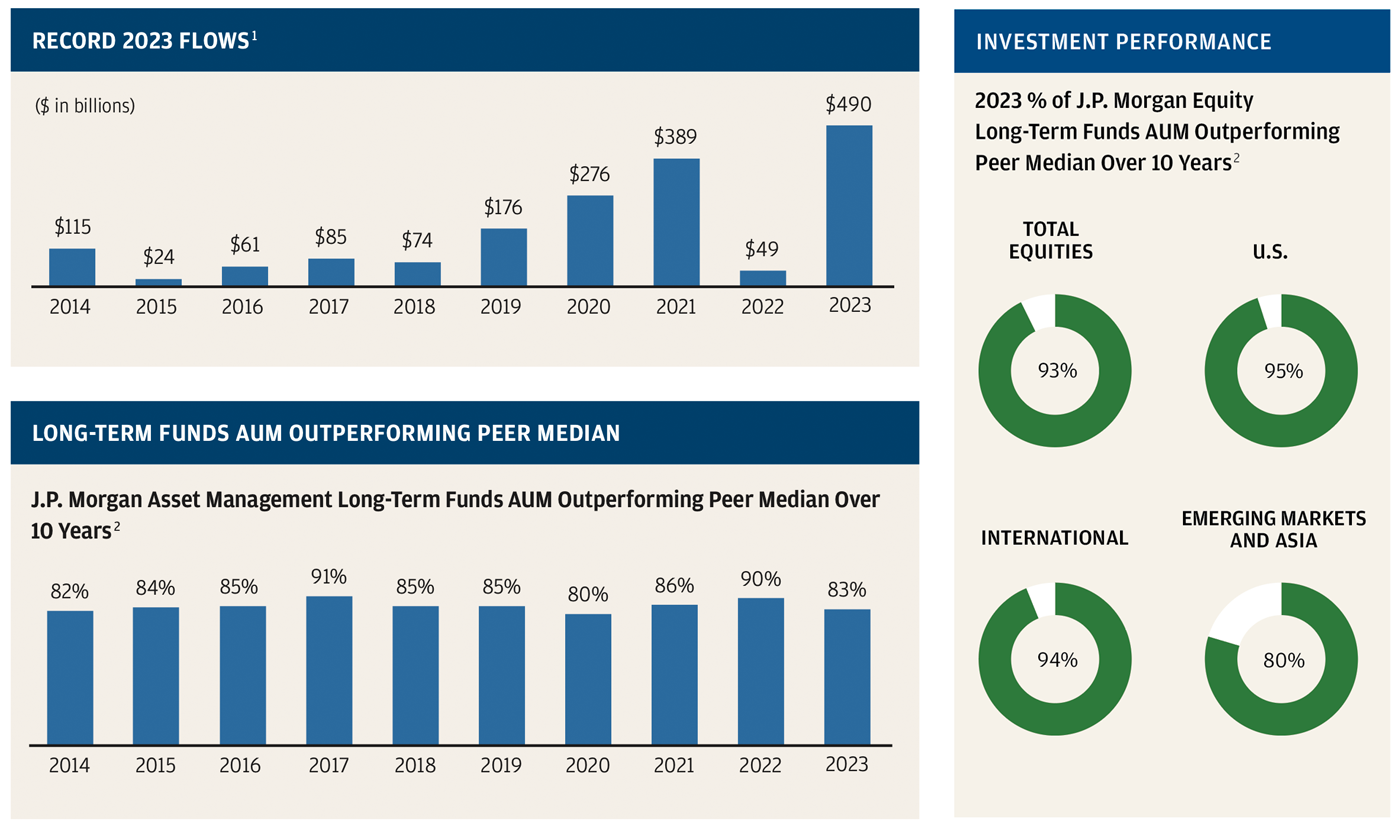

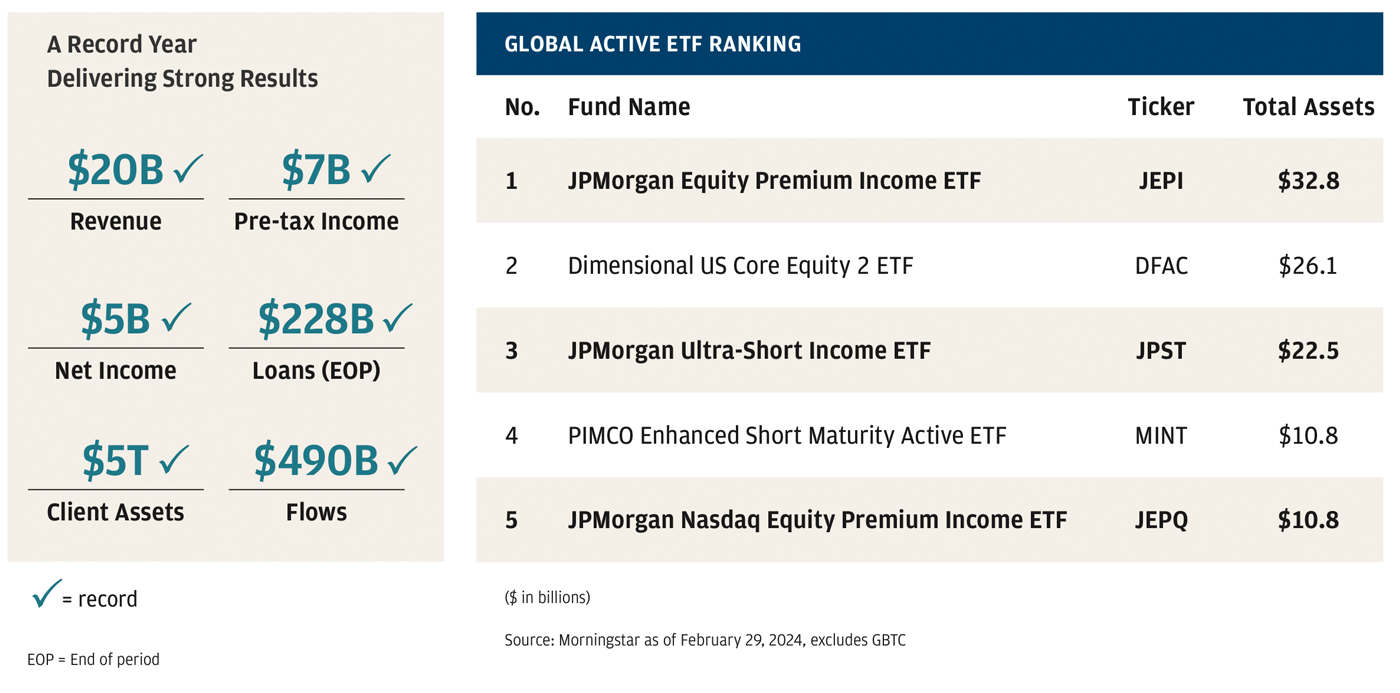

As a fiduciary, delivering strong, long-term investment performance is our foremost priority. Approximately 80% of J.P. Morgan Asset Management assets under management (AUM) outperformed the peer median over a 10-year time period. This exceptional investment performance is an outcome of decades of refinement and involves close to 1,300 investment professionals along with one of the industry’s largest research budgets, which enables us to actively cover nearly 2,500 public companies, with over 5,000 company visits annually. This has resulted in more than 93% of our equity assets outperforming their peers over the past decade.

Achieving outstanding investment results is never easy, but after several years of extensive quantitative easing — which often led to undifferentiated asset moves in concert with one another — we are returning to a market that prioritizes fundamentals in valuing companies and securities, giving us plenty of reasons to be optimistic about the future for our investors across asset classes.

We provide our clients with expertise and effective solutions to support them through all market cycles and prepare them for the future. Equipped with state-of-the-art technology and artificial intelligence (AI)-enhanced tools and capabilities, our advisors stand ready to guide our clients and deliver more personalized offerings — from the first dollar they invest in the markets to the decisions they make about their long-term retirement planning. Simultaneously, to assist our clients in navigating the intricacies of retirement, we offer robust strategies through our SmartRetirement solutions.

Our dedication to research is at the heart of everything we do, from stock selection to unique market and asset allocation insights. For example, we deliver exclusive insights to our clients through our proprietary, industry-leading Eye on the Market and J.P. Morgan Guide to the Markets, viewed by hundreds of thousands of financial advisors and millions of clients every year. And we draw on the depth and breadth of our market and economic expertise to provide insights into investment themes to enable more confident portfolio decisions. Clients rely on us to help them distinguish the signals from the noise.