Source: JPMorgan Chase Institute

Small businesses are a key pillar of the U.S. economy, providing income for millions of families and contributing to the commercial vibrancy of communities in cities.

Researchers, small business service providers, policymakers, and small business owners alike observe that cash flow management challenges are pervasive in the sector, but empirical assessment of cash flow challenges and their effects on small firm performance have been elusive.

This report builds on prior research by the JPMorgan Chase Institute and uses high-frequency administrative data to classify small business cash flow patterns. We analyze the effects of regular and irregular cash flow patterns on the survival and growth of small firms in and across cities.

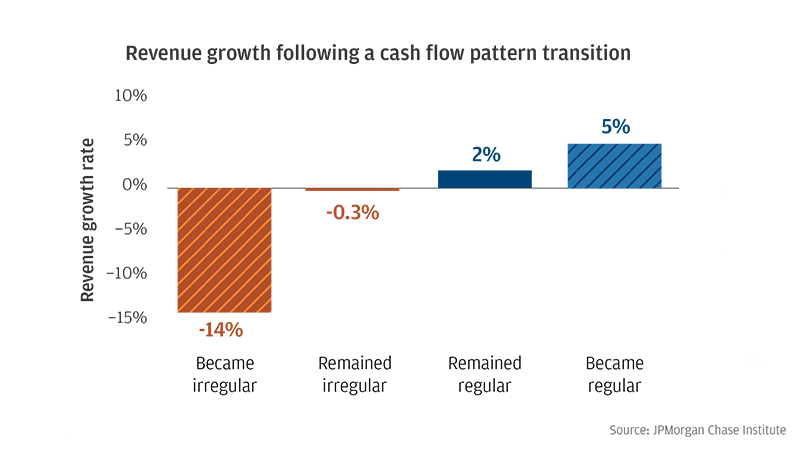

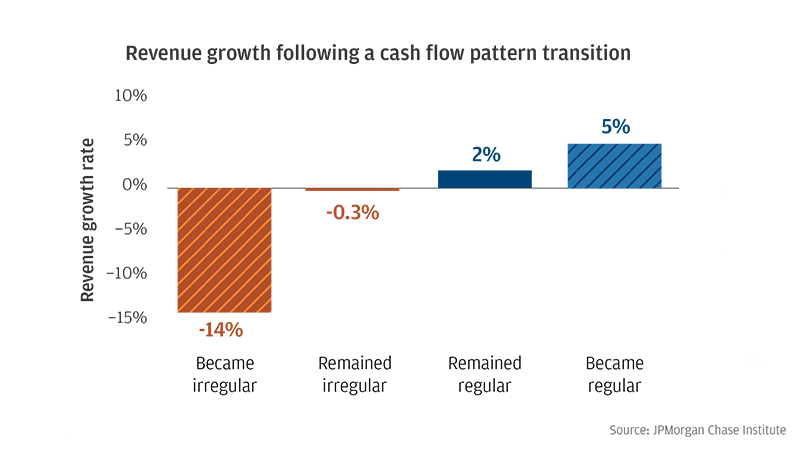

Finding 1: Across cities, firms with irregular cash flows were more likely to exit and had slower revenue growth.

Finding 2: Firms with erratically timed revenues and expenses were most common among firms with irregular cash flows and most likely to exit, but firms with sporadic revenues had the largest revenue declines.

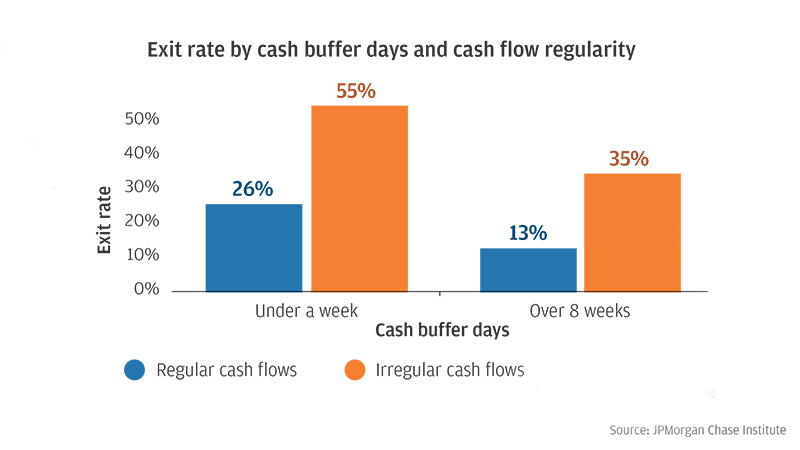

Finding 3: Firms with limited cash buffers and irregular cash flows were the least likely to survive.

These findings suggest that cash flow patterns may be as important as liquidity and access to capital as determinants of small business survival and growth. In addition, small businesses can face qualitatively different kinds of cash flow challenges. Policymakers, product designers, and other decision makers who support small businesses might be most effective not only by targeting their efforts to these distinct challenges, but also by targeting their efforts to the cities and communities where these specific challenges are most often present.

Source: JPMorgan Chase Institute

Source: JPMorgan Chase Institute

Diana Farrell

Founding and Former President & CEO

Chris Wheat

President, JPMorganChase Institute

Carlos Grandet