In 2015, gas prices in the United States were 25 percent lower than they had been in 2014. The US Energy Information Administration projected that this drop in prices would put roughly $700 back into the pockets of US households. Understanding in detail how big this boost really was, who experienced it, and how people responded has important implications for the economy and policymakers.

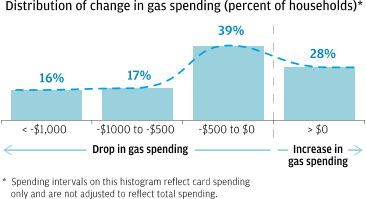

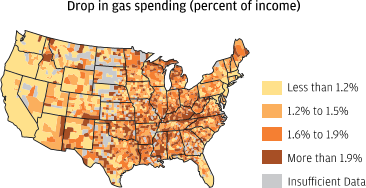

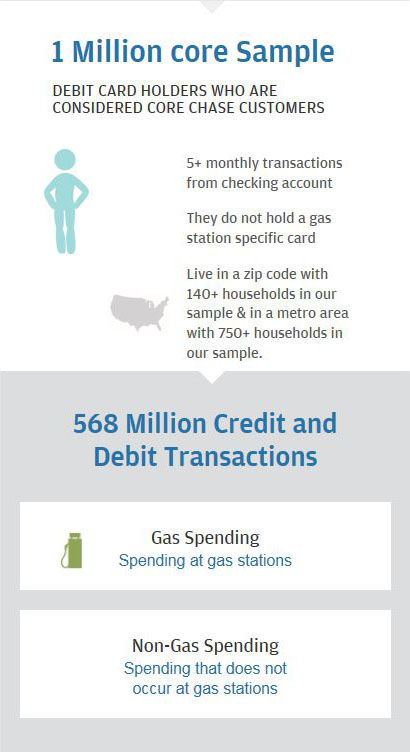

This report relies on an anonymized sample of one million Chase customers across 23 states to quantify the impact of lower gas prices in 2015. Middle-income households spent about $480 less on gas in 2015 than in 2014, the equivalent of more than a one percent increase in annual income for 60 percent of households. The drop in gas spending between 2014 and 2015 varied across the country, with lower impacts felt in the West and urban areas of the Northeast. Households had the potential to save $630 at the pump, of which they spent the majority—58 percent—primarily on non-gas goods and services such as restaurants and retail.

Our data, drawn from 57 million Chase regular debit and credit card customers illuminated the effects declining gas prices had across the US. These four findings cover gas spending and savings, who was the most and least impacted and how lower gas prices impacted consumer spending.