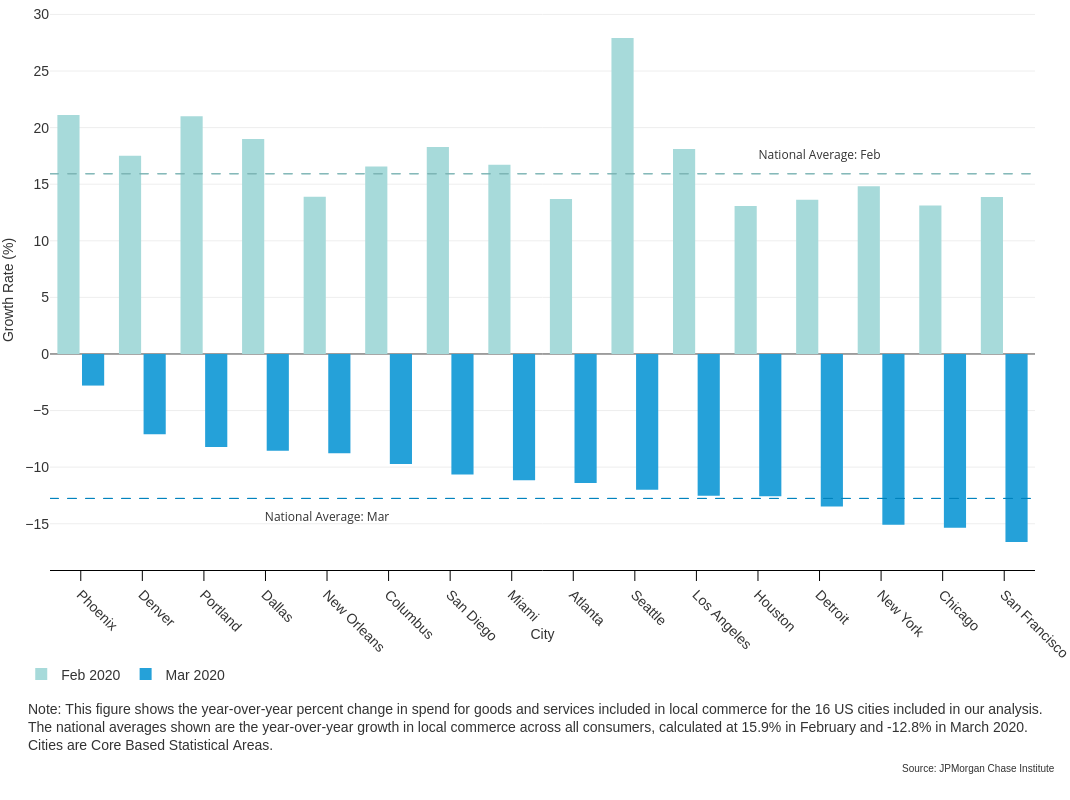

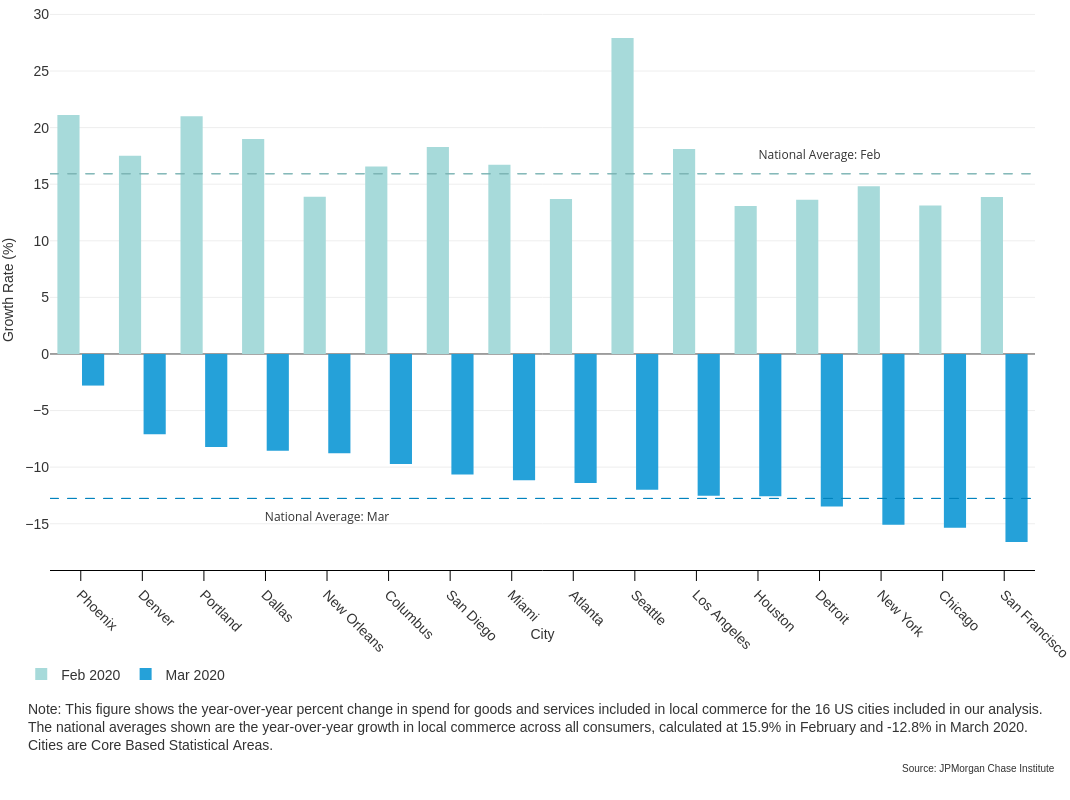

Year-over-year percent change in local commerce spend, by city

Findings

COVID-19 has rapidly transformed everyday life. While the scope of the pandemic is global, consumers experience the economic impacts locally. Understanding the strain of COVID-19 on the local economy requires a place-based view of the interplay between consumers and merchants within communities, which can inform ongoing efforts to aid the recovery of local economies.

This insight leverages a local commerce dataset of approximately 450 million monthly credit card transactions from a sample of 11 million de-identified Chase customers each month between October 2019 and March 2020. The local commerce view represents everyday goods and services transacted between local buyers and sellers and includes the channel by which the transaction was made (online/offline) and the zip code of both the consumer and the merchant, providing an understanding of the distance between a consumer’s residence and where they made a purchase.

The aim of this insight is to inform the impact of the pandemic on the supply and demand of local commerce across U.S. cities, including analyses of high-income versus low-income neighborhoods, access to food, shifts in the types of products and services purchased, and shifts from brick-and-mortar to online.

Year-over-year percent change in local commerce spend, by city

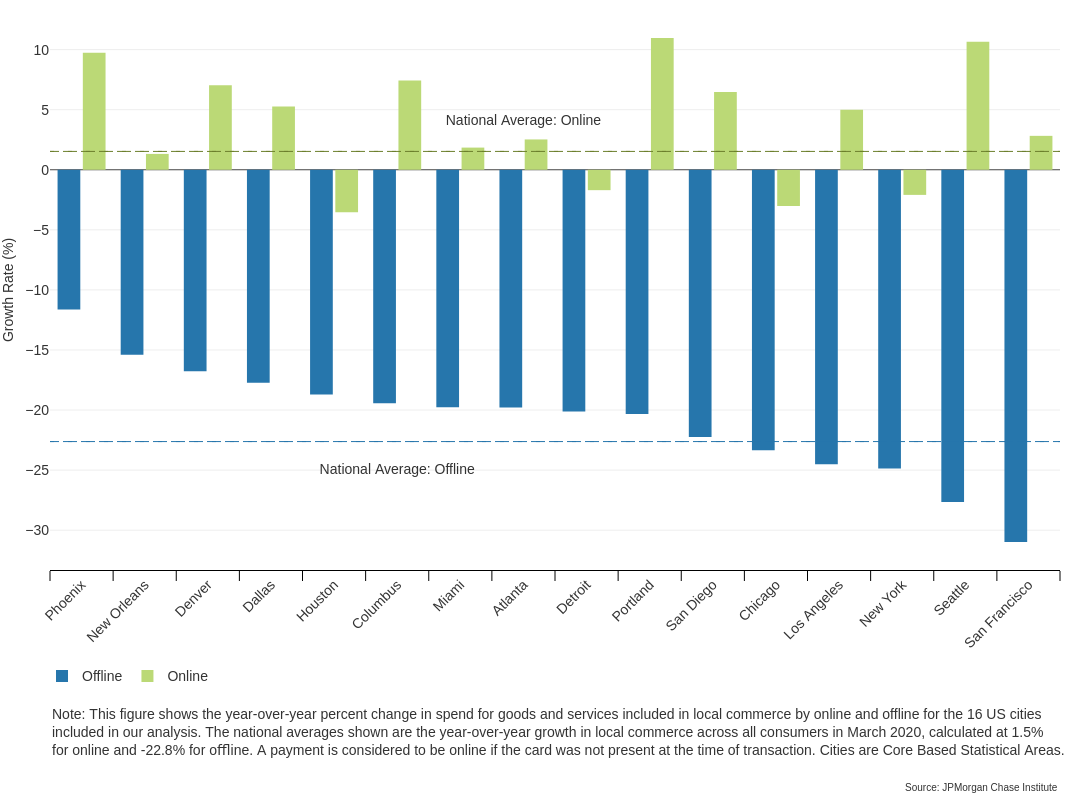

Year-over-year percent change in local commerce spend, by channel

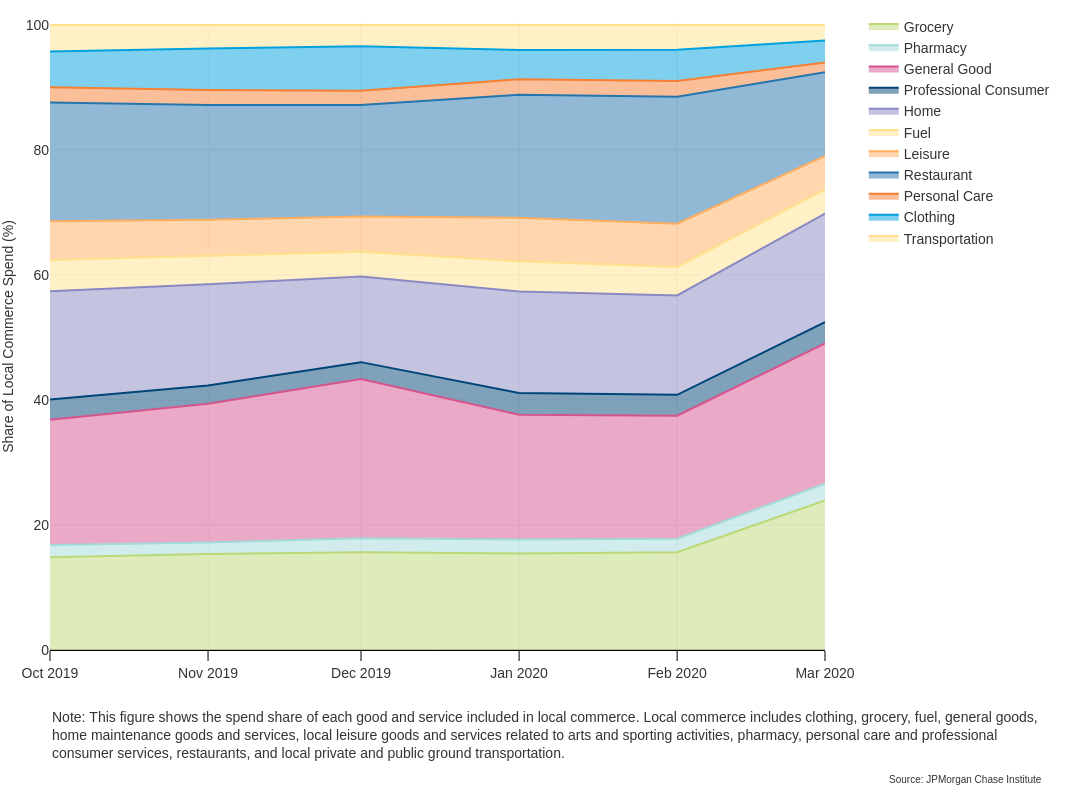

Year-over-year percent change in local commerce spend, by product category

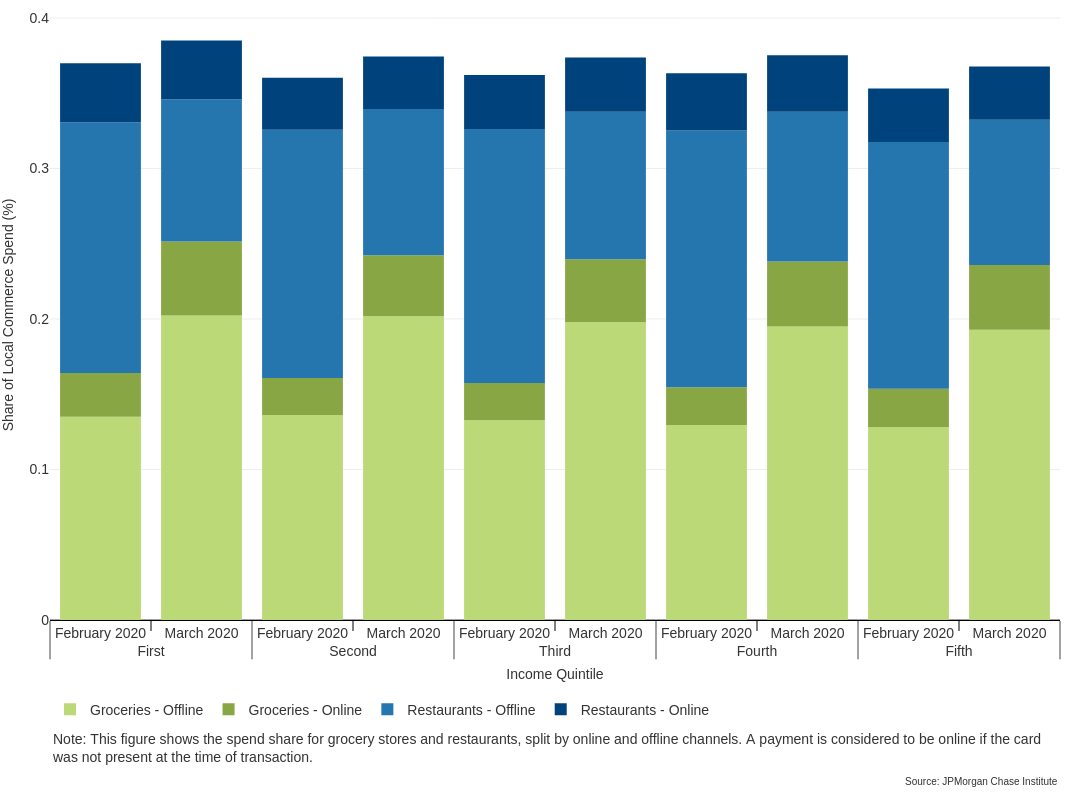

Spend share for grocery stores and restaurants, by online and offline channels

Authors

Chris Wheat

President, JPMorganChase Institute

Marvin Ward

Local Commerce Research Lead JPMorgan Chase Institute

Lindsay Relihan

JPMorgan Chase Institute Academic Fellow