Executive summary

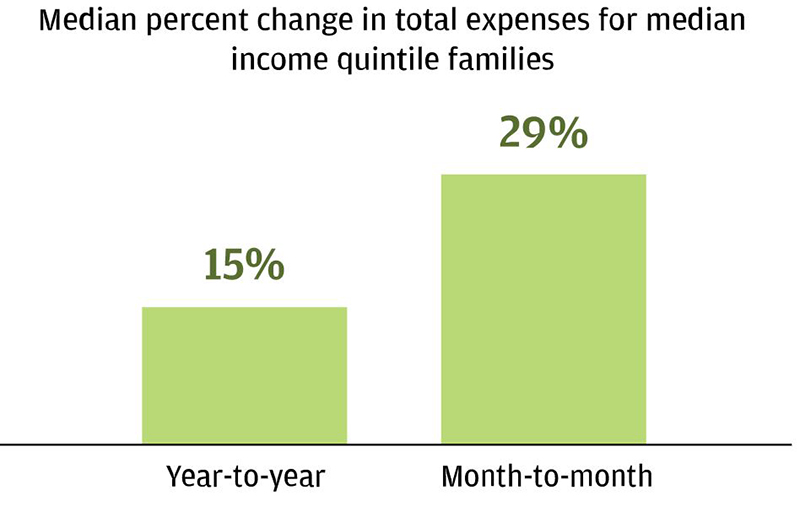

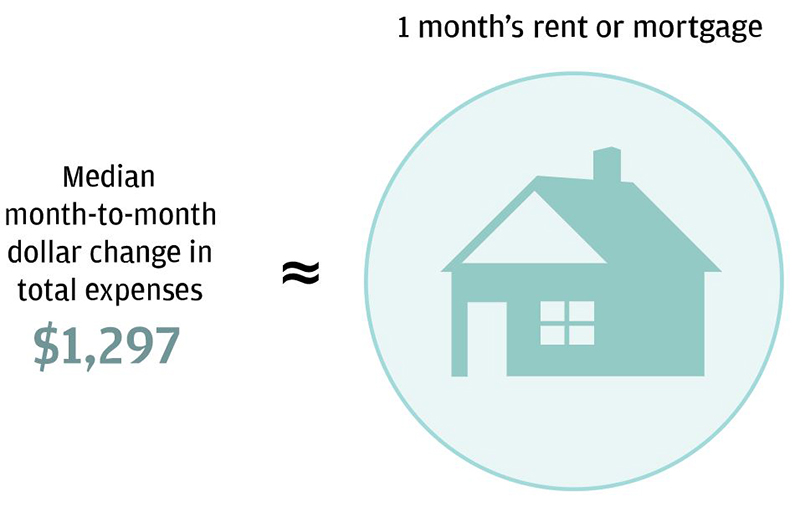

Americans across the income spectrum experience tremendous income and expense volatility, and this volatility has been on the rise. This volatility tests the financial resilience of American families. In Weathering Volatility, we estimated that median-income families needed $4,800 in liquid assets to weather 90 percent of the income and expense volatility observed, but that they had only $3,000—a shortfall of $1,800. In Paychecks, Paydays, and the Online Platform Economy we documented that most income volatility stems from labor income and, specifically, variation in take-home pay within a job rather than job transitions.

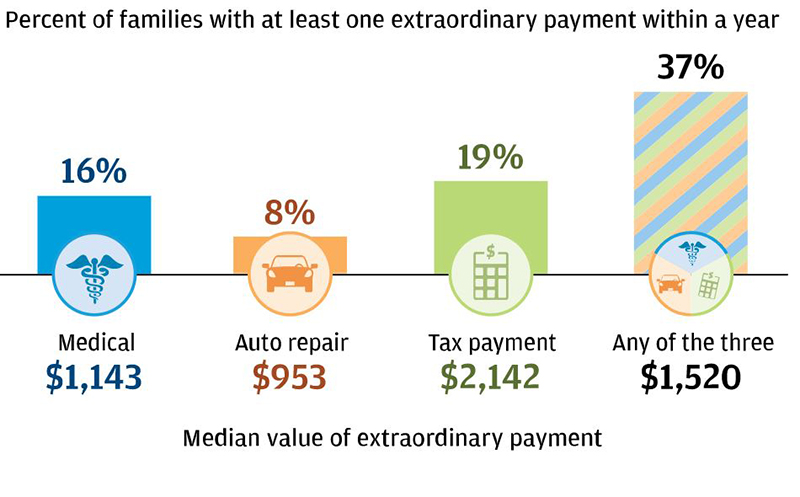

In this report, the JPMorgan Chase Institute assembled a de-identified data asset of nearly 250,000 Chase customers between 2013 and 2015 in order to study how consumers’ expenses vary over time and how their financial behavior changes when faced with extraordinary payments. This high-frequency panel of family finances—weighted to represent the age and income distribution of the nation—provides a first ever look into the components of expense volatility based on real financial transactions and the changes to family income, expenses, assets, and liabilities that coincide with extraordinary medical payments.