% in the prior quarter. Nonaccrual loans were $514 million, down $159 million, or 24%, from the prior year, and down by $52 million, or 9%, from the prior quarter.

Noninterest expense was $653 million, up 9% compared with the prior year, reflecting higher product- and headcount-related expense.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 20% on $13.5 billion of average allocated capital.

- Overhead ratio was 35%, compared with 34% in the prior year.

- Gross investment banking revenue (which is shared with the Corporate & Investment Bank) was a record $502 million, up 13% compared with the prior year and up 12% compared with the prior quarter.

- Average loan balances were $135.6 billion, up 8% compared with the prior year and up 3% compared with the prior quarter.

- Period-end loan balances were $137.1 billion, up 7% compared with the prior year and up 1% compared with the prior quarter.

- Average client deposits and other third-party liabilities were $205.3 billion, up 3% compared with the prior year and up 4% compared with the prior quarter.

ASSET MANAGEMENT (AM)

| Results for AM ($ millions) |

4Q13 |

3Q13 |

4Q12 |

4Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 3,719 |

$ 2,763 |

$ 2,753 |

$ 416 |

15% |

$ 426 |

15% |

| Provision for Credit Losses |

21 |

- |

19 |

21 |

NM |

2 |

11 |

| Noninterest Expenses |

2,245 |

2,003 |

1,943 |

242 |

12 |

302 |

16 |

| Net Income |

$ 568 |

$ 476 |

$ 483 |

$ 92 |

19% |

$ 85 |

18% |

Discussion of Results:

Net income was $568 million, an increase of $85 million, or 18%, from the prior year, reflecting higher net revenue, largely offset by higher noninterest expense.

Net revenue was $3.2 billion, an increase of $426 million, or 15%, from the prior year. Noninterest revenue was $2.6 billion, up $393 million, or 18%, from the prior year, due to net client inflows, higher valuations of seed capital investments and the effect of higher market levels. Net interest income was $585 million, up $33 million, or 6%, from the prior year, due to higher loan and deposit balances, partially offset by narrower loan spreads.

Revenue from Private Banking was $1.6 billion, up 11% compared with the prior year. Revenue from Institutional was $806 million, up 11%. Retail was $770 million, up 32%.

Client assets were $2.3 trillion, an increase of $248 billion, or 12%, compared with the prior year. Assets under management were $1.6 trillion, an increase of $172 billion, or 12%, from the prior year, due to net inflows to long-term products and the effect of higher market levels. Custody, brokerage, administration and deposit balances were $745 billion, up $76 billion, or 11%, from the prior year, due to the effect of higher market levels and custody inflows, partially offset by brokerage outflows.

The provision for credit losses was $21 million, compared with $19 million in the prior year.

Noninterest expense was $2.2 billion, an increase of $302 million, or 16%, from the prior year, primarily due to higher performance-based compensation, higher headcount-related expense and costs related to the control agenda.

Key Metrics and Business Updates:

(All comparisons refer to the prior-year quarter except as noted)

- Return on equity was 25% on $9.0 billion of average allocated capital.

- Pretax margin was 29%, flat to the prior year.

- For the 12 months ended December 31, 2013, assets under management reflected net inflows of $86 billion, driven by net inflows of $90 billion to long-term products and net outflows of $4 billion from liquidity products. For the quarter, net inflows were $23 billion, driven by net inflows of $16 billion to long-term products and net inflows of $7 billion to liquidity products.

- Net long-term client flows were positive for the nineteenth consecutive quarter.

- Assets under management ranked in the top two quartiles for investment performance were 69% over 5 years, 68% over 3 years and 68% over 1 year.

- Customer assets in 4 and 5 Star-rated funds were 49% of all rated mutual fund assets.

- Client assets were $2.3 trillion, a record, up 12% from the prior year and 4% from the prior quarter.

- Average loans were $92.7 billion, a record, up 21% from the prior year and 6% from the prior quarter.

- Period-end loans were $95.4 billion, a record, up 19% from the prior year and 5% from the prior quarter.

- Average deposits were $144.0 billion, a record, up 8% from the prior year and 4% from the prior quarter.

- Period-end deposits were $146.2 billion, a record, up 1% from the prior year and 5% from the prior quarter.

CORPORATE/PRIVATE EQUITY

| Results for Corporate/Private Equity ($ millions) |

4Q13 |

3Q13 |

4Q12 |

3Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 1,752 |

$ 121 |

$ (124) |

$ 1,631 |

NM |

$ 1,876 |

NM |

| Provision for Credit Losses |

(13) |

(17) |

(6) |

4 |

24 |

(7) |

(117) |

| Noninterest Expenses |

441 |

9,096 |

520 |

(8,655) |

(95) |

(79) |

(15) |

| Net Income |

$ 787 |

$ (6,463) |

$ 523 |

$ 7,250 |

NM |

$ 264 |

50% |

Discussion of Results:

Net income was $787 million, compared with net income of $523 million in the prior year.

Private Equity reported net income of $13 million, compared with net income of $50 million in the prior year. Net revenue was $57 million, compared with net revenue of $72 million in the prior year.

Treasury and CIO reported a net loss of $78 million, compared with a net loss of $157 million in the prior year. Net revenue was a loss of $25 million, compared with a loss of $110 million in the prior year. Current-quarter net interest income was a loss of $96 million reflecting the benefit of higher interest rates and reinvestment opportunities.

Other Corporate reported net income of $852 million, compared with net income of $630 million in the prior year. The current quarter included a $1.3 billion gain on the sale of Visa shares and a $0.5 billion gain on the sale of One Chase Manhattan Plaza. The current quarter also included approximately $0.4 billion of pretax legal expense ($0.8 billion after-tax) compared with $0.2 billion of pretax legal expense ($0.1 billion after-tax) in the prior year, and a benefit of $0.3 billion for tax adjustments compared to $0.6 billion in the prior year.

JPMORGAN CHASE (JPM)(*)

| Results for JPM ($ millions) |

4Q13 |

3Q13 |

4Q12 |

3Q13 |

4Q12 |

|---|

| $ O/(U) |

O/(U) % |

$ O/(U) |

O/(U) % |

|---|

| Net Revenue |

$ 24,112 |

$ 23,880 |

$ 24,378 |

$ 232 |

1% |

$ (266) |

(1)% |

| Provision for Credit Losses |

104 |

(543) |

656 |

647 |

NM |

(552) |

(84) |

| Noninterest Expenses |

15,552 |

23,626 |

16,047 |

(8,074) |

(34) |

(495) |

(3) |

| Net Income |

$ 5,278 |

$ (308) |

$ 5,692 |

$ 5,658 |

NM |

$ (414) |

(79)% |

(*)Presented on a managed basis. See note on page 12 and 13 for further explanation of managed basis. Net revenue on a U.S. GAAP basis totaled $23,156 million, $23,117 million, and $23,653 million for the fourth quarter of 2013, forth quarter of 2013, and fourth quarter of 2012, respectively.

Discussion of Results:

Net income was $5.3 billion, down $414 million from the prior year. The decrease was driven by lower net revenue and higher taxes resulting from non-deductible penalties incurred and a lower benefit related to tax adjustments, which were partially offset by lower provision for credit losses and lower noninterest expense.

Net revenue was $24.1 billion, down $266 million, or 1%, compared with the prior year. Noninterest revenue was $13.0 billion, flat compared with the prior year. The current-quarter included a $1.5 billion loss as a result of implementing a funding valuation adjustment ("FVA") framework for OTC derivatives and structured notes, and a $536 million loss from debit valuation adjustmentssup ("DVA") on structured notes and derivative liabilities. Net interest income was $11.1 billion, down $203 million, or 2%, compared with the prior year, reflecting the impact of lower loan yields and lower trading and investment securities balances, partially offset by higher investment securities yields and lower financing costs.

The provision for credit losses was $104 million, down $552 million from the prior year. The total consumer provision for credit losses was $65 million, compared with $1.1 billion in the prior year. The current-quarter provision reflected a $1.2 billion reduction in the allowance for loan losses, compared to a $700 million reduction in the prior year, due to favorable delinquency trends and lower estimated losses in mortgage and credit card portfolios. Consumer net charge-offs were $1.3 billion, compared with $1.8 billion in the prior year, resulting in net charge-off rates of 1.44% and 1.99%, respectively. The decrease in consumer net charge-offs was primarily due to improved delinquency trends. The wholesale provision for credit losses was an expense of $39 million, compared with a benefit of $430 million in the prior year. Wholesale net charge-offs were $22 million, compared with net recoveries of $158 million in the prior year, resulting in a net charge-off rate of 0.03% and a net recovery rate of 0.21%, respectively. The Firm's allowance for loan losses to period-end loans retainedsup> was 1.80%, compared with 2.43% in the prior year. The Firm's nonperforming assets totaled $9.7 billion, down from the prior quarter and prior year levels of $10.4 billion and $11.9 billion, respectively.

Noninterest expense was $15.6 billion, down $495 million, or 3%, compared with the prior year, primarily driven by lower servicing expense. The current quarter included approximately $847 million of legal expense, compared with $1.2 billion of legal expense in the prior year.