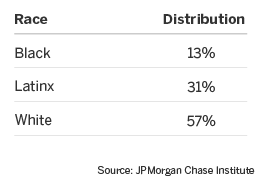

Table 1: Distribution of sample, by owner race

Findings

Small business ownership is commonly thought to not only be a vehicle for financial stability and wealth building, but also a way to close the racial wealth gap. Small businesses are known to be a key component of the small business owner’s financial wellbeing (Gentry and Hubbard 2004), but it is not at all clear from current evidence that small business ownership alone closes the wealth gap. In fact, recent studies have shown that Black- and Latinx-owned small businesses have lower revenues, profit, and cash margins (Farrell, Wheat, and Mac 2020; Fairlie and Robb 2008); are more likely to close and have fewer employees (Fairlie and Robb 2008); and have less access to credit (Federal Reserve System 2017) than White-owned small businesses. Sufficient revenues and profit, the ability to hire employees, and access to credit are some key components of a wealth-generating small business, and racial disparities among these suggest that small business ownership may not close the gap.

This brief examines the liquid wealth of typical small business owners, and shows that there is no meaningful narrowing of the gap in liquid wealth available to Black, Latinx, and White small business owners. Other studies have found that Black business owners have higher wealth than non-business owners (Association for Enterprise Opportunity 2017), and that wealth mobility among Black business owners is similar to White business owners (Bradford 2014). This brief shows that, among a sample of business owners, the gap persists through the first few years of a business ownership.

Although there is much to learn to fully understand how small business ownership and wealth interact, this brief measures the liquid wealth of typical small business owners over the first four years of their business operations, with a specific focus on measuring differences between Black, Latinx, and White small business owners.

Small business assets represent a meaningful share of total small business owner assets, comprising more than 40 percent of the financial assets of the typical owner (Gentry and Hubbard 2004). In previous work the JPMorgan Chase Institute highlighted the importance of cash by studying small businesses’ deposit accounts, and in June 2020 released a report showing how small business outcomes are different based on the small business owner’s race. Box 1 summarizes the findings of that report.

Box 1

Leveraging voter registration data from Florida, Georgia, and Louisiana we informed small business financial outcomes and survival based on self-identified owner race. Among other things we found:

1) Black- and Latinx-owned firms are well-represented among firms that grow organically, but underrepresented among firms with external financing.

2) Black- and Latinx-owned businesses face challenges of lower revenues, profit margins, and cash liquidity. Previous JPMorgan Chase Institute research has shown that each of these, but especially cash liquidity, are important factors in predicting small business exit.

3) Firms with Black owners, particularly owners under the age of 35, were the most likely to exit in the first three years. In the first three years of business, Black- and Latinx-owned small businesses have exit rates 2-6 percentage points higher than White-owned small businesses. However, if firms survive until the fourth year, exit rates among small business owners in each racial group are similar.

4) Black- and Latinx-owned businesses with comparable revenues and cash reserves are just as likely to survive as White-owned businesses. Higher business cash reserves, measured as typical balances divided by typical cash outflows, are associated with similar exit rates to White-owned small businesses.

5) Racial gaps in small business outcomes are evident across cities, even in cities with large Black or Hispanic populations.

To date, very little work has used administrative data to identify the relationship between the finances of small businesses and their owners. This brief provides a first look at this more complete view of small business owners’ finances. We identified 286,500 people who owned a small business that survived at least four years and who used Chase personal banking services.1 In each year of a small business’s life, we calculated the small business owner’s liquid wealth. This is defined to be the average monthly personal and business balances across all Chase deposit accounts in a given year, where each year starts in the month that a business is founded.2 For the purposes of this brief, liquid wealth measures observed balances in personal and business Chase savings and checking accounts. It does not include all assets contributing to total wealth including investment accounts or tangible assets like personal or business property.

Of the 286,500 people in our sample, we identified 19,000 business owners who have self-identified as Black, Latinx, or White using voter registration data. This sample includes Chase customers who registered to vote in Florida, Georgia, and Louisiana and disclosed their race.3 We use this sample to explore the differences in liquid wealth between typical small business owners. Table 1 shows the share of our sample by owner race.

Table 1: Distribution of sample, by owner race

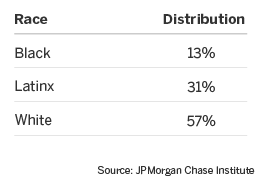

To estimate small business owner liquid wealth, we measured the typical liquid wealth for all small business owners in each of the first four years of business. Liquid wealth of small business owners whose firms survive at least four years increases over time, albeit modestly. The median small business owner has $4,000 more liquid wealth in the fourth year of business than the median small business owner in the first year of business, and this difference is less for the typical Black or Latinx small business owner. Figure 1 shows the median liquid wealth in each of the first four years of business, conditional on the business surviving at least four years, including the median liquid wealth for Black, Latinx, and White small business owners.

Figure 1: Median liquid wealth by year

Although the typical small business owner in year 4 has more liquid wealth than the typical small business owner in year 1, the magnitude of the difference is not suggestive of substantial wealth accumulation. Further, the liquid wealth difference of $2,000 for the typical Black small business owner between years 1 and 4 is less than the $3,700 difference for the typical White small business owner in these years. The $3,000 difference for the typical Latinx small business owner in year 4 compared to year 1 is slightly less than the typical White small business owner. Over the four year period, a small business does not seem to meaningfully increase liquid wealth for the typical owner, even among a sample of successful small businesses. It is true that total wealth could be increasing more materially than our measure of liquid wealth. However, if liquid wealth is somewhat proportional to total wealth, then the persistence in levels is relevant.

If business ownership effectively closed wealth gaps, then one might expect to see some of the liquid wealth gap between the typical Black, Latinx, and White small business owner dissipate as the business matures. However, there were substantial racial gaps in small business owner liquid wealth throughout the entire period, even when requiring that the small businesses survive at least four years.

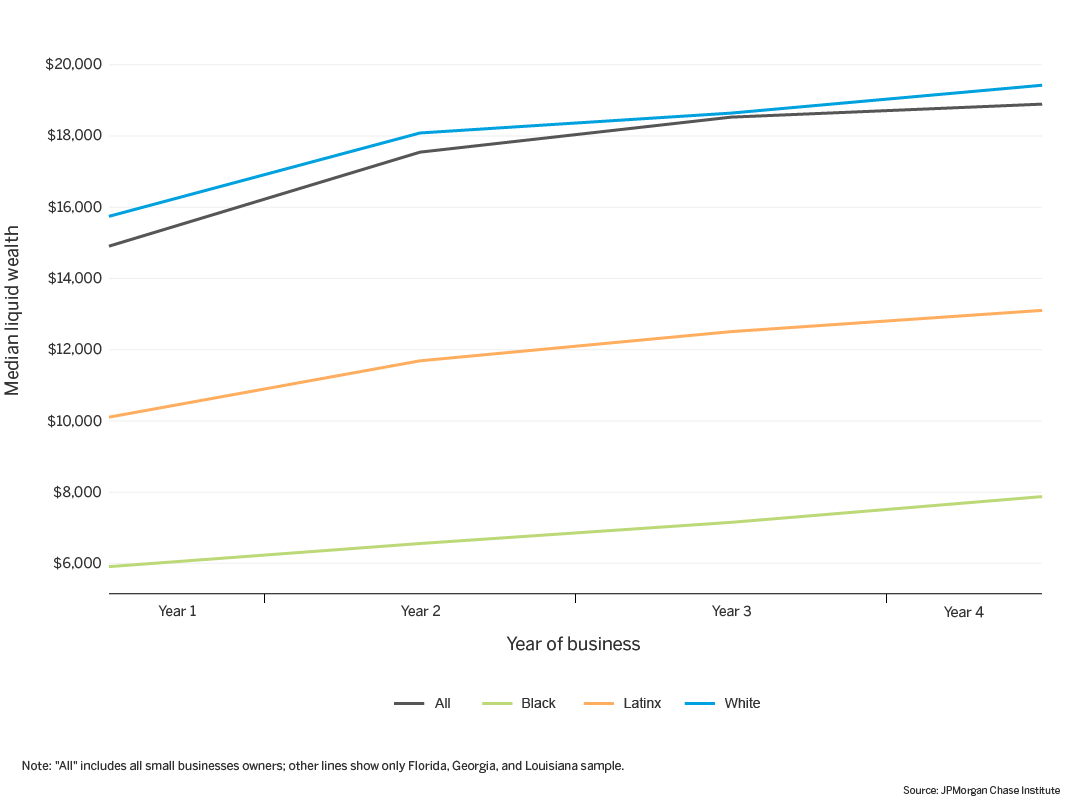

Figures 2 and 3 expand on this analysis by showing the typical within-person year-to-year percent and dollar change in liquid wealth. The typical small business owner in year 2 has a $900 change in liquid wealth, while the typical Black small business owner in year 2 has a $265 change in liquid wealth, corresponding with about 12 percent and 8 percent changes, respectively.

Figure 2: Change in typical small business owner liquid wealth, year-to-year dollar change

Although the typical small business owner in year 4 has more liquid wealth than the typical small business owner in year 1, the magnitude of the difference is not suggestive of substantial wealth accumulation. Further, the liquid wealth difference of $2,000 for the typical Black small business owner between years 1 and 4 is less than the $3,700 difference for the typical White small business owner in these years. The $3,000 difference for the typical Latinx small business owner in year 4 compared to year 1 is slightly less than the typical White small business owner. Over the four year period, a small business does not seem to meaningfully increase liquid wealth for the typical owner, even among a sample of successful small businesses. It is true that total wealth could be increasing more materially than our measure of liquid wealth. However, if liquid wealth is somewhat proportional to total wealth, then the persistence in levels is relevant.

If business ownership effectively closed wealth gaps, then one might expect to see some of the liquid wealth gap between the typical Black, Latinx, and White small business owner dissipate as the business matures. However, there were substantial racial gaps in small business owner liquid wealth throughout the entire period, even when requiring that the small businesses survive at least four years.

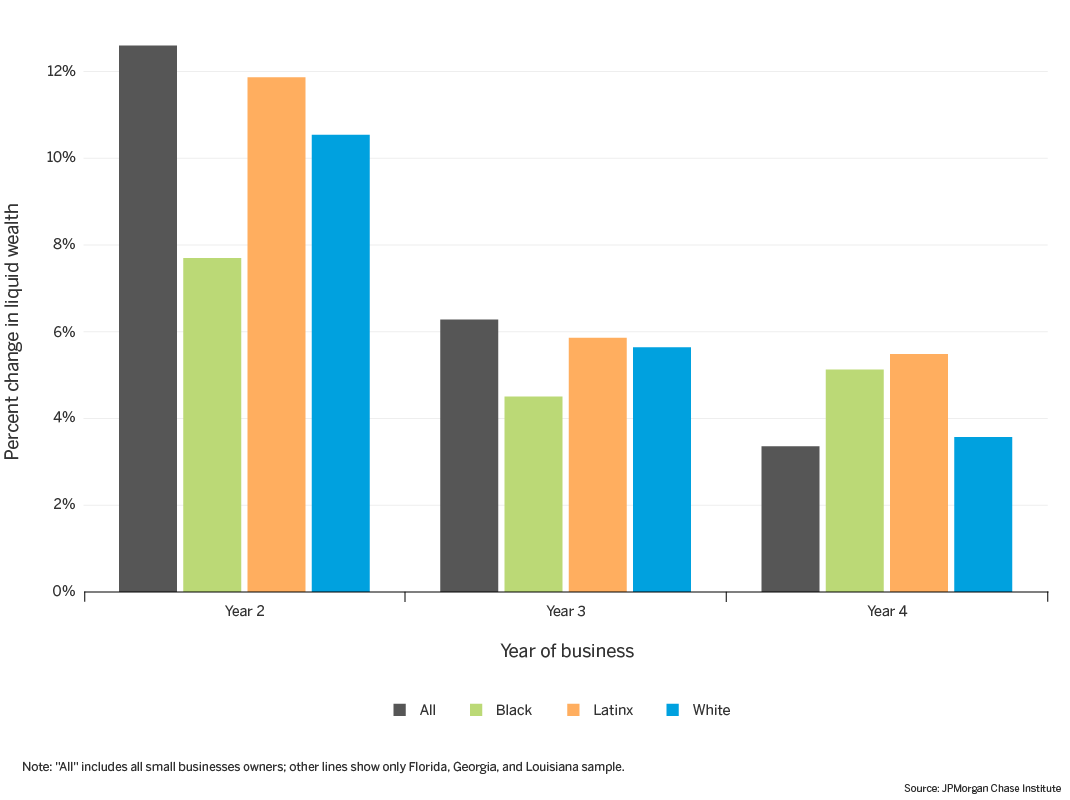

Figures 2 and 3 expand on this analysis by showing the typical within-person year-to-year percent and dollar change in liquid wealth. The typical small business owner in year 2 has a $900 change in liquid wealth, while the typical Black small business owner in year 2 has a $265 change in liquid wealth, corresponding with about 12 percent and 8 percent changes, respectively.

Figure 3: Change in typical small business owner liquid wealth, year-to-year percent change

In each year, the typical Black small business owner had lower liquid wealth increases than the typical White small business owner, and lower percent changes in all but the fourth year. The typical Latinx small business owner saw a higher percentage change in each year than the typical White owner while consistently having a lower absolute change in liquid wealth. Figures 1, 2, and 3 together suggest that much of the difference in percent changes may be due to the much lower base liquid wealth for Black and Latinx small business owners. For example, the year-to-year 3.5 percent increase for White small business owners corresponds with a $360 increase in liquid wealth from year 3 to year 4. The typical Black small business owner had a year-to-year 5 percent increase in liquid wealth in the same period, which corresponds with a $220 increase in liquid wealth. Positive year-to-year growth in liquid wealth might not be surprising given the sample requirement that an owner’s small business survive through four years: growth in liquid wealth is likely a consideration in a small business owner’s decision to remain in business, but the growth rate does not seem sufficient in closing the wealth gap.

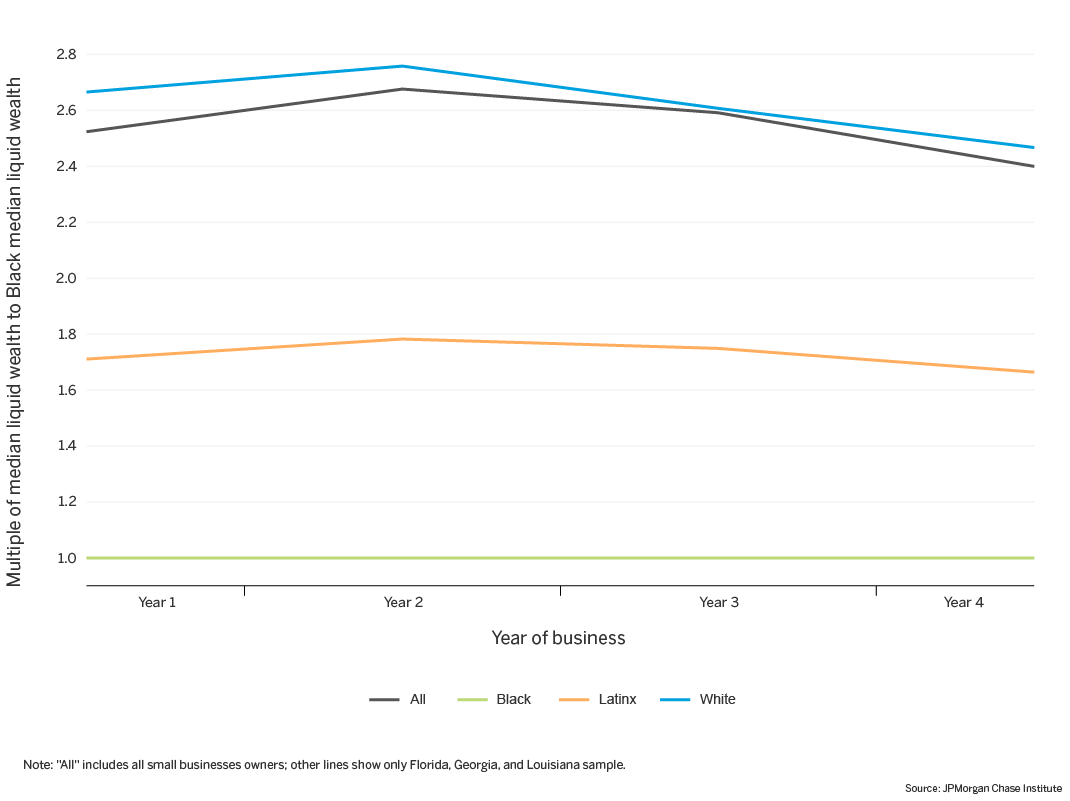

In Finding 1 we show that there are modest gains in small business owner liquid wealth during the first four years of business. However, that change is even more modest for the typical non-White small business owner. The magnitude of this difference can be measured as the multiple of a small business owner’s liquid wealth compared to the typical Black small business owner’s. Figure 4 shows the median liquid wealth of small business owners in the full, Latinx, and White samples as a multiple of the typical Black small business owner’s.

Figure 4: Median Latinx, White, and full sample small business owner liquid wealth as a multiple of the median Black business owner’s

The typical White small business owner has liquid wealth that is about 2.5 times greater than the typical Black small business owner in each year of the period, though as high as 2.75 times in year 2. A similar analysis exploring the median White small business owner’s liquid wealth as a multiple of the median Latinx owner liquid wealth is also fairly consistent: the median White small business owner has about 1.5 times the liquid wealth of the median Latinx small business owner in the firm’s first and fourth year. The typical Black and Latinx small business owner starts with 1.5 to 2.75 times less liquid wealth than the typical White small business owner, and that gap largely persists through the business’s first four years. As shown in figures 2 and 3, the year-to-year change is insufficient to close the liquid wealth gap. Even among businesses that survive four years, small business ownership alone does not suggest a narrowing liquid wealth gap between the typical White and Black small business owner.

This brief explores the liquid wealth changes of small business owners who run businesses that survive at least four years. Even among this sample of relatively successful small business owners, differences in liquid wealth between the typical Black, Latinx, and White small business owner persist over a firm’s first four years. Future work is necessary to understand how liquid wealth changes among a more complete sample of small business owners, including those of firms that exit.

Encouraging new small business starts alone may not close the liquid wealth gap, and policies that support small businesses should consider differences in the liquid wealth available to small business owners. The typical Black and Latinx households have 32 and 67 percent of the liquid wealth of the typical White household, respectively (Farrell et al 2020). It is unsurprising, then, that Black, Latinx, and White small business owners start their businesses with very different levels of liquid wealth. These differences persist through the first four years of business ownership, even among a sample of successful small business owners. Future research can better inform the complex relationship between a small business and its owner’s liquid wealth by comparing the liquid wealth of wage-earners and business owners and estimating the effects of business exit on liquid wealth, among other things.

Small business ownership is risky, and the rewards for successful small business owners are unclear. Even among our sample of small business owners whose businesses survived four years, the gap between the typical White and Black or Latinx small business owner does not meaningfully narrow. Black- and Latinx-owned small businesses exit at a higher rate than White-owned small businesses, and, importantly, this brief does not assess the impact of exit on liquid wealth. Given similar business success among this sample and the lack of similar liquid wealth outcomes, we should continue to interrogate questions around promoting business ownership.

We thank our research team, specifically Anu Raghuram for her hard work and contributions to this research. Additionally, we thank Courtney Hacker and Sruthi Rao for their support. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways, and acknowledge their contributions to each and all releases.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., for his vision and leadership in establishing the Institute and enabling the ongoing research agenda. We remain deeply grateful to Peter Scher, Head of Corporate Responsibility; Heather Higginbottom, President of the JPMC PolicyCenter; and others across the firm for the resources and support to pioneer a new approach to contribute to global economic analysis and insight.

Association for Enterprise Opportunity. 2017. “The Tapestry of Black Business in America: Untapped Opportunities for Success.” https://aeoworks.org/wp-content/uploads/2019/03/AEO_Black_Owned_Business_Report_02_16_17_FOR_WEB-1.pdf

Bradford, William D. 2014. "The ’myth’ that black entrepreneurship can reduce the gap in wealth between black and white families." Economic Development Quarterly 28, no. 3: 254-269.

Evans, David S., and Boyan Jovanovic. 1989. "An estimated model of entrepreneurial choice under liquidity constraints." Journal of Political Economy 97, no. 4: 808-827.

Fairlie, Robert W., and Alicia M. Robb. 2008. Race and Entrepreneurial Success: Black-, Asian-, and White-Owned Businesses in the United States. Cambridge, Massachusetts; London, England: MIT Press.

Farrell, Diana, Fiona Greig, Chris Wheat, Max Liebeskind, Peter Ganong, Damon Jones, and Pascal Noel. 2020. “Racial Gaps in Financial Outcomes: Big Data Evidence.” JPMorgan Chase Institute. https://institute.jpmorganchase.com/institute/research/ household-income-spending/report-racial-gaps-in-financial-outcomes.

Farrell, Diana, Chris Wheat, and Chi Mac. 2020. “Small Business Owner Race, Liquidity, and Survival.” JPMorgan Chase Institute.

Farrell, Diana, Christopher Wheat, and Chi Mac. 2019. "Gender, Age, and Small Business Financial Outcomes." JPMorgan Chase Institute. https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/institute/pdf/institute-report-small-business-financial-outcomes.pdf

Federal Reserve Banks. 2017. “Small Business Credit Survey: Report on Minority-owned Firms.” Federal Reserve Bank.

Gentry, William M., and R. Glenn Hubbard. 2004. "Entrepreneurship and household saving." The BE Journal of Economic Analysis & Policy 4, no. 1.

In addition, we require evidence that a small business owner is using a Chase account prior to the start of their business. For the purposes of this brief, we require that a small business owner make at least one deposit and have total deposits of at least $50 in three of the twelve months prior to a business start.

For example, a business that is founded in June 2015 has a year 1 of June 2015-May 2016 and a year 2 of June 2016-May 2017.

A full discussion on this sample is included in Farrell et al. 2020.

Authors

Chris Wheat

President, JPMorganChase Institute

Chi Mac

Business Research Director

Nicholas Tremper

Senior Research Associate