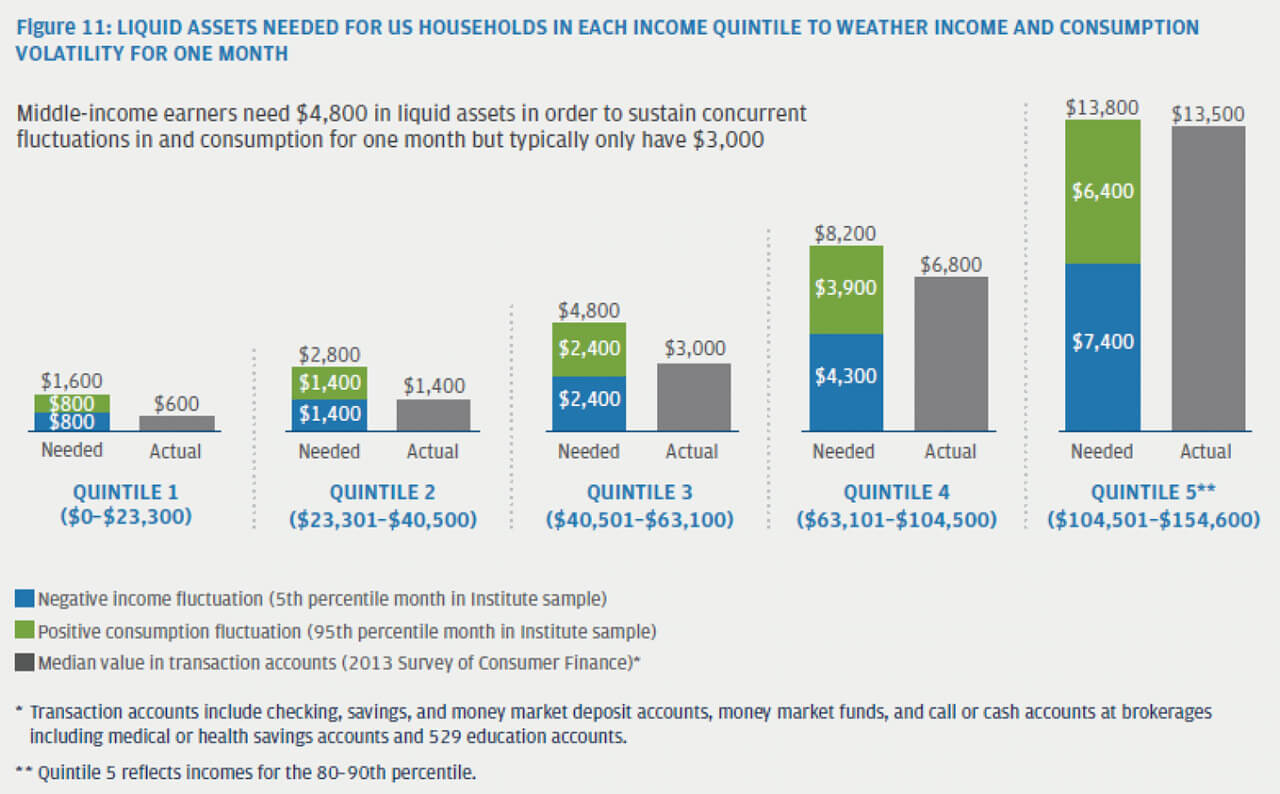

Liquid Assets Needed for U.S. Households in Each Income Quintile to Weather Income and Consumption Volatility For One Month

Middle-income earners need $4,800 in liquid assets in order to sustain concurrent fluctuations in and consumption for one month but typically only have $3,000

Quintile 1 ($0 - $23,300)

Needed: $800 Negative income fluctuation (5th percentile month in institute sample); $800 Positive income fluctuation (95th percentile month in institute sample); $1,600 Median value in transaction accounts (2013 Survey of Consumer Finance) 1

Actual: $600 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Quintile 2 ($23,301 - $40,500)

Needed: $1,400 Negative income fluctuation (5th percentile month in institute sample); $1,400 Positive income fluctuation (95th percentile month in institute sample); $2,800 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Actual $1,400 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Quintile 3 ($40,501 - $63,100)

Needed: $2,400 Negative income fluctuation (5th percentile month in institute sample); $2,400 Positive income fluctuation (95th percentile month in institute sample); $4,800 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Actual: $3,000 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Quintile 4 ($63,101 - $104,500)

Needed: $4,300 Negative income fluctuation (5th percentile month in institute sample); $3,900 Positive income fluctuation (95th percentile month in institute sample); $8,200 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Actual $6,800 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Quintile 52 ($104,501 - $154,600)

Needed: $7,400 Negative income fluctuation (5th percentile month in institute sample); $6,400 Positive income fluctuation (95th percentile month in institute sample)

$13,800 Median value in transaction accounts (2013 Survey of Consumer Finance)1.

Actual: $13,500 Median value in transaction accounts (2013 Survey of Consumer Finance)1*.

1 Transaction accounts include checking, savings, and money market deposit accounts, money market funds, and call or cash accounts at brokerages including medical or health savings accounts and 529 education accounts.

2 Quintile 5 reflects incomes for the 80-90th percentile