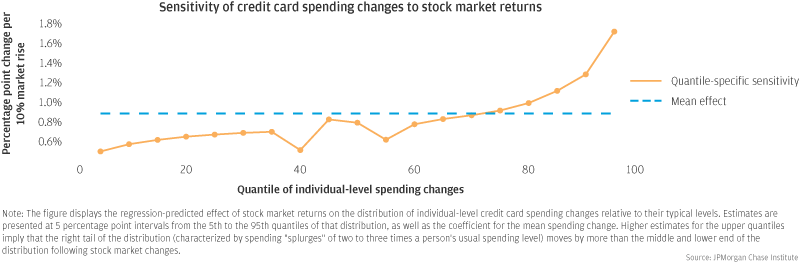

For this JPMorgan Chase Institute report, we analyze granular administrative retail bank data to explore the relationship between the U.S. stock market and consumer behavior, notably consumption and investment. Our research provides a historical perspective that can help policymakers understand how market fluctuations may be transmitted to the real economy over relatively short time horizons. This report documents a correlation between credit card spending and stock returns that plays out over the course of just a few months. This relationship appears to be driven disproportionately by specific types of activity—notably, temporary spending spikes on credit cards—and investor status or gender.

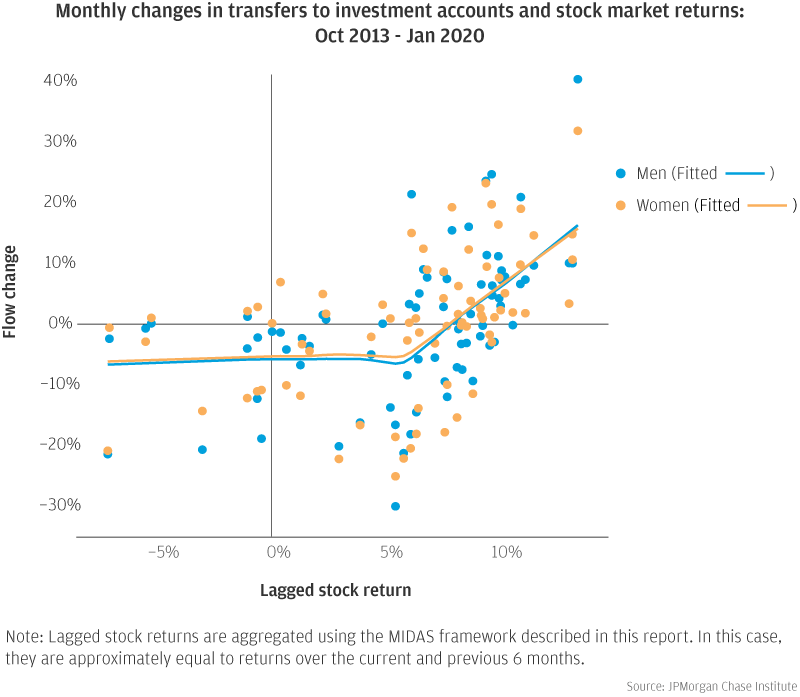

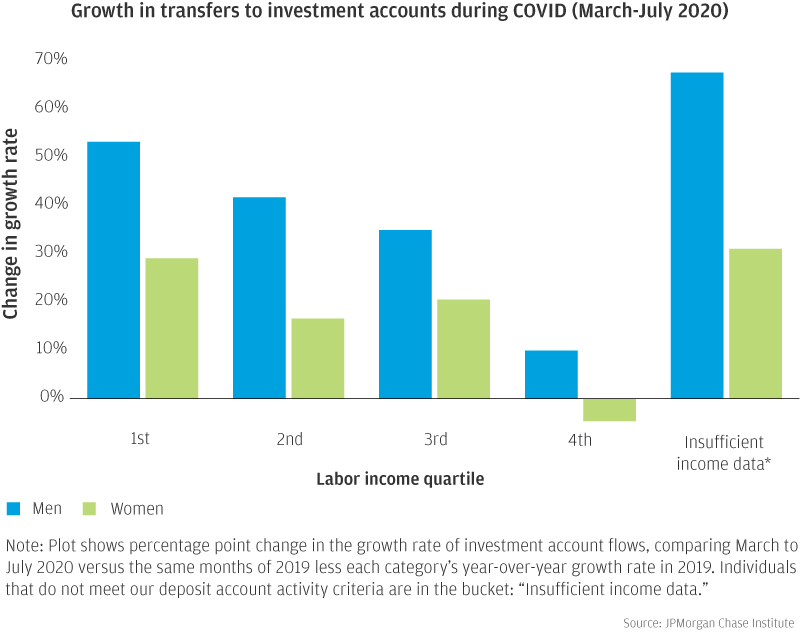

In addition to spending patterns, we examine retail flows to investment accounts. These transfers suggest "returns chasing" behavior; they track lagged stock market changes with an R-squared of over 20 percent. In sum, procyclical behavior can be seen on both spending and investment fronts, and the magnitudes vary across gender and wealth indicators. Specifically, in our sample, credit card spending by men and investors was more responsive to stocks than that of women and non-investors. With respect to investment flows, gender differences were smaller; the sensitivity of male investment flows to market returns was only modestly above the estimate for women. Our data cover much of the period following the Great Recession, from 2012 through mid-2020. Importantly, we separate the COVID-crisis from the rest of the sample, to prevent outliers from this unique shock from driving the results. This perspective can help policymakers understand how dynamics play out within a business cycle and illuminate tradeoffs associated with short-term “management” of the cycle through markets. Since our sample is mainly limited to one economic expansion, we study separately how individuals’ spending and investment flows played out during the COVID shock to illustrate similarities and contrasts with the dynamics observed in the preceding years. The analysis can be summarized in the following four findings: