How we’re making an impact

We’re committed to creating a stronger economy through business and community investments, local collaborations and policy advocacy. Our approach focuses on five key areas.

Business growth and entrepreneurship

Helping business owners achieve their goals and strengthen their communities through our ecosystem of tools and resources.

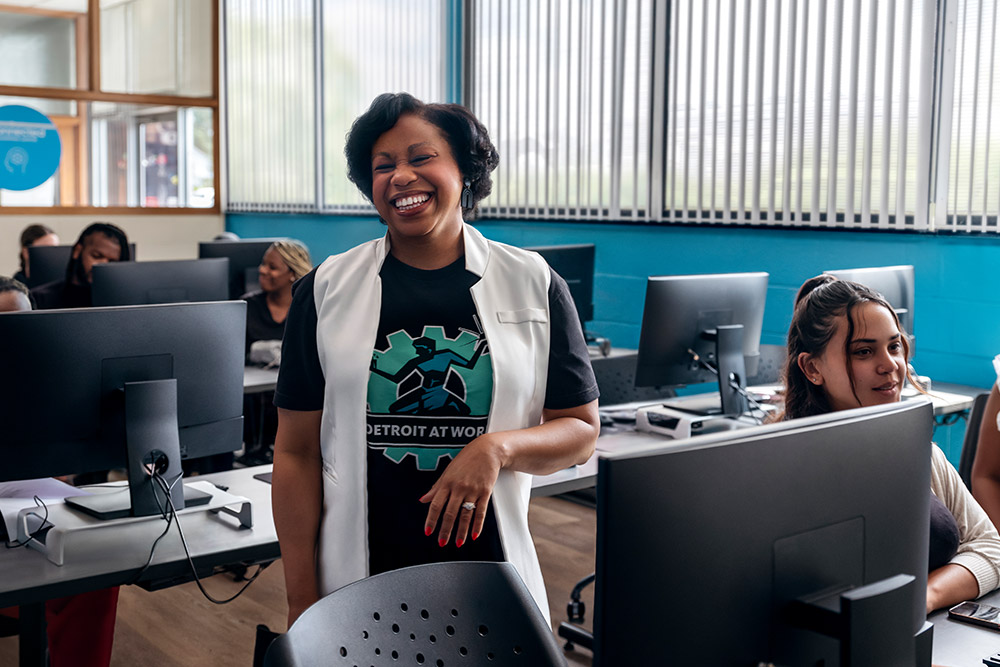

Careers and skills

Supporting and developing career-connected education, skills training and policy solutions that connect job seekers to more opportunities.

Community development

Helping to improve housing access and affordability, as well as supporting vital institutions like governments, hospitals and universities.

Environmental sustainability

Supporting the ongoing energy transition and scaling essential energy technologies.

Financial health and wealth creation

Helping individuals build wealth for themselves and their families by offering the right financial products and services to plan for their future goals.