Tax time is a major cash-flow event for U.S. households. In a typical year, roughly four out of five filers receive refunds during tax season. Past JPMCI research has shown that prior to the pandemic, a tax refund was the single largest cash infusion of the year for 40 percent of families, amounting to almost six weeks’ worth of income, and fueling an increase in both spending and balances.

This year tax time could look different. The IRS has reported a significant backlog in processing claims, with as many as six million unprocessed individual tax returns as of December 2021. This has prompted warnings from national consumer advocates that taxpayers should expect their 2022 refunds to be delayed. In addition, families are facing a complicated backdrop of strong labor markets, rising inflation, and receding pandemic-related federal assistance. Will this tax season provide its usual boost to cash balances and spending?

A Profile of Tax Refund Recipients and Early Filers

Tax filers who receive refunds tend to be younger, have lower take-home income, and have less in their savings, compared to those who owe taxes. Early filers, likely to be the first to experience any IRS processing delays, tend to be lower-income households, for whom the tax refund represents an even larger cash flow event. Families who file earliest have cash balances 61 percent lower and incomes 28 percent lower than those who file later.

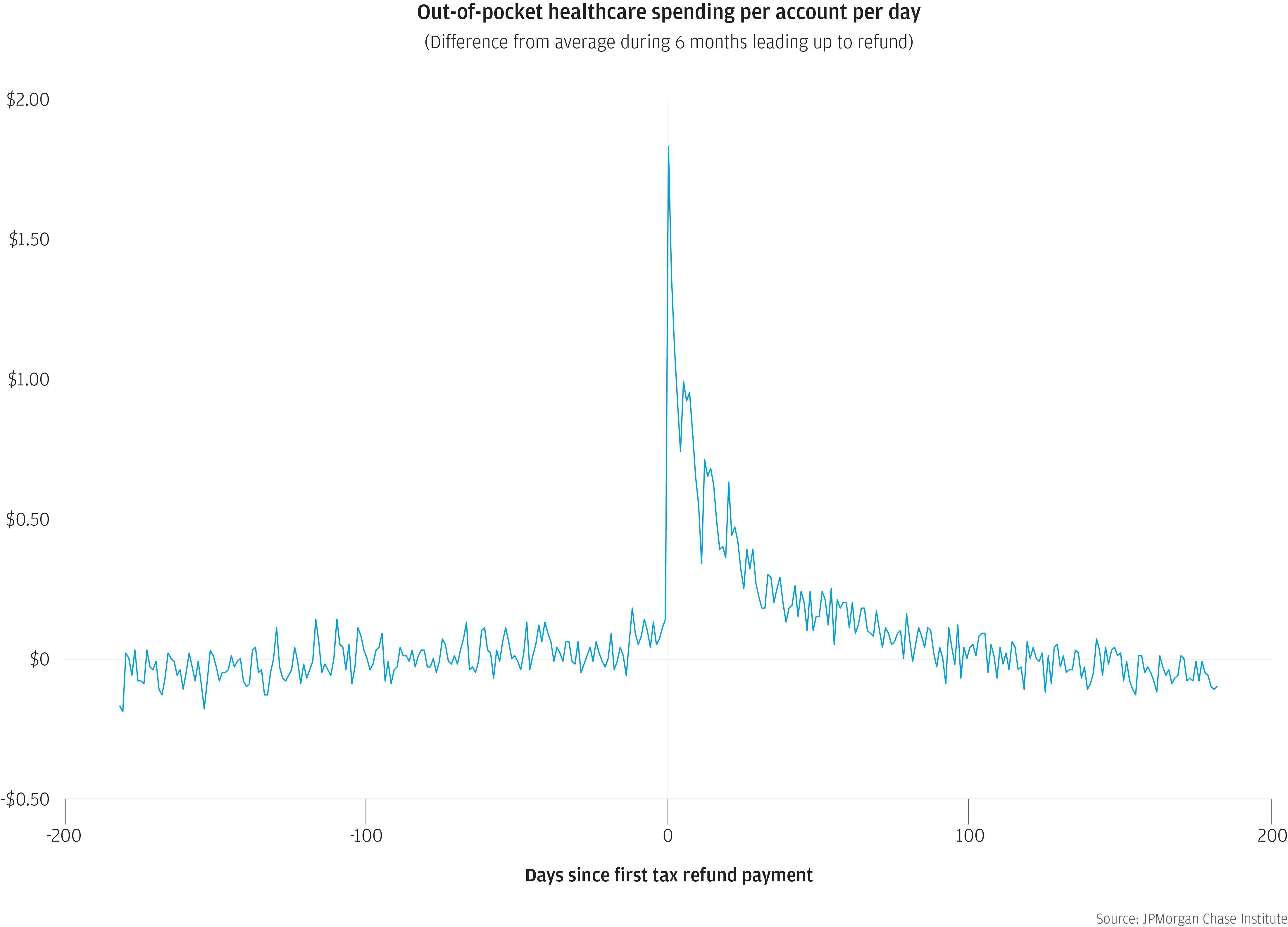

Historically, families depend on the cash infusion from tax refunds to fuel spending. Cash withdrawals, durable goods purchases, and credit payments all increase by 85 percent or more in the week after a tax refund. But families also use their tax refunds to meet basic needs, such as healthcare expenses and groceries. As shown in the figure below, prior to the pandemic, families increased expenditures on out of pocket healthcare costs by 60 percent in the week after refund receipt. Our research shows that cash flow dynamics impact not only when families pay for healthcare but also when they actually receive healthcare, and this may have larger health consequences if families routinely defer care. Notably, lower income households and earlier filers, for whom the refund has a larger cash flow impact, increase their spending the most. And they spend the largest share of their tax refund on basic necessities like in-person healthcare services.