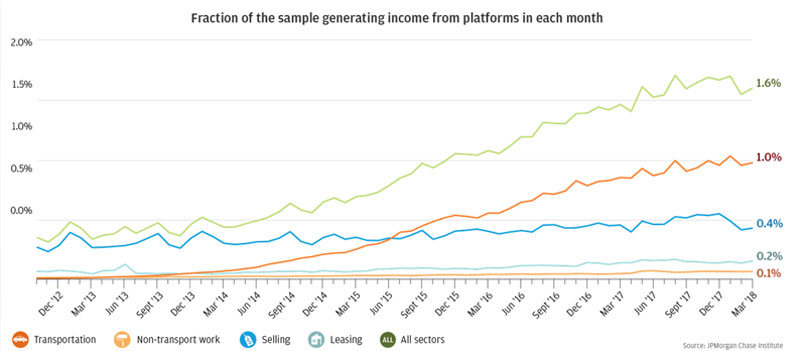

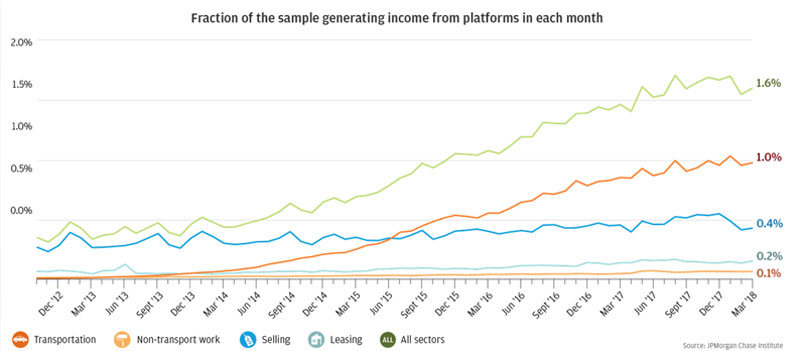

Figure 2: As of March 2018, 1.6 percent of sample families participated in the Online Platform Economy

Everyone knows someone with a side hustle—the aspiring actor who drives for Uber and Lyft, the seamstress who sells dance costumes on Etsy, the millennial who leases out an apartment on Airbnb when on vacation. Before the digital age, small-scale operators relied on word of mouth to find customers, but over the past five years there has been explosive growth in the number and reach of online platforms that make that match faster and cheaper. The resulting Online Platform Economy comprises marketplaces for ride-sharing, home-sharing, pet-sitting, arts and crafts, and scores of other goods and services. These platforms are catalyzing significant changes in many markets where they have penetrated. Just how big an impact are they having on labor markets overall, and how fast is their impact growing?

In September 2018, the JPMorgan Chase Institute (JPMCI) and the U.S. Bureau of Labor Statistics (BLS) each published research on these questions. In this brief we compare findings and insights from JPMCI’s The Online Platform Economy in 2018: Drivers, Workers, Sellers, and Lessors and BLS’s Electronically mediated work: New questions in the Contingent Worker Supplement and from a panel discussion on October 10, 2018, co-hosted by JPMCI and the Aspen Institute Future of Work Initiative. The panel featured JPMCI Director of Consumer Research Fiona Greig, BLS Associate Commissioner for Employment and Unemployment Statistics Michael Horrigan, Visiting Scholar at Cornell University’s ILR School and former BLS Commissioner, Erica Groshen, and CNN Business senior economic reporter Lydia DePillis (Figure 1).

Figure 1: From left to right, Lydia DePillis (CNN Business), Erica Groshen (Cornell ILR School), Fiona Greig (JPMCI), Michael Horrigan (BLS), Diana Farrell (JPMCI) at October 20, 2018, event on the Online Platform Economy. Click here to watch the video from the event.

The JPMCI Online Platform Economy dataset comprises a de-identified sample of 39 million Chase checking account customers, of whom 2.3 million received at least one payment through at least one of 128 online platforms between October 2012 and March 2018. The platforms met three criteria for inclusion: they matched independent suppliers with customers; they mediated the payment between from customer to supplier; and they empowered suppliers to enter and exit the market whenever they wanted.

The findings show that the percentage of account holders earning platform income rose five-fold, from 0.3 percent of the sample in the first quarter of 2013 to 1.6 percent in the first quarter of 2018. During the most recent twelve-month period ending March 2018, 4.5 percent of account holders earned income from the Online Platform Economy. The majority of these participants work for online platforms for three or fewer months in a year.

We further sub-categorized platforms based on whether they mediated transportation work (like ridesharing or moving services), other work (like dog walking or telemedicine), selling (like crafts or used books), or asset leasing (like home sharing or parking space sublets). We found that 1.6 percent of our sample generated platform income in March 2018, including 1.0 percent from transportation (0.9 percent) or non-transport work (0.1 percent), and 0.6 percent from selling (0.4 percent) or leasing (0.2 percent) (Figure 2). The growth in participation since 2013 was driven almost entirely by transportation platforms. Coincident with that growth, average monthly earnings on transportation platforms decreased by more than 50 percent between 2013 and 2017. Overall, platform income represented 20 percent of total take-home income for the average participant who had generated platform earnings at any point in the prior year, a significant though secondary source.

Figure 2: As of March 2018, 1.6 percent of sample families participated in the Online Platform Economy

In the same week that JPMCI released its findings on the Online Platform Economy, BLS released its estimates of “electronically mediated work.” Their questionnaire comprised four new questions added to the May 2017 Contingent Worker Supplement of the Current Population Survey. Respondents answered, whether any work they performed in the last week could be described as “short, in-person tasks or jobs through companies that connect them directly with customers using a website or mobile app” or “short, online tasks or projects through companies that maintain lists that are accessed through an app or a website.” In either case, respondents were told to consider only companies which coordinate payment for the work. The criteria for the economic activity being measured are nearly identical between the JPMCI and BLS studies—however, given the wording, it is likely that BLS’s questions largely captured activity that JPMCI classified as transportation and non-transport work and may not have captured much selling or leasing activity.

Though the questions generated some confusion on the part of respondents and surveyors, cleaned data from BLS show that 1.0 percent of respondents did electronically mediated work in the relevant week of May 2017, the same number that JPMCI reported for online platform participation in labor platforms during that month.1,2 Twenty-two percent of electronically mediated workers reported that their main job during the reporting week was in the “transportation and utilities” industry, the second most common industry for these workers behind “professional and business services” (31 percent). When viewed as a percentage of workers in the entire industry, 4.5 percent of workers whose main job is in “transportation and utilities” did electronically mediated work during the survey week—a larger fraction than in any other industry.

All told, the JPMCI and BLS estimates for participation in labor platforms were remarkably similar, both estimating 1.0 percent of respondents earning income from labor platforms through electronically mediated work in May 2017. This similarity is striking in light of the very different but complementary approaches taken by JPMCI and BLS to offer views into the Online Platform Economy. The fact that the two estimates were so close gives us confidence that they are in the right ball-park.

It is worth calling out their complementary strengths and weaknesses, however. Compared to the BLS survey data, the JPMCI administrative banking data are available at much higher frequency (individual transactions over a 65 month period, versus a snapshot each time the questionnaire is fielded—so far, only once) and on much larger samples (39 million checking account customers, versus 153,000 survey respondents). The JPMCI data also contain information like transaction amounts, which can be difficult to collect in a survey without imposing significant respondent burden.

In contrast, the BLS survey data capture characteristics of the work itself (whether it was done in-person or remotely), along with rich information about the respondents, including what they consider their “main job,”, their education level, family structure, gender, race, and ethnicity.

Just as the data have complementary strengths, they also face complementary measurement challenges. The checking account customers in the JPMCI data are not statistically representative of the US population. For example, they cannot be used to draw inferences about the unbanked. The sample contains a disproportionate share of younger Americans and residents on the West Coast. Since these subgroups are more likely to generate platform income, participation in the JPMCI sample may be higher than in the U.S. as a whole. On the other hand, the JPMCI data only include transactions that flow directly from the chosen 128 platform companies to customers’ checking accounts, so there may be additional platform participants in the JPMCI universe of customers who were not identified.3

For BLS, a main challenge (as with any questionnaire) arises from respondent interpretation and burden. It can take many months and significant research to design each question so that a respondent will understand it, and every question taps a respondent’s time and attention, which are exhaustible resources. In the case of the electronically mediated work questionnaire, design was challenged by tight budget and time constraints. Many respondents evidently misinterpreted the questions, as the BLS estimates of electronically mediated employment decreased from 3.3 percent to 1.0 percent after recoding false positives.

Two other measurement factors make the JPMCI and BLS estimates difficult to compare. First, whereas the JPMCI data measure participation over the course of the month, BLS measures participation in the prior week. Second, whereas BLS specifically asked respondents to report on only their individual activity, the bank account data analyzed by JPMCI aggregated linked accounts; since family members typically share accounts, JPMCI’s participation estimates likely reflect the platform activity of an entire family rather than an individual. While it is not clear which approach is the better way to measure participation, given the sporadic nature of participation documented in the JPMCI data, these differences in units of time and analysis could result in higher participation estimates in the JPMCI data.

In light of these differences in measurement challenges and approaches, it is remarkable that both JPMCI and BLS estimated participation on labor platforms at 1.0 percent. Despite the striking similarity in topline results, these two studies revealed a few key differences in terms of the role platform work plays in a family’s financial life and the sectors of work in which people are engaged.

First, the JPMCI data suggested that platform work was a secondary source of income for families over the prior year, with average monthly revenues below $1,000. For an average participant who had earned platform income at any point in a year, platform income represented just 26 percent of monthly income among drivers and 15 percent among non-transport workers. These patterns may be difficult to reconcile with the BLS finding that 70 percent of those who reported electronically mediated work during the survey week characterized it as their “main job.”

Second, whereas over 90 percent of labor platform participants in May 2017 were engaged in transportation platforms according to the JPMCI data, only 4.5 percent of respondents to the BLS survey characterized their main job as being in the transportation and utilities industries. A possible reconciliation of these results is if transportation-related electronically mediated work is less likely to be someone’s main job, and many participants on transportation platforms have main jobs in non-transportation sectors.

With it engaging just 1.0 percent of Americans, and representing a far smaller share of total U.S. labor income, why should we expend energy measuring, analyzing, and formulating policy agenda around the Online Platform Economy?

There are at least three reasons.

First, the Online Platform Economy is growing very fast. Platform work could be a form of contingent work or alternative work arrangement, which on the whole actually declined between 2005 and 2017, according to BLS.4 But the Online Platform Economy has grown five-fold in four years from 0.3 percent of families in 2013 to 1.6 percent in 2017. Are platform participants new additions to the contingent and freelance populations or are they freelance workers whose mechanisms for finding work have shifted to platforms? With 4.5 percent of families engaged in the Online Platform Economy at some point in a given year, JPMCI estimated that roughly 5.5 million families’ tax returns may need to reflect earnings from independent work, many of whom may not currently file a 1099 or Schedule Self-Employment, according to a recent study. In short, it is worth paying attention to anything growing that fast.

Second, the Online Platform Economy is arguably disrupting two industries at scale—the transportation and hotel industries. Roughly 2.4 percent of families generated income from a transportation platform over the prior year, roughly comparable to the percent of employed persons who drive for a living (2.8 percent), according to CPS 2017 data.5 Recent research indicates that private accommodation grew nearly twice as fast (11 percent) as the overall US travel market and now represents roughly 15 percent of rooms available in certain places. It is no surprise that we have seen policy actions taken to protect or level the playing field for the incumbent industry in some places.6

Though we have not seen this level of disruption in other industries, there is much innovation in this space and it may just be a matter of time. In fact 70 of the 128 platforms studied in the JPMCI data were for non-transport work representing a range of types of services, including home repairs, data analytics, legal services, talk therapy, and dog walking. Year-over-year participation in the non-transport work sector, still the smallest of the four sectors, grew by 37 percent, faster than the other three sectors in the JPMCI data (15 percent for transportation, 10 percent for leasing, and -6 percent for selling).

These dynamics underscore the need for policy responses that are tailored not just by sector but also by the diverse role platforms are playing in the economic lives of participants. For some it is a lifeline between jobs. For others it is a source of extra cash that allows them to take a vacation. Still others use them to source clients for an already-established small business. We ought to consider different policy tools to address the needs of these very different types of participants.

Third, while the Online Platform Economy is not currently “the future of work,” it is pushing the limits of, and raising new questions about, how workers are defined, sourced, and compensated. Is a ride-share driver “working” when she is on her way to pick up her next passenger? Should she be compensated if she gets in an accident en route through no fault of her own? Should she be paid a minimum wage or trip price? If she can complete more trips in an hour due in part to algorithmic enhancements should she or the platform be compensated for greater productivity? Should she be protected or compensated if passengers systematically cancel rides from her because of her gender or race? The answers to many of these questions hinge on whether she is, or ought to be, classified as an employee, a contingent worker, or perhaps a new class of independent worker.

More broadly, whether and how platform work will complement traditional work in tomorrow’s labor market depends on policy and business decisions taken today. Traditional work arrangements provide employees with much more than just a paycheck. Will employers always be the main conduit for non-wage benefits like health insurance, life-cycle savings tools, and tax withholdings? If so, workers will almost certainly rely on a primary traditional employer for these resources, and the more flexible opportunities provided by online platforms may remain on the fringe.

But what if policy measures or innovations emerge that make these non-wage benefits more readily available to freelance workers? Will platforms disrupt traditional employment entirely? That may depend on whether the surge in supply, and preference for, this new flexible form of work reflects broader trends (and needs) related to income volatility, rising inequality, an aging workforce, and dual-income families and, importantly, whether platforms are ameliorating or exacerbating these trends. It may also depend on whether platforms are helpful market makers linking suppliers and buyers in a relationship that serves both, or whether platforms take advantage of market inefficiencies in a way that exploits workers, buyers, or both. The answers to these questions are complicated and likely vary by platform.

Significant gaps remain in our understanding of the Online Platform Economy, gaps which could start to be filled with two additional sources of data. The first is tax data showing how workers are categorizing the income they earn and what percentage of their income is coming from primary versus secondary sources. The second source is enterprise employment data provided by businesses themselves. Enterprise data could reveal how are employers are sourcing talent, whether those methods are changing, whether they are use online platforms and contingent workers, and if so, to fill what roles, and in service of what business goals.

See the full BLS report for its accounting of the process of fielding the survey and analyzing the findings at:

https://www.bls.gov/opub/mlr/2018/article/electronically-mediated-work-new-questions-in-the-contingent-worker-supplement.htm

We focus on participation in labor platforms (transportation and non-transport work) rather than all platforms, since the BLS survey questions explicitly inquired about short tasks, projects, or jobs, and discussions with BLS staff indicated that their intent was to measure participation in labor platforms.

Specifically, there are more than 128 platforms that meet our criteria, but we focused on those with significant financial backing at the time. In addition, we estimated that 2 percent of platform payments to accounts in our sample go through alternative payment systems like PayPal, but participants can receive platform payment through other channels we would not pick up.

The fraction of the workforce characterizing their main job as contingent work or an alternative work arrangement declined slightly between 2005 and 2017 (from 4.1 percent in 2005 to 3.8 in 2017 for contingent work and from 10.7 percent in 2005 to 10.1 percent in 2017 for alternative work arrangements).

According to Table 11b of the 2017 CPS, 2.8 percent of those 20 years and older (comparable to the age cutoff for the JPMCI data) who are employed are in the following two occupations: Driver/sales workers and truck drivers (2.3 percent) and Taxi drivers and chauffeurs (0.5 percent).

See, examples of legislation aimed at establishing minimum wages or requiring licenses for drivers on ride-sharing apps in New York City and Seattle and aimed at increasing registration requirements for home-sharing hosts home-sharing in San Francisco and Washington, DC.