How we’re making an impact

Our initiatives are rooted in how we do business: this means serving our customers, clients and communities while running a healthy and vibrant company.

Helping our clients achieve their objectives

Our capital, data and expertise supports clients with financing solutions to scale and grow. We aim to provide strategic advice to help clients achieve their decarbonization goals and continue our efforts to align key sectors of our financing portfolio with net zero emissions outcomes.

Supporting the ongoing energy transition and scaling essential energy technologies

We aim to finance and facilitate $1 trillion over 10 years – from 2021 through the end of 2030 – for scaling and development of climate initiatives. We seek to support a low-carbon future while also maintaining energy affordability, security and reliability.

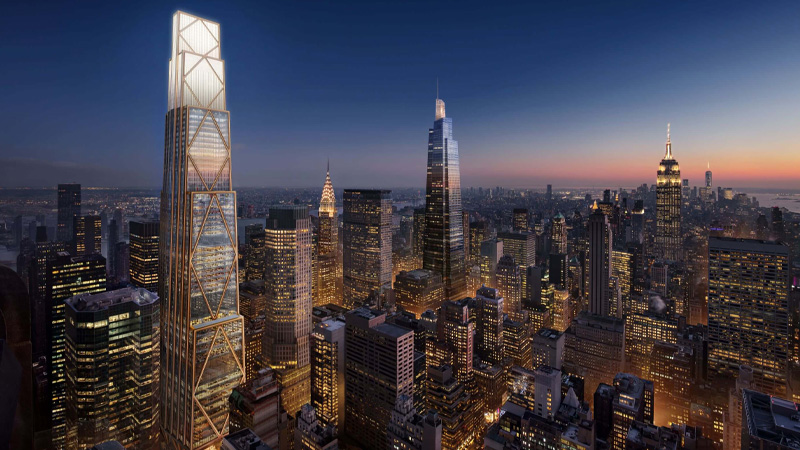

Managing Operational Sustainability

We seek to implement solutions to responsibly meet our sustainability goals in line with business priorities. We aim to construct and operate more sustainable buildings and manage our energy and carbon footprint.